Navigating the Future: A Deep Dive into Stock Market Trends for 2025

Navigating the Future: A Deep Dive into Stock Market Trends for 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: A Deep Dive into Stock Market Trends for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: A Deep Dive into Stock Market Trends for 2025

- 2 Introduction

- 3 Navigating the Future: A Deep Dive into Stock Market Trends for 2025

- 3.1 Understanding the Landscape: Key Drivers of Market Trends

- 3.2 Analyzing the Trends: What to Expect in 2025

- 3.3 Stock Trends Chart 2025: A Visual Representation

- 3.4 Related Searches:

- 3.5 Stock Trends Chart 2025: Frequently Asked Questions

- 3.6 Stock Trends Chart 2025: Tips for Investors

- 3.7 Conclusion:

- 4 Closure

Navigating the Future: A Deep Dive into Stock Market Trends for 2025

Predicting the future of the stock market is a daunting task, fraught with uncertainty. However, by analyzing current trends, economic indicators, and technological advancements, we can gain valuable insights into potential market movements in the coming years. This exploration delves into key factors that may shape the stock trends chart 2025, providing a comprehensive overview for investors and market enthusiasts alike.

Understanding the Landscape: Key Drivers of Market Trends

The stock trends chart 2025 will be influenced by a complex interplay of factors. Some of the most prominent drivers include:

1. Global Economic Growth: The global economy is expected to continue its recovery from the pandemic, albeit at a slower pace. Factors like inflation, interest rate hikes, and geopolitical tensions will play a crucial role in determining the trajectory of growth.

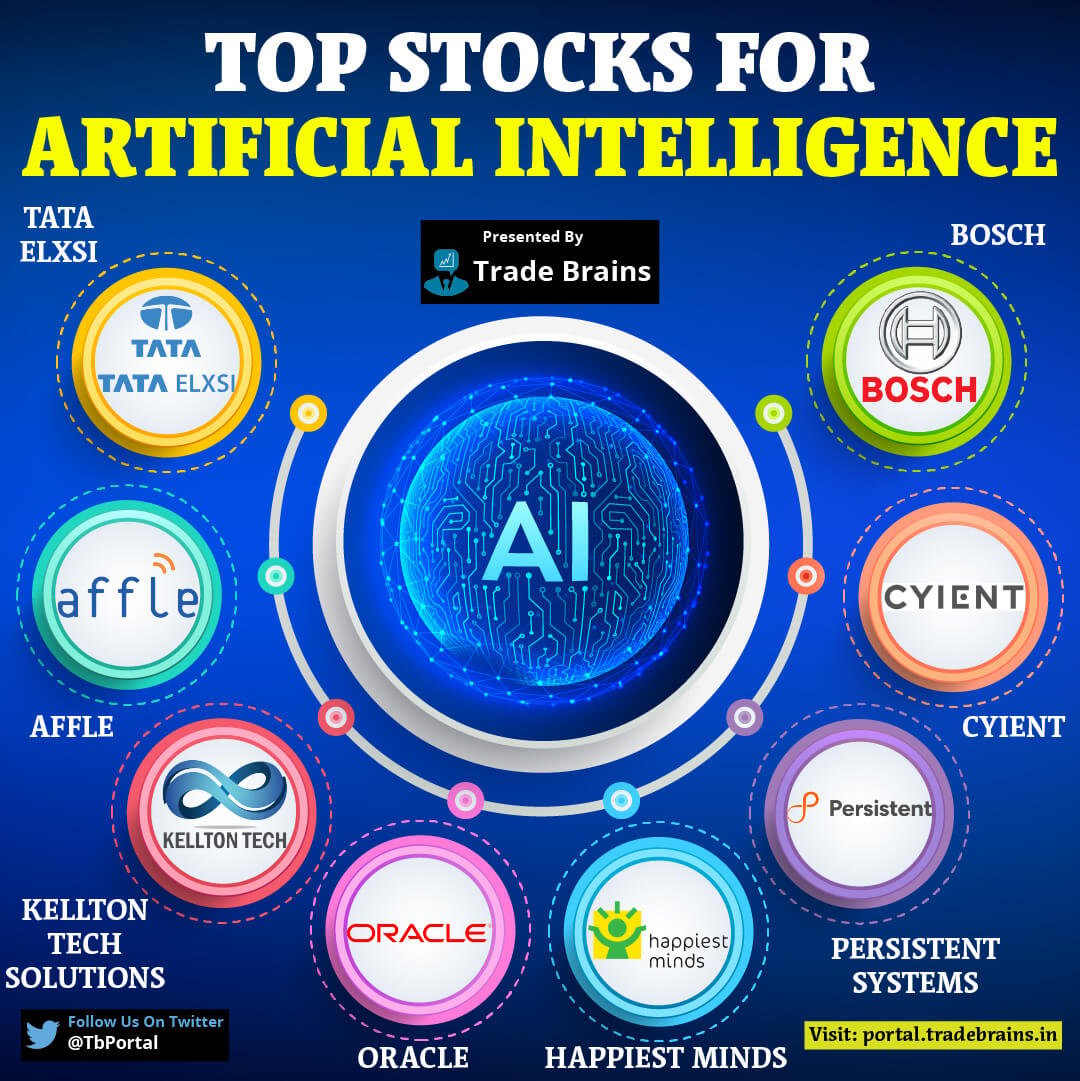

2. Technological Innovation: Technological advancements continue to disrupt industries and create new opportunities. Artificial intelligence (AI), automation, and the rise of the metaverse are expected to drive significant investment in the coming years.

3. Climate Change and Sustainability: The growing awareness of climate change is pushing businesses and investors towards sustainable practices. Companies with strong environmental, social, and governance (ESG) credentials are likely to attract more capital.

4. Demographics and Consumer Behavior: Shifting demographics, particularly the aging population and the rise of the millennial generation, will influence consumer spending patterns and investment priorities.

5. Geopolitical Landscape: Geopolitical events, such as trade wars, conflicts, and sanctions, can significantly impact market sentiment and investment flows.

6. Monetary Policy: Central banks worldwide are navigating a delicate balance between controlling inflation and supporting economic growth. Interest rate changes and quantitative easing measures will have a direct impact on stock valuations.

7. Regulatory Environment: Government regulations and policies play a crucial role in shaping market behavior. Changes in tax laws, antitrust policies, and data privacy regulations can influence investment decisions.

8. Emerging Markets: Emerging economies are expected to play a more prominent role in the global economy. Investments in these markets offer potential for higher returns but also carry higher risks.

Analyzing the Trends: What to Expect in 2025

While predicting specific stock prices is impossible, analyzing the trends discussed above can provide a framework for understanding potential market movements. Here are some key areas to watch:

1. Sectoral Shifts: As technological innovation continues, sectors like technology, healthcare, and renewable energy are likely to experience significant growth. Traditional industries may face challenges due to automation and changing consumer preferences.

2. The Rise of ESG Investing: Investors are increasingly prioritizing companies with strong ESG credentials. This trend is likely to continue, driving capital towards businesses focused on environmental sustainability, social responsibility, and good corporate governance.

3. Automation and the Future of Work: The rise of automation will impact various industries, creating both opportunities and challenges. Companies that embrace automation and adapt to the changing workforce will likely outperform their peers.

4. The Metaverse and Web3: The development of the metaverse and Web3 technologies is expected to create new investment opportunities. Companies involved in virtual reality, augmented reality, blockchain, and decentralized finance are likely to attract significant interest.

5. Healthcare Innovations: Advancements in biotechnology, genomics, and personalized medicine are driving growth in the healthcare sector. Companies developing innovative treatments and therapies will likely benefit from increased investment.

6. Emerging Markets Growth: Emerging markets are expected to experience continued economic growth, fueled by rising middle classes and increasing urbanization. Investors seeking higher returns may look towards these markets, but they should be aware of the associated risks.

7. Volatility and Market Corrections: The stock market is inherently volatile. While long-term growth is expected, short-term fluctuations are inevitable. Investors should be prepared for market corrections and maintain a diversified portfolio.

Stock Trends Chart 2025: A Visual Representation

The stock trends chart 2025 is a hypothetical representation of potential market movements. It is not a prediction but rather a visualization of potential scenarios based on current trends and economic indicators.

Note: The chart is illustrative and does not reflect actual market performance.

Key Elements of the Chart:

- X-Axis: Time (Months/Years)

- Y-Axis: Stock Index Value (e.g., S&P 500)

- Trend Lines: Indicate potential upward or downward movements

- Key Events: Highlight significant economic or geopolitical events that could influence market sentiment

Interpreting the Chart:

The chart can help investors understand:

- Potential Growth Trajectories: The upward trend lines suggest potential growth in the market.

- Periods of Volatility: The fluctuations in the chart indicate potential market corrections or periods of uncertainty.

- Impact of Key Events: The markers on the chart highlight events that could influence market sentiment.

Limitations of the Chart:

- Hypothetical: The chart is based on assumptions and does not guarantee future performance.

- Simplified: The chart does not account for all the complexities of the stock market.

Related Searches:

1. Stock Market Predictions 2025: Explore forecasts from various financial institutions and analysts regarding stock market performance in 2025.

2. Top Stocks to Buy in 2025: Research recommendations from experts and financial advisors on promising stocks to invest in for 2025.

3. Stock Market Trends 2025: Analyze in-depth trends shaping the stock market landscape in 2025, including technological advancements, economic growth, and geopolitical factors.

4. Investing in the Metaverse 2025: Explore the potential of investing in metaverse-related companies and technologies for 2025.

5. ESG Investing Trends 2025: Analyze the growing importance of ESG investing and its impact on stock market trends in 2025.

6. Artificial Intelligence Stock Market 2025: Explore the role of AI in shaping the stock market and identify potential investment opportunities in AI-related companies.

7. Global Economic Outlook 2025: Understand the projected global economic growth, inflation rates, and interest rate policies that could influence stock market performance in 2025.

8. Emerging Market Investment Opportunities 2025: Identify promising investment opportunities in emerging markets and assess the associated risks and rewards.

Stock Trends Chart 2025: Frequently Asked Questions

Q1: Is it possible to accurately predict stock market performance?

A: Predicting the stock market with absolute certainty is impossible. However, by analyzing historical data, current trends, and economic indicators, investors can gain insights into potential market movements and make informed investment decisions.

Q2: What are the biggest risks to the stock market in 2025?

A: The stock market is subject to numerous risks, including:

- Economic Slowdown: A global economic slowdown could negatively impact corporate profits and stock valuations.

- Inflation: High inflation can erode corporate earnings and reduce investor confidence.

- Interest Rate Hikes: Rising interest rates can increase borrowing costs for businesses and make stocks less attractive to investors.

- Geopolitical Uncertainty: Geopolitical events, such as wars, trade disputes, and sanctions, can create market volatility and disrupt investment flows.

Q3: How can investors prepare for potential market volatility in 2025?

A: Investors can prepare for market volatility by:

- Diversifying their portfolios: Investing in a range of asset classes, such as stocks, bonds, and real estate, can help mitigate risk.

- Maintaining a long-term perspective: Market fluctuations are inevitable, but focusing on long-term investment goals can help weather short-term volatility.

- Regularly reviewing their portfolios: Periodically reviewing investment strategies and adjusting them based on market conditions is essential.

Q4: What are some of the best investment strategies for 2025?

A: Investment strategies for 2025 should consider:

- Long-term growth: Investing in companies with strong fundamentals and growth potential.

- ESG investing: Prioritizing companies with strong environmental, social, and governance practices.

- Technological innovation: Investing in sectors driven by technological advancements, such as AI, automation, and the metaverse.

- Emerging markets: Exploring investment opportunities in rapidly growing emerging economies.

Q5: How can investors stay informed about stock market trends?

A: Investors can stay informed about stock market trends by:

- Following financial news: Reading reputable financial publications and news sources.

- Consulting with financial advisors: Seeking professional advice from qualified financial professionals.

- Utilizing online resources: Accessing investment research, market data, and analysis tools available online.

Stock Trends Chart 2025: Tips for Investors

1. Embrace a Long-Term Perspective: Avoid making impulsive investment decisions based on short-term market fluctuations. Focus on long-term goals and strategies.

2. Diversify Your Portfolio: Spread your investments across different asset classes, sectors, and geographies to mitigate risk.

3. Conduct Thorough Research: Before investing in any company or asset, thoroughly research its fundamentals, growth prospects, and potential risks.

4. Monitor Market Trends: Stay informed about current market trends, economic indicators, and geopolitical events that could impact investment decisions.

5. Seek Professional Advice: Consult with a qualified financial advisor to develop a personalized investment plan tailored to your financial goals and risk tolerance.

6. Manage Your Emotions: Avoid letting fear or greed drive your investment decisions. Stay disciplined and stick to your investment plan.

7. Stay Patient: Investing is a long-term game. Be patient and avoid making hasty decisions based on short-term market movements.

Conclusion:

The stock trends chart 2025 is a valuable tool for understanding potential market movements, but it is not a crystal ball. While the future of the stock market is uncertain, analyzing current trends and economic indicators can provide valuable insights for investors to make informed decisions.

By understanding the key drivers of market trends, embracing a long-term perspective, and staying informed, investors can navigate the dynamic landscape of the stock market and potentially achieve their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Deep Dive into Stock Market Trends for 2025. We hope you find this article informative and beneficial. See you in our next article!