Navigating the Future: Bank Trends in 2025

Navigating the Future: Bank Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Bank Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Bank Trends in 2025

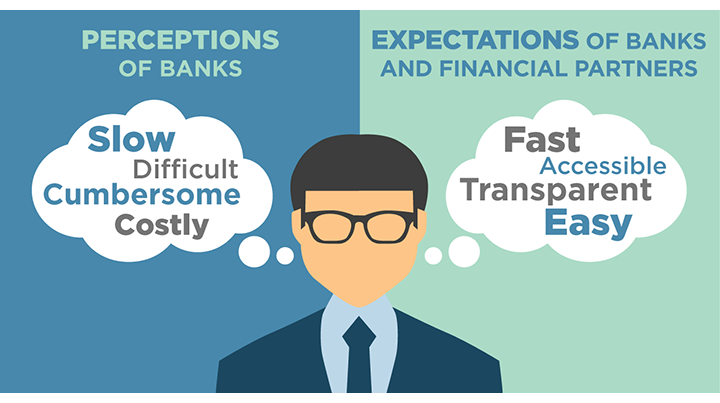

The banking landscape is in constant flux, driven by technological advancements, evolving customer expectations, and a growing focus on sustainability. Bank trends in 2025 are poised to reshape the industry, creating opportunities for innovation and growth while presenting challenges for traditional institutions.

The Rise of Digital Banking and FinTech

Digital banking has become the cornerstone of modern financial services. By 2025, the lines between traditional banks and FinTech will continue to blur, with both seeking to leverage technology to deliver a seamless and personalized customer experience.

- Hyper-Personalization: Banks will utilize data analytics and artificial intelligence (AI) to understand customer needs and preferences better. This will enable them to offer tailored financial products and services, including personalized investment advice, customized loan offers, and targeted financial education programs.

- Open Banking and API Integration: Open banking allows customers to share their financial data with third-party applications, facilitating a more connected and integrated financial ecosystem. Banks will embrace open banking to offer enhanced services and partnerships, fostering innovation and competition.

- Mobile-First Banking: The adoption of smartphones and tablets will continue to drive the growth of mobile banking. Banks will invest in developing user-friendly mobile apps that offer a comprehensive range of financial services, including payments, transfers, budgeting, and investment management.

- The Rise of Embedded Finance: Banking services will be integrated into non-financial platforms, such as e-commerce websites, ride-sharing apps, and social media platforms. This trend will enable customers to access financial services seamlessly within their everyday activities.

The Importance of Data Security and Privacy

As banks rely increasingly on data to deliver personalized services, safeguarding customer data becomes paramount.

- Advanced Security Measures: Banks will implement robust security measures, including multi-factor authentication, encryption, and threat intelligence, to protect customer data from cyberattacks and data breaches.

- Data Privacy Regulations: Compliance with data privacy regulations like GDPR and CCPA will be crucial for maintaining customer trust and avoiding hefty fines.

- Transparency and Control: Banks will empower customers to control their data by providing clear and transparent information about data collection, usage, and sharing practices.

Sustainable Finance and ESG Investing

Sustainability and environmental, social, and governance (ESG) considerations are gaining increasing importance in the financial sector.

- Green Lending and Investments: Banks will prioritize lending to businesses and projects that promote environmental sustainability, such as renewable energy, green buildings, and sustainable agriculture.

- ESG Reporting and Disclosure: Banks will be expected to report on their ESG performance, demonstrating their commitment to responsible and ethical business practices.

- Impact Investing: Investors will increasingly seek investments that generate both financial returns and positive social and environmental impact. Banks will play a crucial role in facilitating impact investing by offering dedicated products and services.

The Rise of the "Hybrid" Bank

The future of banking will see a convergence of traditional and digital models, creating "hybrid" banks that offer both physical and digital services.

- Branch Transformation: Physical branches will evolve into experience centers, offering personalized financial advice, specialized services, and community engagement activities.

- Digital-First Branch Experience: Banks will integrate digital technologies into their branches, such as interactive kiosks, video conferencing, and mobile check-in, to enhance customer experience.

- Omnichannel Customer Service: Banks will provide a consistent and seamless experience across all channels, including online, mobile, and physical branches, to meet customer needs effectively.

The Impact of Artificial Intelligence (AI)

AI is poised to revolutionize banking operations and customer experience.

- AI-Powered Customer Service: AI chatbots and virtual assistants will provide 24/7 customer support, answering questions, resolving issues, and providing personalized financial advice.

- Fraud Detection and Prevention: AI algorithms will detect and prevent fraudulent transactions in real time, enhancing security and protecting customer funds.

- Risk Management and Compliance: AI can analyze vast amounts of data to identify and mitigate risks, ensuring compliance with regulations and minimizing financial losses.

The Changing Role of the Banker

As technology plays a more prominent role, the role of bankers will evolve.

- Financial Advisors and Relationship Managers: Bankers will focus on providing personalized financial advice, building strong customer relationships, and understanding individual needs.

- Technology Experts: Bankers will need to be proficient in using digital tools and technologies to deliver seamless and innovative financial services.

- Data Analysts and Interpreters: Bankers will need to understand and interpret data to identify trends, anticipate customer needs, and make informed decisions.

The Future of Payment Systems

The way we pay for goods and services is undergoing a transformation.

- Contactless Payments: Mobile wallets and contactless payment methods will become the dominant form of payment, offering speed, convenience, and security.

- Biometric Authentication: Facial recognition, fingerprint scanning, and other biometric technologies will enhance security and streamline payment processes.

- Cryptocurrencies and Digital Assets: The adoption of cryptocurrencies and digital assets will continue to grow, creating new opportunities for banks to offer financial services in the digital asset space.

Challenges and Opportunities in the Banking Industry

The trends shaping bank trends in 2025 present both challenges and opportunities for the industry.

- Competition from FinTechs: Traditional banks face intense competition from innovative FinTech companies that offer specialized financial services and a more agile approach.

- Regulatory Compliance: Navigating a complex and evolving regulatory landscape poses a significant challenge for banks.

- Cybersecurity Threats: The increasing reliance on technology exposes banks to cyberattacks and data breaches, requiring robust security measures.

- Talent Acquisition and Retention: Attracting and retaining skilled employees with expertise in technology, data analytics, and customer service is crucial for success.

Related Searches:

- Banking Technology Trends: Explore advancements in banking technology, including cloud computing, blockchain, and AI.

- Digital Banking Adoption: Examine the growing adoption of digital banking services and its impact on customer behavior.

- FinTech Disruption: Analyze the impact of FinTech companies on the traditional banking industry and the emergence of new financial services.

- Customer Experience in Banking: Understand the evolving expectations of bank customers and how banks are adapting to provide a seamless and personalized experience.

- Sustainable Finance and ESG Investing: Explore the increasing importance of sustainability and ESG considerations in the financial sector.

- Future of Banking Jobs: Analyze the changing role of bankers and the skills required to succeed in the future of banking.

- Payment Innovation: Examine advancements in payment technologies, including contactless payments, mobile wallets, and cryptocurrencies.

- Cybersecurity in Banking: Explore the challenges of cybersecurity in the banking industry and the measures being taken to protect customer data.

FAQs about Bank Trends in 2025

-

Q: What are the key drivers of bank trends in 2025?

- A: Technological advancements, evolving customer expectations, and a growing focus on sustainability are the primary drivers of bank trends in 2025.

-

Q: How will technology impact the banking industry in 2025?

- A: Technology will play a transformative role in banking, enabling hyper-personalization, open banking, mobile-first banking, AI-powered customer service, and advanced security measures.

-

Q: What are the implications of open banking for banks?

- A: Open banking will create new opportunities for banks to offer enhanced services and partnerships, fostering innovation and competition.

-

Q: How will banks adapt to the increasing importance of sustainability?

- A: Banks will prioritize green lending, ESG reporting, and impact investing to demonstrate their commitment to responsible and ethical business practices.

-

Q: What are the challenges facing the banking industry in 2025?

- A: Competition from FinTechs, regulatory compliance, cybersecurity threats, and talent acquisition are some of the key challenges facing the banking industry in 2025.

Tips for Banks in 2025

- Embrace Digital Transformation: Invest in technology to enhance customer experience, streamline operations, and stay ahead of the competition.

- Prioritize Customer Experience: Focus on providing a seamless, personalized, and secure experience across all channels.

- Develop a Strong Data Strategy: Leverage data analytics and AI to understand customer needs, personalize services, and mitigate risks.

- Embrace Open Banking: Explore opportunities to collaborate with third-party providers and offer innovative financial solutions.

- Invest in Sustainability: Align business practices with ESG principles to attract investors and demonstrate a commitment to social responsibility.

- Develop a Robust Cybersecurity Strategy: Implement advanced security measures to protect customer data from cyberattacks and data breaches.

- Invest in Talent Development: Attract and retain skilled employees with expertise in technology, data analytics, and customer service.

Conclusion

Bank trends in 2025 are poised to reshape the banking industry, creating a more digital, personalized, and sustainable financial landscape. Banks that embrace these trends, leverage technology effectively, and prioritize customer experience will be best positioned for success. The future of banking is characterized by innovation, collaboration, and a commitment to delivering value to customers in a rapidly evolving world.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Bank Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!