Navigating the Future: Interest Rate Trends in 2025 and 2026

Navigating the Future: Interest Rate Trends in 2025 and 2026

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Interest Rate Trends in 2025 and 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: Interest Rate Trends in 2025 and 2026

- 2 Introduction

- 3 Navigating the Future: Interest Rate Trends in 2025 and 2026

- 3.1 The Influence of Inflation

- 3.2 The Role of Economic Growth

- 3.3 Global Monetary Policy

- 3.4 Technological Advancements and Innovation

- 3.5 Geopolitical Factors

- 4 Understanding the Importance of Interest Rate Trends

- 5 Exploring Related Searches

- 5.6 1. Federal Reserve Interest Rate Projections

- 5.7 2. Interest Rate Forecasts

- 5.8 3. Interest Rate History

- 5.9 4. Interest Rate Impact on Stocks

- 5.10 5. Interest Rate Impact on Real Estate

- 5.11 6. Interest Rate Impact on Bonds

- 5.12 7. Interest Rate Impact on the Economy

- 5.13 8. Interest Rate Impact on Currency Exchange Rates

- 6 FAQs about Interest Rate Trends in 2025 and 2026

- 7 Tips for Managing Interest Rate Trends

- 8 Conclusion

- 9 Closure

Navigating the Future: Interest Rate Trends in 2025 and 2026

The financial landscape is constantly evolving, and understanding interest rate trends is crucial for individuals and businesses alike. These trends directly impact borrowing costs, investment returns, and the overall economic climate. While predicting the future with absolute certainty is impossible, analyzing current economic indicators and historical patterns can shed light on potential trajectories for interest rates in the coming years. This article will explore the factors influencing interest rate trends in 2025 and 2026, offering a comprehensive understanding of this vital aspect of the financial world.

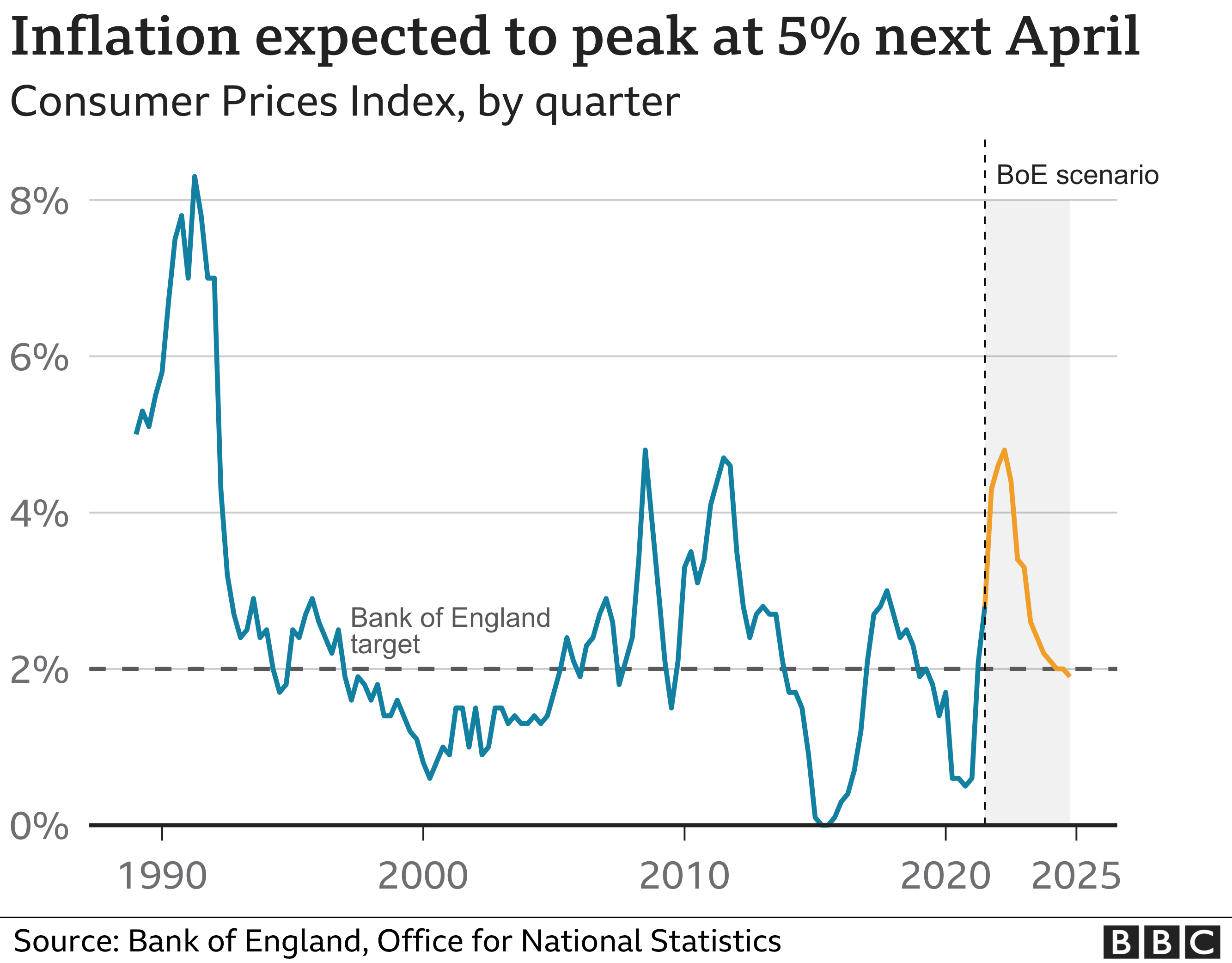

The Influence of Inflation

Inflation is a key driver of interest rate trends. When inflation rises, central banks typically raise interest rates to cool down the economy and curb price increases. Conversely, when inflation falls, central banks may lower interest rates to stimulate economic growth. The Federal Reserve (Fed) in the United States and other central banks worldwide use interest rate adjustments as a primary tool to manage inflation.

In recent years, the world has experienced a surge in inflation, driven by factors like supply chain disruptions, increased energy prices, and pent-up demand following the COVID-19 pandemic. This has prompted central banks to raise interest rates aggressively. However, the pace of rate hikes is expected to slow down as inflation shows signs of easing.

The Role of Economic Growth

Economic growth is another crucial factor influencing interest rate trends. When economic growth is strong, central banks may be inclined to raise interest rates to prevent overheating. Conversely, during periods of weak economic growth, central banks might lower interest rates to stimulate borrowing and investment.

The global economy is facing several challenges, including geopolitical tensions, rising energy prices, and potential recessions. These factors could impact economic growth prospects and influence central bank decisions on interest rates.

Global Monetary Policy

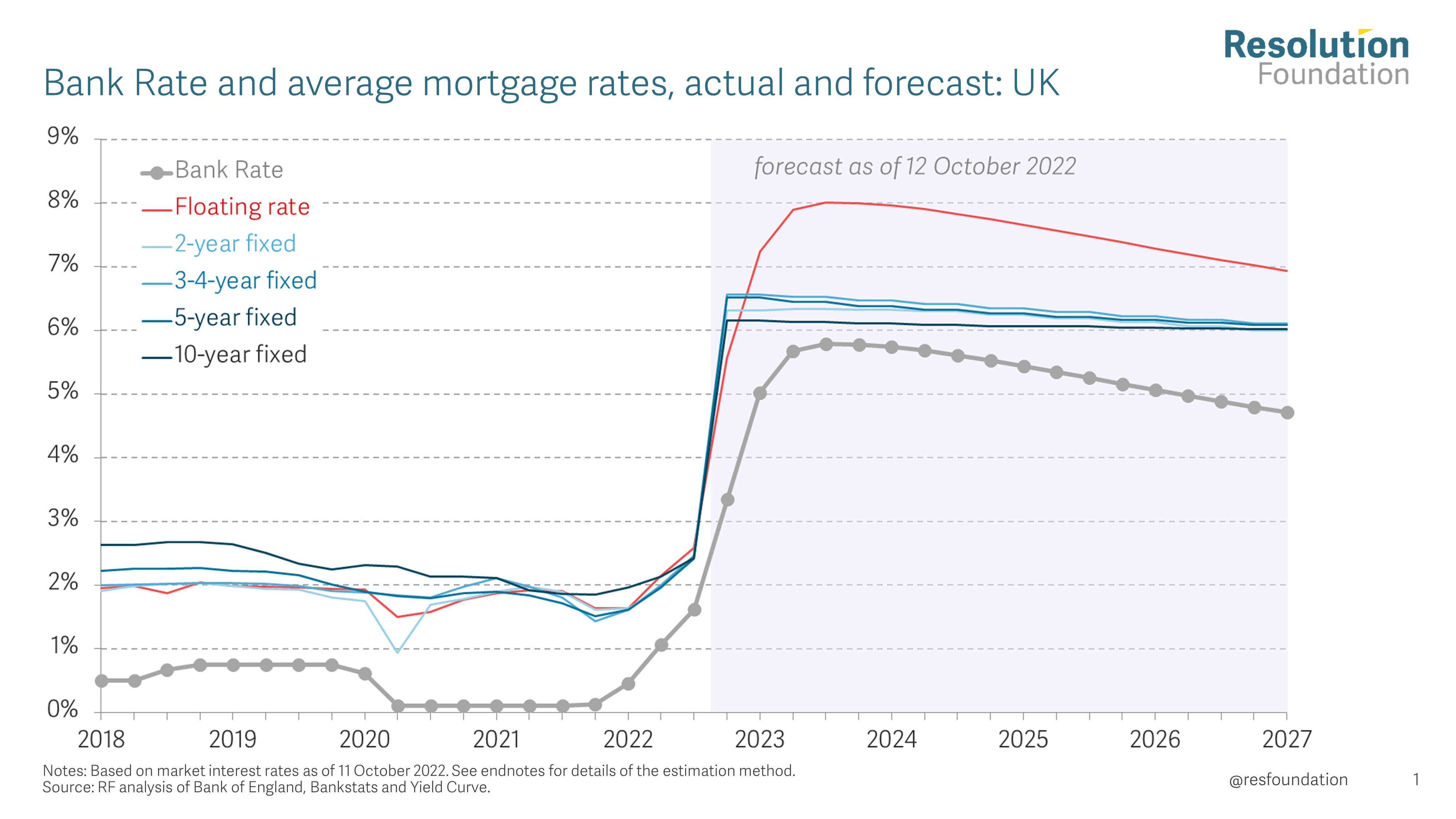

The actions of central banks around the world also play a significant role in shaping interest rate trends. When major central banks like the Fed raise interest rates, it can influence interest rates in other countries as well. This is because investors may seek higher returns in countries with higher interest rates, leading to increased demand for those currencies and potentially pushing up interest rates elsewhere.

Coordination between major central banks is essential for maintaining global financial stability. However, diverging economic conditions and policy priorities can lead to different interest rate paths in different regions.

Technological Advancements and Innovation

Technological advancements and innovation are increasingly influencing the financial landscape, impacting interest rate trends. New technologies like blockchain and artificial intelligence (AI) are transforming financial services, leading to greater efficiency, reduced costs, and potentially lower interest rates.

However, the impact of technology on interest rates is complex and multifaceted. While some innovations might lead to lower borrowing costs, others could lead to higher inflation, requiring central banks to adjust interest rates accordingly.

Geopolitical Factors

Geopolitical events and tensions can significantly impact interest rate trends. For instance, the ongoing conflict in Ukraine has led to energy price volatility and heightened uncertainty, influencing central bank decisions on interest rates.

Geopolitical instability can also disrupt global trade and investment flows, impacting economic growth and potentially leading to higher interest rates.

Understanding the Importance of Interest Rate Trends

Interest rate trends are crucial for several reasons:

- Borrowing Costs: Interest rates directly impact borrowing costs for individuals and businesses. Higher interest rates mean higher costs for loans, mortgages, and credit cards, making it more expensive to borrow money. Conversely, lower interest rates make borrowing more affordable.

- Investment Returns: Interest rates influence investment returns. Higher interest rates generally lead to higher returns on savings accounts and fixed-income investments. However, they can also lead to lower stock prices as investors seek higher returns in less risky investments.

- Economic Growth: Interest rates play a vital role in regulating economic activity. Central banks use interest rate adjustments to stimulate or slow down economic growth, depending on the prevailing conditions.

- Currency Values: Interest rates can influence currency values. When interest rates rise in a particular country, it can attract foreign investment, increasing demand for that currency and potentially strengthening its value.

Exploring Related Searches

Understanding interest rate trends is essential, and many related searches provide further insight into this complex topic. Here are some key related searches and their relevance to the overall understanding of interest rate trends:

1. Federal Reserve Interest Rate Projections

The Federal Reserve regularly releases projections for future interest rates, known as the Summary of Economic Projections (SEP). These projections provide valuable insights into the Fed’s outlook for inflation, economic growth, and interest rates. Analyzing these projections can help investors and businesses anticipate potential changes in interest rates and make informed decisions.

2. Interest Rate Forecasts

Numerous economic institutions and analysts provide interest rate forecasts based on their analysis of economic data and trends. These forecasts can offer valuable perspectives on potential interest rate movements, although it’s crucial to note that these predictions are not always accurate. Comparing forecasts from different sources can provide a more comprehensive understanding of the range of potential outcomes.

3. Interest Rate History

Understanding historical interest rate trends can provide valuable context for current and future trends. Studying past interest rate cycles and their relationship with economic conditions can help investors and businesses identify potential patterns and anticipate future movements.

4. Interest Rate Impact on Stocks

Interest rates have a significant impact on stock prices. When interest rates rise, investors may shift their investments from stocks to bonds, which offer higher returns in a rising interest rate environment. This can lead to lower stock prices. Conversely, falling interest rates can boost stock prices as investors seek higher returns in riskier assets.

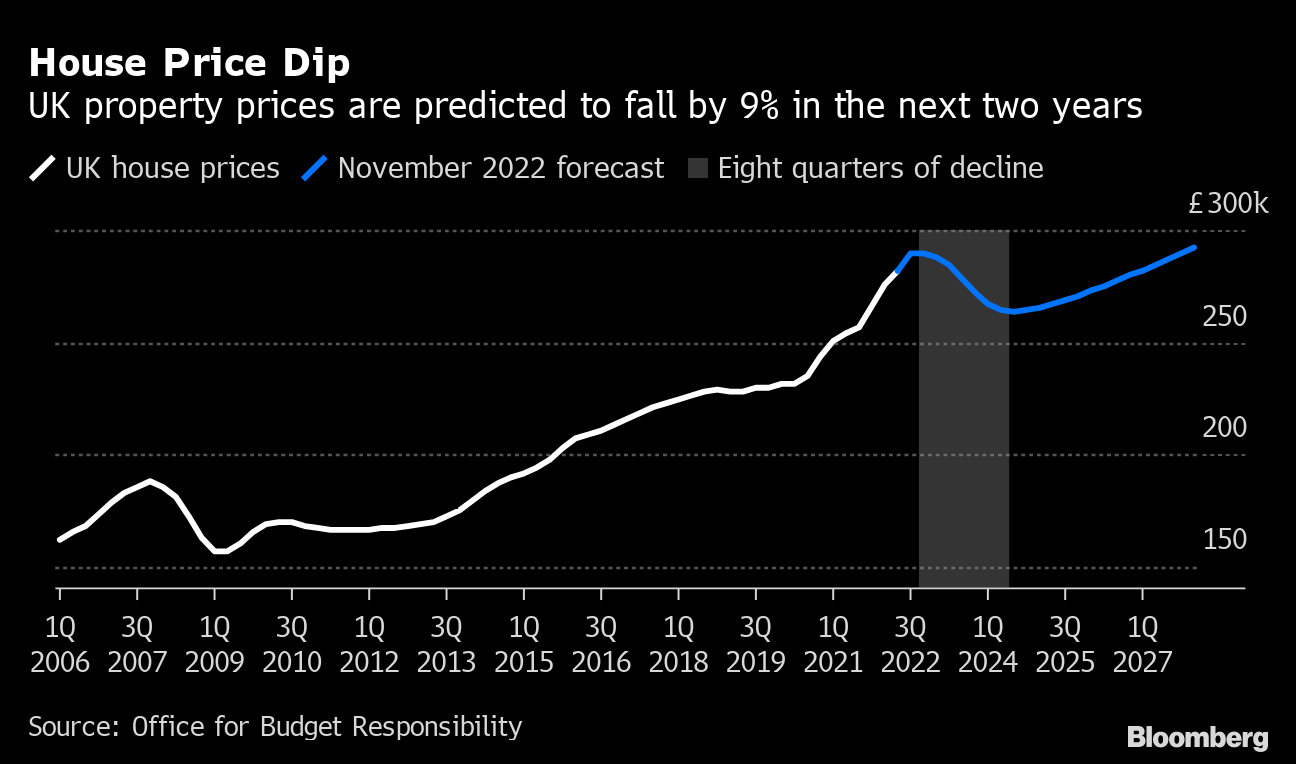

5. Interest Rate Impact on Real Estate

Interest rates play a crucial role in the real estate market. Higher interest rates make mortgages more expensive, potentially reducing demand for housing and slowing down price appreciation. Conversely, lower interest rates can boost demand for housing and lead to higher prices.

6. Interest Rate Impact on Bonds

Interest rates have an inverse relationship with bond prices. When interest rates rise, bond prices fall, and vice versa. This is because investors demand higher returns on new bonds issued at higher interest rates, making existing bonds with lower interest rates less attractive.

7. Interest Rate Impact on the Economy

Interest rates are a powerful tool used by central banks to manage economic activity. Higher interest rates can slow down economic growth by making borrowing more expensive, while lower interest rates can stimulate borrowing and investment, leading to economic expansion.

8. Interest Rate Impact on Currency Exchange Rates

Interest rates can influence currency exchange rates. Higher interest rates in a particular country can attract foreign investment, increasing demand for that currency and potentially strengthening its value. Conversely, lower interest rates can weaken a currency’s value.

FAQs about Interest Rate Trends in 2025 and 2026

Q: What are the key factors driving interest rate trends in 2025 and 2026?

A: The key factors influencing interest rate trends in the coming years include:

- Inflation: The pace of inflation and its trajectory will be a primary driver of central bank decisions on interest rates.

- Economic Growth: Global economic growth prospects, including the potential for recessions, will significantly impact interest rate trends.

- Global Monetary Policy: The actions of major central banks, particularly the Fed, will play a crucial role in shaping interest rate movements.

- Technological Advancements: Technological innovations in finance could lead to both higher and lower interest rates depending on their impact on inflation and economic growth.

- Geopolitical Factors: Geopolitical events and tensions, such as the ongoing conflict in Ukraine, can introduce uncertainty and volatility into interest rate trends.

Q: What are the potential implications of interest rate trends for individuals and businesses?

A: Interest rate trends have significant implications for individuals and businesses:

- Borrowing Costs: Higher interest rates make borrowing more expensive, impacting individuals’ mortgage payments, student loan payments, and business loan costs.

- Investment Returns: Interest rates influence investment returns, impacting savings accounts, fixed-income investments, and stock market performance.

- Economic Growth: Interest rate changes can affect economic growth, impacting job creation, consumer spending, and business investment.

- Currency Values: Interest rate fluctuations can influence currency exchange rates, affecting the cost of imports and exports for businesses.

Q: What strategies can individuals and businesses adopt to navigate interest rate trends?

A: Individuals and businesses can adopt several strategies to navigate interest rate trends:

- Monitor Interest Rates: Regularly track interest rate movements and economic indicators to stay informed about potential changes.

- Review Financial Plans: Reassess financial plans and adjust investment strategies based on interest rate trends.

- Consider Fixed-Rate Loans: Consider fixed-rate loans for mortgages and other debts to lock in lower interest rates.

- Diversify Investments: Diversify investments across different asset classes to mitigate the impact of interest rate fluctuations.

- Manage Debt: Prioritize paying down high-interest debt to minimize the impact of rising interest rates.

- Explore Alternative Financing Options: Consider alternative financing options, such as crowdfunding or peer-to-peer lending, which may offer lower interest rates than traditional banks.

Tips for Managing Interest Rate Trends

- Stay Informed: Keep abreast of economic news, central bank announcements, and interest rate forecasts.

- Plan Ahead: Develop a financial plan that considers potential interest rate scenarios and includes strategies for managing risk.

- Review Debt: Regularly review debt obligations and consider refinancing options to lower interest rates.

- Diversify Investments: Diversify investment portfolios across different asset classes to mitigate the impact of interest rate fluctuations.

- Consult Financial Professionals: Seek advice from financial professionals to develop customized strategies for navigating interest rate trends.

Conclusion

Interest rate trends are a complex and dynamic aspect of the financial world. Understanding the factors influencing these trends is crucial for individuals and businesses alike. By staying informed, planning ahead, and seeking professional guidance, individuals and businesses can navigate the evolving interest rate landscape and make informed decisions that support their financial goals.

While predicting the future with absolute certainty is impossible, analyzing current economic indicators, historical patterns, and expert forecasts can provide valuable insights into potential interest rate movements. By understanding the forces at play and adopting appropriate strategies, individuals and businesses can position themselves to thrive in the evolving financial landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Interest Rate Trends in 2025 and 2026. We appreciate your attention to our article. See you in our next article!