Navigating the Future: Insurance Industry Trends Shaping 2025

Navigating the Future: Insurance Industry Trends Shaping 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Insurance Industry Trends Shaping 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: Insurance Industry Trends Shaping 2025

- 2 Introduction

- 3 Navigating the Future: Insurance Industry Trends Shaping 2025

- 3.1 1. The Rise of Insurtech:

- 3.2 2. Personalized Insurance Experiences:

- 3.3 3. Embracing the Sharing Economy:

- 3.4 4. The Rise of Embedded Insurance:

- 3.5 5. Sustainability and Climate Change:

- 3.6 6. The Importance of Cybersecurity:

- 3.7 7. Regulatory Landscape and Compliance:

- 3.8 8. The Future of the Workforce:

- 4 Related Searches:

- 5 FAQs by Trends in Insurance Industry 2025:

- 6 Tips by Trends in Insurance Industry 2025:

- 7 Conclusion by Trends in Insurance Industry 2025:

- 8 Closure

Navigating the Future: Insurance Industry Trends Shaping 2025

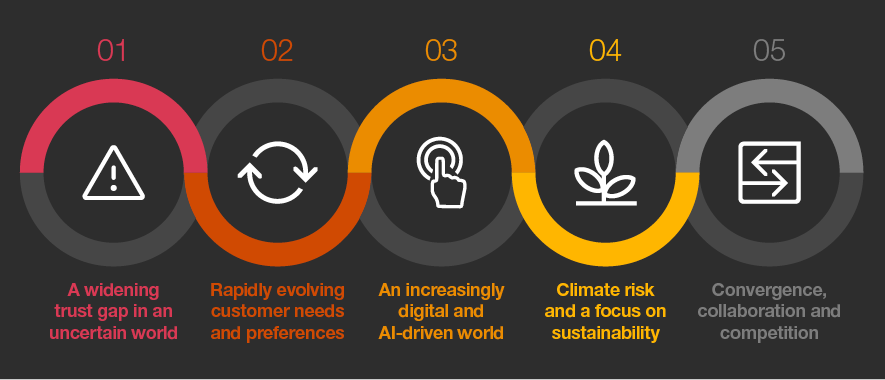

The insurance industry is undergoing a rapid transformation, driven by technological advancements, evolving customer expectations, and a shifting global landscape. As we approach 2025, the industry will be defined by its ability to adapt and embrace innovation. This article delves into the key trends in the insurance industry that will shape the landscape and define the future of risk management.

1. The Rise of Insurtech:

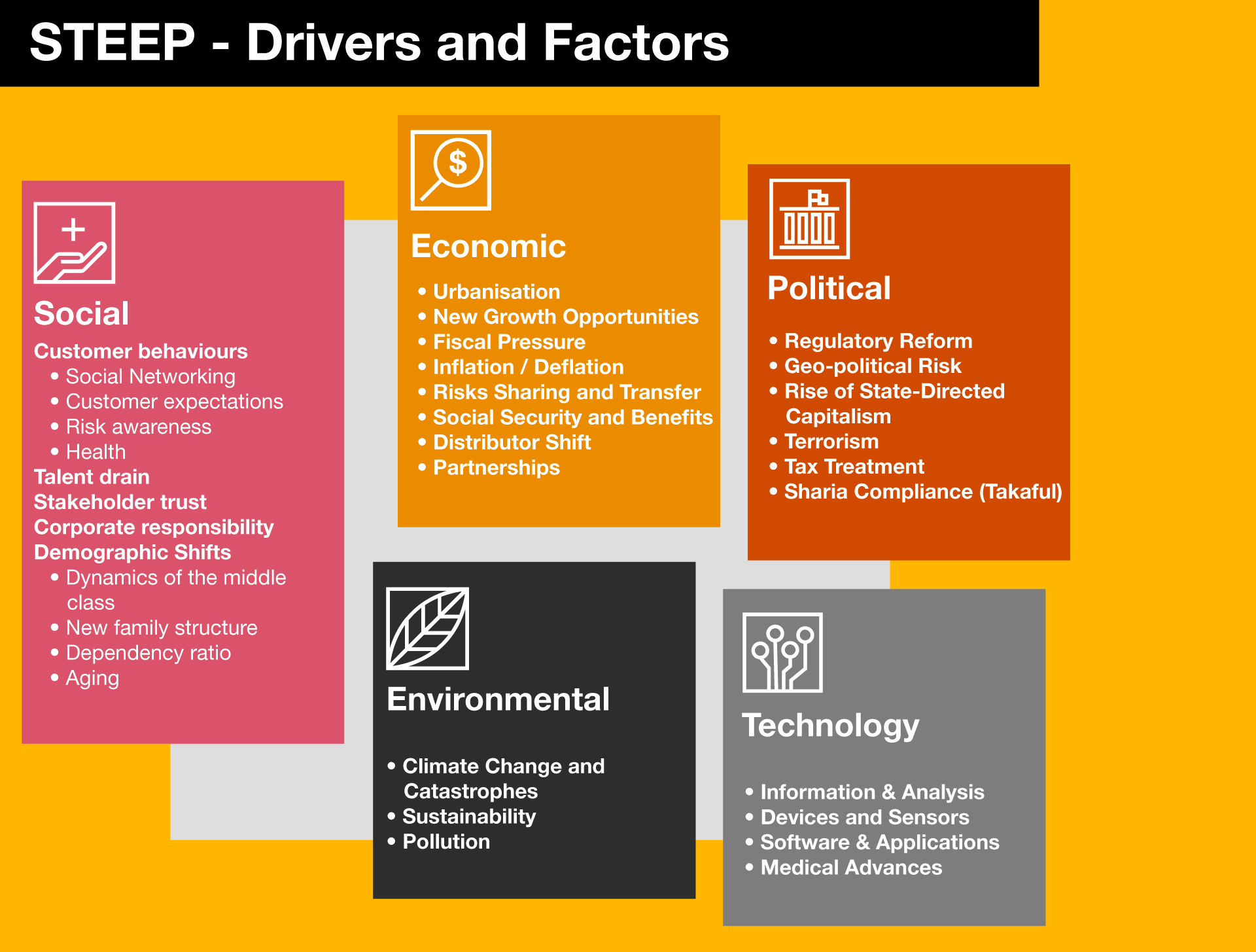

Insurtech, the intersection of insurance and technology, is revolutionizing the industry. This trend is characterized by the emergence of innovative startups and established players adopting cutting-edge technologies to disrupt traditional business models.

- Artificial Intelligence (AI): AI is transforming how insurance companies operate, from automating tasks to personalizing customer experiences. AI-powered chatbots are providing instant customer support, while algorithms are analyzing data to personalize pricing and identify fraud.

- Internet of Things (IoT): Connected devices are generating vast amounts of data, providing insurers with real-time insights into risk factors. This data can be used to develop dynamic pricing models, optimize claims processing, and offer personalized risk management solutions.

- Blockchain Technology: Blockchain is revolutionizing the insurance value chain by creating secure, transparent, and efficient systems. It can be used to streamline claims processing, facilitate peer-to-peer insurance, and improve data security.

- Big Data Analytics: Insurers are leveraging big data analytics to gain a deeper understanding of customer behavior, market trends, and risk factors. This data-driven approach enables them to develop tailored products, improve pricing strategies, and enhance risk assessment.

2. Personalized Insurance Experiences:

Customers are demanding personalized experiences across all industries, and insurance is no exception. This trend is pushing insurers to tailor their offerings to meet individual needs and preferences.

- Data-driven Customization: Insurers are using data to understand customer profiles, risk appetites, and lifestyle choices. This information enables them to develop customized insurance policies, pricing models, and communication strategies.

- Digital-first Customer Journeys: Insurers are investing in digital platforms and mobile applications to provide seamless and convenient customer experiences. This includes online quoting, policy management, claims reporting, and customer support.

- Hyper-personalization through AI: AI algorithms are analyzing customer data to predict their needs and preferences. This enables insurers to offer personalized recommendations, product suggestions, and communication tailored to each individual.

3. Embracing the Sharing Economy:

The sharing economy is impacting various sectors, and insurance is no exception. Peer-to-peer (P2P) insurance platforms are emerging, offering alternative models of risk sharing and coverage.

- P2P Insurance Models: P2P platforms connect individuals with similar risk profiles, allowing them to share risks and premiums. This can lead to lower costs and more flexible coverage options.

- Collaborative Risk Management: P2P platforms encourage members to engage in proactive risk management, sharing best practices and collaborating to reduce losses.

- Increased Transparency and Control: P2P insurance platforms provide greater transparency into pricing and risk assessment, empowering customers with more control over their insurance decisions.

4. The Rise of Embedded Insurance:

Embedded insurance is integrating insurance products directly into other platforms and services, making it easier for customers to access coverage.

- Insurance as a Service (IaaS): This approach allows businesses to embed insurance into their existing platforms and services, offering seamless and convenient access to coverage.

- Expanding Distribution Channels: Embedded insurance opens up new distribution channels for insurers, reaching customers through online marketplaces, ride-sharing platforms, and other digital services.

- Personalized and Contextual Coverage: Embedded insurance allows insurers to offer coverage that is tailored to the specific context and needs of the customer.

5. Sustainability and Climate Change:

Climate change is posing new risks and challenges for the insurance industry. Insurers are responding by developing products and services that address sustainability and climate resilience.

- Climate-related Risk Assessment: Insurers are incorporating climate change data into their risk assessments, evaluating the impact of extreme weather events, rising sea levels, and other climate-related risks.

- Green Insurance Products: Insurers are offering products that incentivize sustainable behavior, such as discounts for energy-efficient homes or electric vehicles.

- Climate Change Mitigation and Adaptation: Insurers are investing in climate change mitigation and adaptation initiatives, supporting projects that reduce greenhouse gas emissions and enhance resilience to climate-related risks.

6. The Importance of Cybersecurity:

As the insurance industry becomes increasingly digital, cybersecurity becomes paramount. Protecting sensitive customer data and preventing cyberattacks is crucial for maintaining trust and ensuring business continuity.

- Data Security and Privacy: Insurers are implementing robust data security measures to protect customer information from breaches and unauthorized access.

- Cyber Risk Management: Insurers are developing strategies to manage cyber risks, including implementing preventative measures, responding to incidents, and recovering from attacks.

- Cyber Insurance Products: Insurers are offering cyber insurance products to protect businesses from financial losses associated with cyberattacks, data breaches, and other cyber risks.

7. Regulatory Landscape and Compliance:

The regulatory landscape for the insurance industry is evolving rapidly, driven by technological advancements, consumer protection concerns, and global economic trends.

- Data Protection Regulations: Insurers are adapting to new data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), ensuring compliance and safeguarding customer data.

- Insurtech Regulations: Regulators are developing frameworks to address the unique challenges posed by insurtech companies, balancing innovation with consumer protection and market stability.

- Global Regulatory Harmonization: Efforts are underway to harmonize insurance regulations across borders, simplifying cross-border operations and promoting global market integration.

8. The Future of the Workforce:

The insurance industry is experiencing a skills gap, with a growing need for professionals with expertise in technology, data analytics, and customer experience.

- Upskilling and Reskilling: Insurers are investing in training programs to upskill and reskill their workforce, equipping employees with the skills needed to thrive in a digital environment.

- Attracting and Retaining Talent: Insurers are focusing on attracting and retaining talented individuals with the skills and expertise needed to navigate the changing industry landscape.

- Embracing Diversity and Inclusion: Insurers are embracing diversity and inclusion initiatives to create a more diverse and representative workforce, fostering innovation and better serving a diverse customer base.

Related Searches:

1. Future of Insurance Technology: This search explores the latest technological advancements shaping the insurance industry, including AI, IoT, blockchain, and big data analytics. It focuses on how these technologies are transforming business models, customer experiences, and risk management strategies.

2. Insurtech Startups: This search investigates the growing ecosystem of insurtech startups, analyzing their innovative business models, disruptive technologies, and impact on the traditional insurance market. It highlights the key players, funding trends, and challenges faced by these startups.

3. Digital Insurance Transformation: This search examines the broader digital transformation taking place in the insurance industry, exploring how companies are adopting digital strategies, optimizing their operations, and improving customer engagement through digital channels.

4. Personalized Insurance Solutions: This search focuses on the increasing demand for personalized insurance solutions, analyzing how insurers are leveraging data, AI, and digital technologies to tailor products and services to individual needs and preferences.

5. Sharing Economy in Insurance: This search investigates the impact of the sharing economy on the insurance industry, exploring the emergence of peer-to-peer insurance platforms, collaborative risk management models, and the implications for traditional insurance providers.

6. Insurance Industry Trends 2025: This search provides a comprehensive overview of the key trends shaping the insurance industry in 2025, including technological advancements, customer expectations, and regulatory changes. It offers insights into the future of risk management and the challenges and opportunities facing the industry.

7. Climate Change and Insurance: This search examines the impact of climate change on the insurance industry, exploring how insurers are assessing climate-related risks, developing sustainable insurance products, and supporting climate change mitigation and adaptation initiatives.

8. Cybersecurity in Insurance: This search focuses on the growing importance of cybersecurity in the insurance industry, analyzing the threats posed by cyberattacks, the need for data security and privacy, and the role of cyber insurance products in mitigating risks.

FAQs by Trends in Insurance Industry 2025:

1. What are the biggest challenges facing the insurance industry in 2025?

The insurance industry in 2025 will face several significant challenges, including:

- Keeping pace with technological advancements: The rapid evolution of technologies like AI, IoT, and blockchain requires constant adaptation and investment to remain competitive.

- Meeting evolving customer expectations: Customers are demanding personalized experiences, digital convenience, and transparent pricing, forcing insurers to adapt their offerings and service models.

- Managing climate change risks: Climate change is increasing the frequency and severity of extreme weather events, posing new challenges for insurers in terms of risk assessment, pricing, and coverage.

- Maintaining cybersecurity: The growing reliance on digital technologies exposes insurers to cyber threats, necessitating robust security measures and proactive risk management strategies.

- Adapting to regulatory changes: The evolving regulatory landscape, driven by data protection concerns and insurtech innovations, requires insurers to stay informed and compliant.

2. How will AI impact the insurance industry in 2025?

AI is expected to play a transformative role in the insurance industry by 2025, impacting various aspects of the business:

- Automated tasks and processes: AI can automate repetitive tasks, such as claims processing, underwriting, and customer service, improving efficiency and reducing costs.

- Personalized customer experiences: AI algorithms can analyze customer data to personalize pricing, offer tailored product recommendations, and provide customized communication.

- Improved risk assessment: AI can analyze vast amounts of data to identify risk factors, predict potential claims, and optimize pricing strategies.

- Fraud detection and prevention: AI-powered systems can detect and prevent fraudulent claims, reducing losses and improving accuracy.

- Enhanced data insights: AI can extract valuable insights from data, enabling insurers to better understand customer behavior, market trends, and emerging risks.

3. What are the benefits of embedded insurance?

Embedded insurance offers several benefits for both insurers and customers:

- Increased convenience and accessibility: Customers can access insurance coverage seamlessly through platforms and services they already use, eliminating the need for separate applications or searches.

- Personalized and contextual coverage: Insurers can offer coverage that is tailored to the specific context and needs of the customer, such as insurance for a specific ride-sharing trip or a particular online purchase.

- Expanded distribution channels: Embedded insurance opens up new distribution channels for insurers, reaching customers through online marketplaces, ride-sharing platforms, and other digital services.

- Improved customer experience: Embedded insurance can provide a more streamlined and convenient customer experience, reducing friction and enhancing satisfaction.

- New revenue opportunities: Embedded insurance offers new revenue streams for insurers, allowing them to expand their reach and offer products to a wider audience.

4. How can insurers prepare for the future of the workforce?

To thrive in the future of the insurance industry, insurers need to prepare their workforce for the changing landscape:

- Invest in upskilling and reskilling: Provide employees with training programs that equip them with the skills needed for a digital environment, including data analytics, technology, and customer experience.

- Attract and retain talent: Focus on attracting and retaining talented individuals with the skills and expertise needed to navigate the changing industry landscape.

- Embrace diversity and inclusion: Create a diverse and inclusive workforce that reflects the customer base, fostering innovation and better understanding of diverse needs and perspectives.

- Promote a culture of innovation: Encourage experimentation and exploration of new ideas, fostering a culture that embraces change and adapts to new technologies and business models.

- Develop leadership skills: Invest in leadership development programs that equip managers with the skills to lead and motivate employees in a digital and rapidly evolving environment.

Tips by Trends in Insurance Industry 2025:

- Embrace a digital-first strategy: Prioritize digital platforms, mobile applications, and online customer experiences to meet evolving customer expectations.

- Invest in data analytics and AI: Leverage data and AI to personalize customer experiences, optimize pricing, and improve risk assessment.

- Explore new distribution channels: Consider embedded insurance and alternative distribution models to reach new customers and expand your market reach.

- Focus on customer experience: Prioritize customer satisfaction by providing seamless, convenient, and personalized experiences across all touchpoints.

- Stay informed about regulatory changes: Monitor evolving regulations and ensure compliance with data protection laws and other industry-specific regulations.

- Cultivate a culture of innovation: Encourage experimentation and exploration of new technologies and business models to stay ahead of the curve.

- Invest in cybersecurity: Implement robust security measures to protect customer data and prevent cyberattacks.

- Develop a sustainable strategy: Address climate change risks and opportunities by developing sustainable insurance products and supporting climate-related initiatives.

Conclusion by Trends in Insurance Industry 2025:

The insurance industry is at a crossroads, facing both challenges and opportunities. By embracing innovation, adapting to evolving customer expectations, and navigating the changing regulatory landscape, insurers can position themselves for success in the future. The trends outlined in this article provide a roadmap for navigating this transformation, highlighting the importance of technology, data, customer-centricity, and sustainability. As the industry continues to evolve, those who embrace these trends will be best positioned to thrive in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Insurance Industry Trends Shaping 2025. We appreciate your attention to our article. See you in our next article!