Navigating the Future: A Look at Apple Stock Trends in 2025

Navigating the Future: A Look at Apple Stock Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: A Look at Apple Stock Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: A Look at Apple Stock Trends in 2025

- 2 Introduction

- 3 Navigating the Future: A Look at Apple Stock Trends in 2025

- 3.1 Apple Stock Trends in 2025: A Multifaceted Analysis

- 3.2 Key Drivers of Apple Stock Trends in 2025

- 3.3 Potential Risks to Apple Stock Trends in 2025

- 3.4 Related Searches: Apple Stock Trends in 2025

- 3.5 FAQs: Apple Stock Trends in 2025

- 3.6 Tips for Investing in Apple Stock in 2025

- 3.7 Conclusion: Apple Stock Trends in 2025

- 4 Closure

Navigating the Future: A Look at Apple Stock Trends in 2025

The tech landscape is constantly evolving, and Apple, a titan in the industry, finds itself at the center of this dynamic shift. Predicting the future of any stock is inherently challenging, but understanding the factors that influence Apple stock trends in 2025 can provide valuable insights for investors.

Apple Stock Trends in 2025: A Multifaceted Analysis

Predicting stock trends requires a comprehensive analysis that considers various factors, including:

- Market Dynamics: The global economy, interest rates, inflation, and consumer spending patterns all play a significant role in shaping market sentiment and influencing stock prices.

- Technological Innovation: Apple’s continuous innovation in hardware, software, and services is a key driver of its success. The company’s ability to introduce groundbreaking products and services will be crucial in maintaining its market leadership.

- Competitive Landscape: The tech industry is highly competitive, with players like Samsung, Google, and Microsoft vying for market share. Apple’s ability to differentiate itself and maintain its brand value will be critical.

- Regulatory Environment: Government regulations, particularly those related to data privacy, antitrust, and intellectual property, can impact Apple’s operations and stock performance.

- Consumer Demand: Ultimately, Apple’s success depends on consumer demand for its products and services. Factors like consumer confidence, purchasing power, and product adoption rates will influence sales and, consequently, stock prices.

Key Drivers of Apple Stock Trends in 2025

1. The Metaverse and Augmented Reality (AR): Apple is reportedly investing heavily in AR and VR technologies. The metaverse, a virtual world where users can interact and engage in various activities, is expected to be a significant growth area in the coming years. Apple’s foray into this space could drive significant revenue and stock growth.

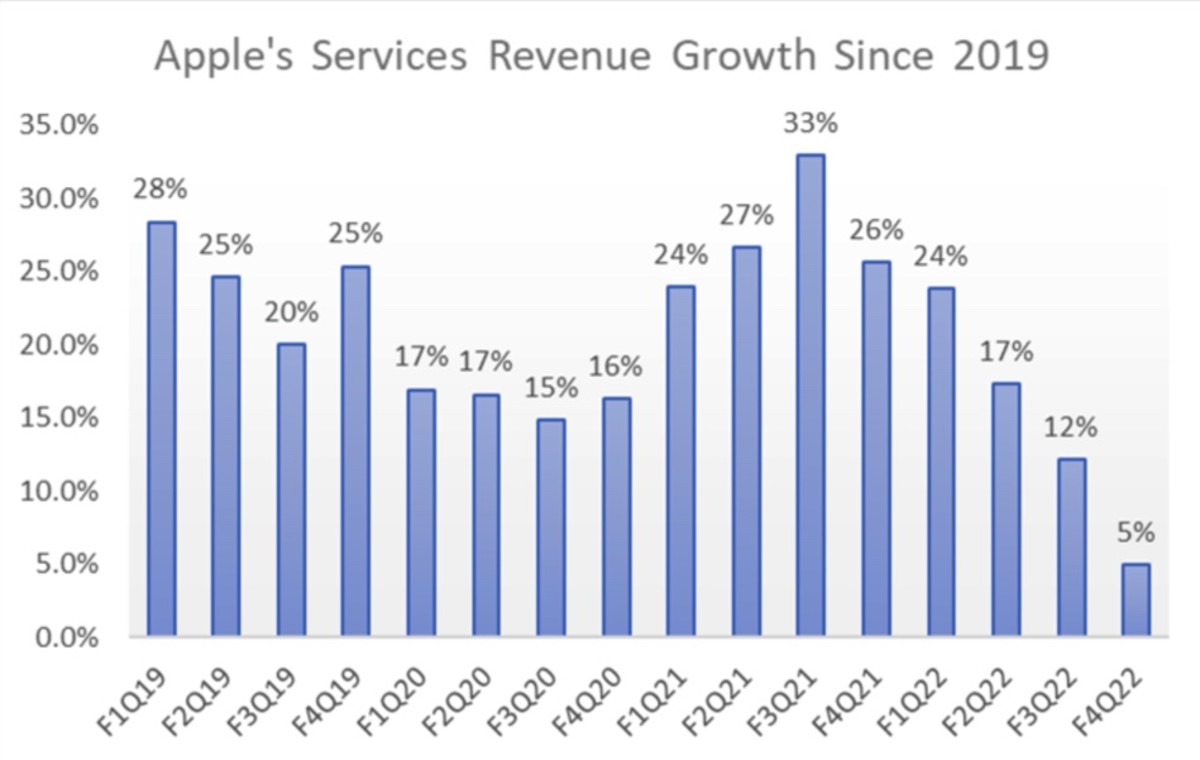

2. Continued Expansion of Services: Apple’s services business, which includes Apple Music, Apple TV+, Apple Pay, and iCloud, is a growing revenue stream. Continued expansion and innovation in these areas could contribute to consistent stock growth.

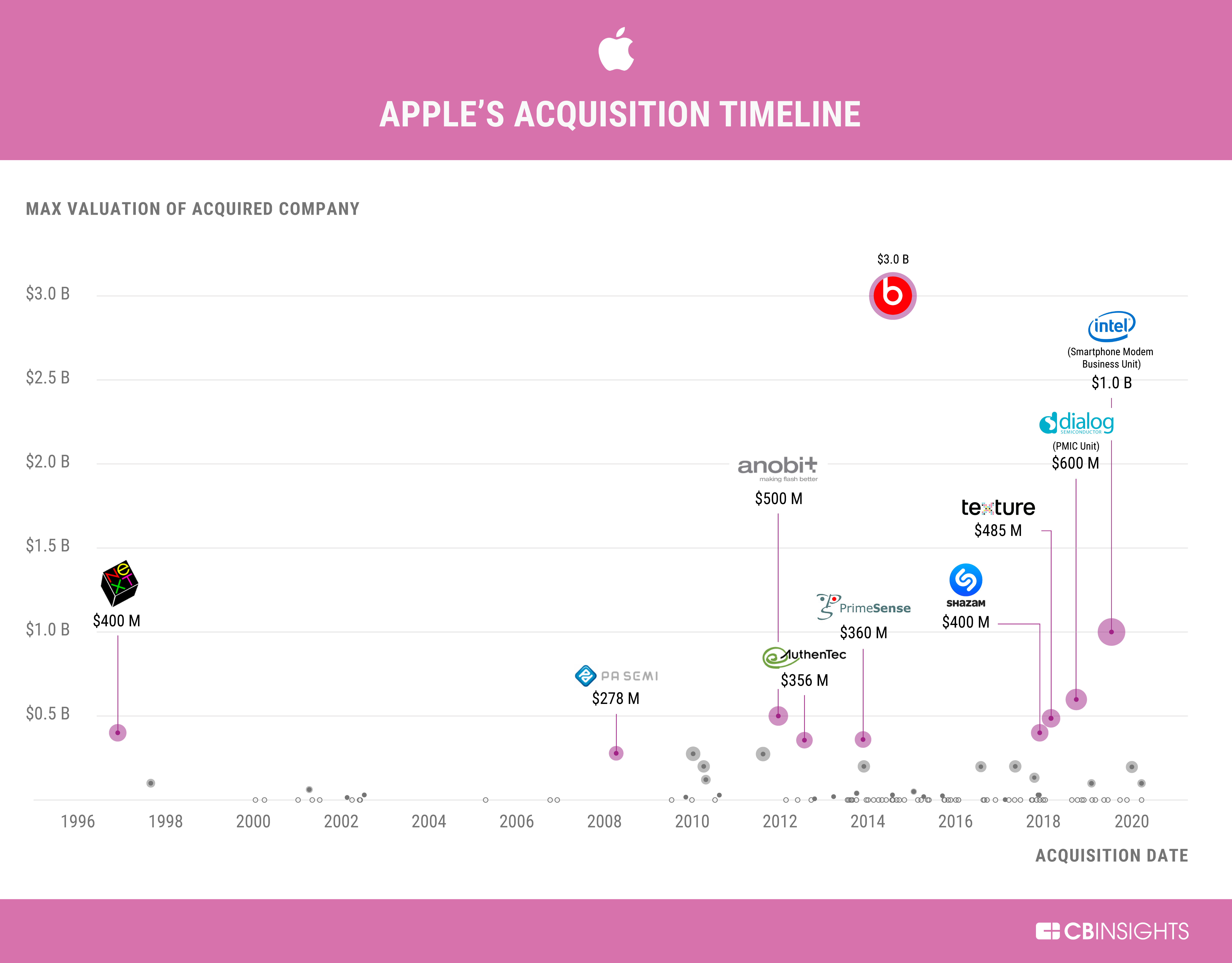

3. Hardware Innovation: Apple’s ability to introduce innovative hardware products, such as the iPhone, iPad, and Mac, remains a key driver of its stock performance. Continued advancements in chip technology, design, and user experience could attract new customers and drive sales.

4. Focus on Sustainability: Consumers are increasingly demanding sustainable products and practices. Apple’s commitment to environmental sustainability, including its use of recycled materials and energy-efficient manufacturing processes, could attract environmentally conscious investors and bolster stock performance.

5. Emerging Markets Growth: Apple has significant growth potential in emerging markets like India and China. Expanding its market presence in these regions could contribute to increased sales and stock appreciation.

Potential Risks to Apple Stock Trends in 2025

While Apple enjoys a strong market position, it faces potential risks that could impact its stock performance:

1. Supply Chain Disruptions: Global supply chain disruptions, such as those caused by the COVID-19 pandemic, can impact Apple’s production and sales, potentially leading to stock volatility.

2. Economic Slowdown: A global economic slowdown could negatively impact consumer spending, leading to reduced demand for Apple products and potentially affecting stock prices.

3. Competition: Intense competition from other tech giants could erode Apple’s market share and affect its profitability, impacting stock performance.

4. Regulatory Challenges: Increased regulatory scrutiny, particularly in areas like data privacy and antitrust, could impose significant costs on Apple and negatively impact its stock.

5. Currency Fluctuations: Fluctuations in currency exchange rates can impact Apple’s revenue and profitability, potentially influencing its stock price.

Related Searches: Apple Stock Trends in 2025

Understanding the various factors influencing Apple stock trends in 2025 necessitates exploring related searches that provide a broader context:

- Apple Stock Forecast 2025: This search explores analysts’ predictions and projections for Apple’s stock price in 2025.

- Apple Stock Price History: Analyzing historical stock price data can reveal trends and patterns that may help predict future price movements.

- Apple Financial Performance: Understanding Apple’s financial performance, including its revenue, profits, and cash flow, is crucial for evaluating its stock potential.

- Apple Products and Services: Analyzing the popularity, adoption rates, and future prospects of Apple’s products and services can shed light on its future growth potential.

- Apple Competitors: Understanding the competitive landscape and the strategies of Apple’s competitors can provide insights into its market position and future prospects.

- Apple Innovation: Keeping abreast of Apple’s latest technological innovations and product launches can provide insights into its future growth trajectory.

- Apple Investor Relations: Accessing Apple’s investor relations materials, such as earnings calls and investor presentations, can provide valuable insights into the company’s strategy and outlook.

- Apple News and Analysis: Staying updated on news and analysis from reputable financial sources can help investors stay informed about Apple’s performance and market trends.

FAQs: Apple Stock Trends in 2025

Q1: What are the key factors driving Apple stock growth in 2025?

A1: Continued innovation in hardware and services, expansion into new markets like the metaverse, and a strong commitment to sustainability are expected to drive Apple stock growth in 2025.

Q2: What are the potential risks to Apple stock in 2025?

A2: Supply chain disruptions, economic slowdown, increased competition, regulatory challenges, and currency fluctuations are potential risks that could impact Apple stock performance.

Q3: How does Apple’s financial performance impact its stock price?

A3: Apple’s financial performance, including its revenue, profits, and cash flow, is a key indicator of its stock potential. Strong financial performance typically leads to higher stock prices, while weak performance can result in declines.

Q4: What is the role of consumer demand in Apple stock trends?

A4: Consumer demand for Apple products and services is a crucial factor influencing stock performance. High demand leads to increased sales and profits, boosting stock prices. Conversely, weak demand can negatively impact stock performance.

Q5: How can investors stay informed about Apple stock trends?

A5: Investors can stay informed by monitoring news and analysis from reputable financial sources, accessing Apple’s investor relations materials, and analyzing its financial performance and market trends.

Tips for Investing in Apple Stock in 2025

- Conduct Thorough Research: Before investing in Apple stock, it is crucial to conduct thorough research, understanding the company’s financial performance, product portfolio, and market position.

- Consider Your Investment Goals: Determine your investment goals and risk tolerance before investing in Apple stock. It’s essential to align your investments with your financial objectives.

- Diversify Your Portfolio: Diversifying your portfolio by investing in various assets, including stocks, bonds, and real estate, can help mitigate risk and enhance returns.

- Monitor Market Trends: Keeping abreast of market trends and news related to Apple can provide valuable insights into its stock performance.

- Seek Professional Advice: If you are unsure about investing in Apple stock, consulting with a financial advisor can provide personalized guidance and support.

Conclusion: Apple Stock Trends in 2025

Predicting the future of Apple stock trends in 2025 is a complex endeavor, influenced by a multitude of factors. However, by understanding the key drivers of its growth, potential risks, and the broader market context, investors can make informed decisions. While Apple faces challenges and uncertainties, its continued innovation, strong brand, and loyal customer base position it for future success. Ultimately, the performance of Apple stock will depend on its ability to adapt to evolving market dynamics and meet the changing needs of consumers.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Look at Apple Stock Trends in 2025. We thank you for taking the time to read this article. See you in our next article!