Navigating the Future: Insurance Industry Trends in 2025

Navigating the Future: Insurance Industry Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Insurance Industry Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Insurance Industry Trends in 2025

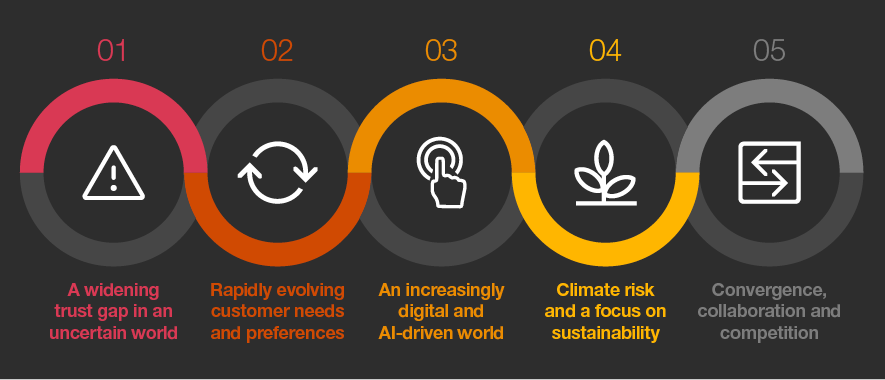

The insurance industry is undergoing a rapid transformation, driven by technological advancements, evolving customer expectations, and a changing global landscape. As we approach 2025, understanding these trends is crucial for insurers to remain competitive and adapt to the evolving needs of their customers.

Insurance Industry Trends in 2025 represent a confluence of forces shaping the future of risk management and financial security. This analysis will delve into eight key areas impacting the industry:

1. The Rise of Insurtech and Digital Transformation:

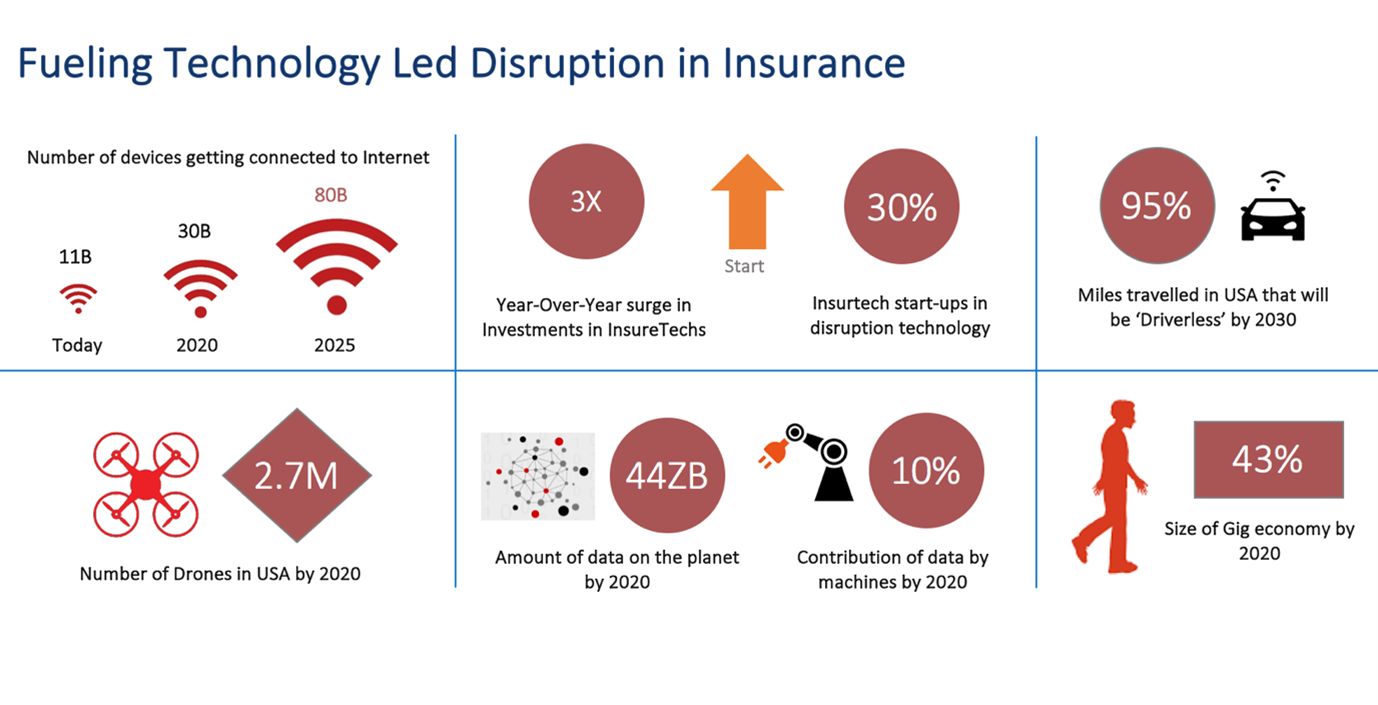

Insurtech, the intersection of insurance and technology, is revolutionizing the industry. Insurtech startups are disrupting traditional insurance models with innovative solutions, leveraging data analytics, artificial intelligence (AI), and cloud computing to deliver faster, more personalized, and efficient insurance products and services.

- Data-driven Underwriting and Pricing: Insurers are increasingly relying on data analytics to assess risk profiles and determine premiums more accurately. This allows for tailored policies and competitive pricing, leading to better customer experiences and increased profitability.

- Automated Claims Processing: AI and machine learning are streamlining claims processing, reducing processing times, and minimizing errors. This results in faster payouts and improved customer satisfaction.

- Personalized Insurance Products: Insurtech companies are developing personalized insurance products based on individual needs and risk profiles, offering greater flexibility and value to customers.

- Digital Distribution Channels: Insurers are leveraging digital platforms like mobile apps and online portals to reach a wider audience and provide convenient, 24/7 access to insurance services.

2. The Growing Importance of Customer Experience:

Customers are demanding a more personalized and seamless insurance experience. Insurers must adapt to these expectations by offering intuitive digital interfaces, proactive communication, and personalized solutions.

- Customer-centricity: Insurers are shifting their focus to customer needs, offering personalized solutions and tailoring products to individual requirements.

- Enhanced Customer Service: Improved customer service channels, including chatbots, virtual assistants, and 24/7 online support, are becoming increasingly important.

- Data Privacy and Security: Customers are becoming more aware of data privacy and security. Insurers must ensure robust data protection measures and transparent data handling practices to maintain trust.

3. The Impact of Climate Change:

Climate change is increasing the frequency and severity of natural disasters, posing significant challenges to the insurance industry. Insurers are adapting their underwriting and risk management strategies to account for these evolving risks.

- Climate-related Risk Modeling: Insurers are developing sophisticated models to assess and quantify climate-related risks, enabling them to adjust premiums and coverage accordingly.

- Sustainable Insurance Products: Insurers are offering products that promote sustainability and encourage climate-friendly practices, such as discounts for green buildings or electric vehicles.

- Disaster Preparedness and Response: Insurers are enhancing their disaster preparedness and response capabilities, providing support to policyholders during and after natural disasters.

4. The Rise of the Sharing Economy:

The sharing economy is reshaping various sectors, including insurance. Insurers are developing new products and services to meet the evolving needs of individuals and businesses participating in sharing platforms.

- Peer-to-Peer Insurance: P2P insurance platforms allow individuals to share risks and pool premiums, offering alternative insurance solutions.

- On-Demand Insurance: Insurers are providing short-term, on-demand insurance coverage for specific events or activities, catering to the needs of gig workers and those participating in the sharing economy.

5. The Growing Role of Artificial Intelligence (AI):

AI is transforming various aspects of the insurance industry, from underwriting and claims processing to customer service and fraud detection.

- AI-powered Underwriting: AI algorithms can analyze large datasets to assess risk profiles more accurately and personalize premiums.

- Automated Claims Processing: AI-powered chatbots and virtual assistants can handle routine claims inquiries and expedite the claims process.

- Fraud Detection: AI can identify patterns and anomalies in claims data, helping to prevent and detect fraudulent activities.

6. The Importance of Cybersecurity:

As insurers increasingly rely on digital platforms and data, cybersecurity becomes paramount. Protecting sensitive customer data and ensuring operational resilience are crucial for maintaining trust and mitigating risks.

- Cybersecurity Investments: Insurers are investing heavily in cybersecurity infrastructure and personnel to protect against cyber threats.

- Data Encryption and Security Protocols: Implementing robust data encryption and security protocols is essential to safeguard sensitive information.

- Cyber Risk Insurance: Insurers are offering specialized cyber risk insurance policies to protect businesses against financial losses resulting from cyberattacks.

7. The Growing Demand for Transparency and Trust:

Customers are demanding greater transparency from insurers. They want clear and concise information about their policies, coverage, and pricing.

- Simplified Policy Language: Insurers are simplifying policy language to make it more understandable and accessible to customers.

- Increased Transparency: Insurers are providing more detailed information about their pricing models and risk assessments.

- Ethical Data Handling: Insurers are emphasizing ethical data handling practices and ensuring transparency in their use of customer data.

8. The Integration of Blockchain Technology:

Blockchain technology offers potential benefits for the insurance industry, including enhanced security, efficiency, and transparency.

- Smart Contracts: Blockchain-based smart contracts can automate insurance processes, reducing manual errors and improving efficiency.

- Data Security and Integrity: Blockchain’s decentralized nature enhances data security and integrity, reducing the risk of fraud and data breaches.

- Transparency and Traceability: Blockchain provides a transparent and auditable record of insurance transactions, improving trust and accountability.

Related Searches:

1. Future of Insurance Technology: This search explores the latest technological advancements shaping the insurance industry, including AI, blockchain, and cloud computing.

2. Insurtech Startups: This search focuses on the growing number of insurtech startups disrupting traditional insurance models and offering innovative solutions.

3. Insurance Industry Trends 2025: This search provides a comprehensive overview of the key trends shaping the insurance industry in the coming years.

4. Impact of Climate Change on Insurance: This search investigates the challenges posed by climate change to the insurance industry and how insurers are adapting to these risks.

5. Digital Transformation in Insurance: This search explores how insurers are leveraging digital technologies to improve efficiency, customer experience, and product development.

6. Customer Experience in Insurance: This search focuses on the evolving customer expectations in the insurance industry and how insurers are adapting to meet these demands.

7. AI in Insurance: This search delves into the various applications of AI in the insurance industry, including underwriting, claims processing, and fraud detection.

8. Cybersecurity in Insurance: This search examines the cybersecurity challenges facing the insurance industry and the measures insurers are taking to protect sensitive data and ensure operational resilience.

FAQs about Insurance Industry Trends in 2025:

1. What are the biggest challenges facing the insurance industry in 2025?

The insurance industry faces several challenges in 2025, including:

- Keeping up with rapid technological advancements: Insurers must constantly adapt to new technologies and integrate them into their operations.

- Meeting evolving customer expectations: Customers demand personalized experiences, seamless digital interactions, and transparent communication.

- Addressing the impact of climate change: Insurers must adapt their risk management strategies and pricing models to account for increasing climate-related risks.

- Maintaining cybersecurity: Protecting sensitive customer data and ensuring operational resilience against cyber threats is crucial.

2. How will technology impact the insurance industry in 2025?

Technology will play a transformative role in the insurance industry in 2025, driving:

- Increased automation: AI and machine learning will automate many insurance processes, improving efficiency and reducing costs.

- Personalized insurance products: Insurers will leverage data analytics to develop personalized insurance products tailored to individual needs.

- Enhanced customer experiences: Digital platforms and AI-powered chatbots will provide customers with convenient and personalized interactions.

- Improved risk assessment and pricing: Data analytics and AI will enable insurers to assess risks more accurately and set premiums more effectively.

3. How can insurers prepare for the insurance industry trends in 2025?

Insurers can prepare for the future by:

- Embracing digital transformation: Investing in technology and adopting digital solutions to improve efficiency, customer experience, and product development.

- Focusing on customer-centricity: Prioritizing customer needs and tailoring products and services to individual requirements.

- Addressing climate change risks: Developing climate-related risk models and offering sustainable insurance products.

- Investing in cybersecurity: Protecting sensitive customer data and ensuring operational resilience against cyber threats.

- Building partnerships with insurtech startups: Collaborating with insurtech companies to access innovative technologies and solutions.

4. What are the benefits of these trends for insurance customers?

These trends offer several benefits for insurance customers, including:

- Personalized insurance products: Customers can access insurance products tailored to their specific needs and risk profiles.

- Improved customer experience: Customers can enjoy faster and more convenient interactions with insurers through digital platforms and AI-powered services.

- Increased transparency and trust: Customers can access clear and concise information about their policies and coverage.

- Enhanced security and privacy: Insurers are implementing robust cybersecurity measures to protect sensitive customer data.

Tips for Insurers:

- Embrace a data-driven approach: Leverage data analytics and AI to improve risk assessment, pricing, and customer segmentation.

- Invest in digital transformation: Adopt digital platforms, mobile apps, and online portals to enhance customer experience and reach new markets.

- Focus on customer experience: Prioritize customer needs, offer personalized solutions, and provide excellent customer service.

- Stay informed about emerging technologies: Continuously monitor the latest technological advancements and explore opportunities to integrate them into your business.

- Build partnerships with insurtech startups: Collaborate with insurtech companies to access innovative solutions and accelerate digital transformation.

- Develop a comprehensive cybersecurity strategy: Invest in robust cybersecurity infrastructure and personnel to protect sensitive data and ensure operational resilience.

- Promote transparency and trust: Provide clear and concise information about policies and coverage, and ensure ethical data handling practices.

Conclusion:

Insurance Industry Trends in 2025 are shaping the future of risk management and financial security. By embracing these trends, insurers can create a more efficient, customer-centric, and sustainable industry. The key to success lies in adapting to technological advancements, prioritizing customer experience, addressing climate change risks, and maintaining cybersecurity. Insurers who embrace these trends will be well-positioned to thrive in the evolving insurance landscape and provide innovative solutions to meet the needs of their customers in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Insurance Industry Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!