Navigating the Future: Investing Trends for 2025 and Beyond

Navigating the Future: Investing Trends for 2025 and Beyond

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Investing Trends for 2025 and Beyond. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Investing Trends for 2025 and Beyond

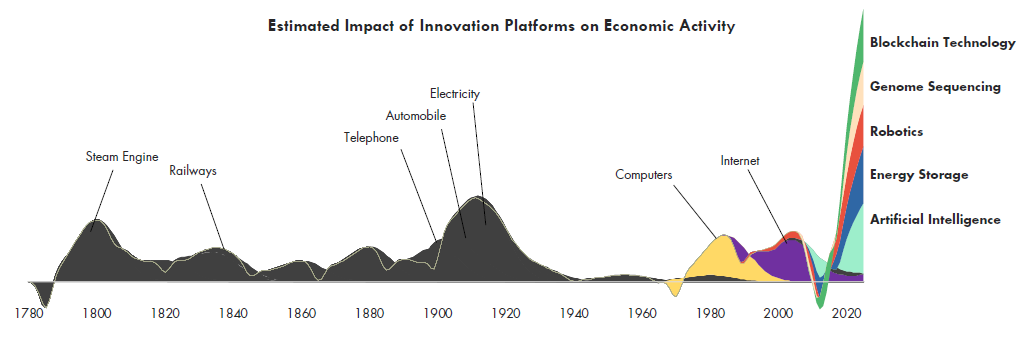

The investment landscape is in constant flux, shaped by technological advancements, evolving societal priorities, and global economic shifts. As we approach 2025, several key trends are emerging, offering both opportunities and challenges for investors. Understanding these trends and their implications is crucial for making informed investment decisions and maximizing returns.

Investing Trends 2025

1. Sustainable Investing: A Moral and Financial Imperative

Sustainable investing is no longer a niche concept; it’s becoming mainstream. Investors are increasingly prioritizing investments aligned with their values, seeking companies demonstrating strong environmental, social, and governance (ESG) practices. This trend is driven by a growing awareness of climate change, social inequality, and corporate accountability.

Benefits:

- Positive Impact: Sustainable investments contribute to a more sustainable and equitable world.

- Reduced Risk: Companies with strong ESG practices tend to be more resilient and less susceptible to long-term risks.

- Enhanced Returns: Studies show that sustainable investments can generate comparable or even higher returns compared to traditional investments.

2. The Rise of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming industries, and the financial sector is no exception. These technologies are being used to automate tasks, improve risk management, personalize investment strategies, and enhance trading efficiency.

Benefits:

- Improved Efficiency: AI-powered platforms can analyze vast amounts of data and identify investment opportunities faster and more accurately than humans.

- Enhanced Risk Management: AI algorithms can predict market trends and assess risk more effectively, enabling better risk management strategies.

- Personalized Investment Strategies: AI can tailor investment strategies to individual investor profiles, goals, and risk tolerance.

3. The Growth of Decentralized Finance (DeFi)

DeFi, built on blockchain technology, offers a decentralized and transparent alternative to traditional financial systems. It allows for peer-to-peer lending, borrowing, trading, and other financial services without intermediaries.

Benefits:

- Transparency and Security: Transactions on the blockchain are transparent and immutable, reducing the risk of fraud and manipulation.

- Financial Inclusion: DeFi can provide access to financial services for individuals who may not have access to traditional banking.

- Innovation and Efficiency: DeFi enables new and innovative financial products and services, often with lower costs and faster processing times.

4. The Importance of Data and Analytics

In today’s data-driven world, access to reliable and insightful data is critical for making sound investment decisions. Investors are increasingly leveraging data analytics tools to identify trends, assess risks, and optimize their portfolios.

Benefits:

- Data-Driven Decisions: Data analytics provides objective insights and helps investors make informed decisions based on evidence rather than intuition.

- Enhanced Risk Management: Data analysis can identify potential risks and opportunities, allowing investors to adjust their strategies proactively.

- Improved Performance: By analyzing market data, investors can identify undervalued assets and potentially outperform the market.

5. The Growing Demand for Alternative Investments

Traditional investments like stocks and bonds are still important, but investors are seeking diversification through alternative asset classes. These include real estate, private equity, hedge funds, and commodities.

Benefits:

- Diversification: Alternative investments can reduce portfolio volatility and improve overall risk-adjusted returns.

- Potential for Higher Returns: Some alternative investments offer the potential for higher returns than traditional assets.

- Inflation Hedging: Certain alternative investments, such as real estate and commodities, can act as a hedge against inflation.

6. The Rise of Impact Investing

Impact investing focuses on generating both financial returns and positive social and environmental impact. Investors seek companies that address pressing global challenges like climate change, poverty, and healthcare.

Benefits:

- Social and Environmental Impact: Impact investments contribute to a more sustainable and equitable world.

- Potential for Competitive Returns: Impact investments can deliver competitive financial returns while making a positive difference.

- Alignment with Values: Impact investing allows investors to align their portfolios with their personal values and beliefs.

7. The Importance of Financial Literacy

As investment options become increasingly complex, financial literacy is becoming more crucial than ever. Investors need to understand basic financial concepts, different investment strategies, and the risks and rewards associated with various asset classes.

Benefits:

- Informed Decisions: Financial literacy empowers investors to make informed investment decisions based on their understanding of the market.

- Increased Confidence: A strong understanding of finances can boost investor confidence and reduce anxiety.

- Long-Term Success: Financial literacy is essential for achieving long-term financial goals and building a secure future.

8. The Role of Technology in Investment Management

Technology is playing a transformative role in investment management, enabling investors to access information, manage their portfolios, and execute trades more efficiently. Robo-advisors, online brokerage platforms, and mobile apps are making investing more accessible and affordable.

Benefits:

- Accessibility and Affordability: Technology has lowered the barrier to entry for investing, making it accessible to a wider range of individuals.

- Efficiency and Convenience: Online platforms and mobile apps offer convenience and efficiency, allowing investors to manage their portfolios from anywhere at any time.

- Personalized Advice: Robo-advisors can provide personalized investment recommendations based on individual investor profiles and goals.

Related Searches

1. Future of Investing

The future of investing is driven by technological advancements, changing demographics, and evolving societal priorities. AI, blockchain, and sustainable investing are shaping the landscape, creating new opportunities and challenges. Investors must adapt to these changes and embrace innovation to thrive in the future.

2. Investment Trends 2025

Investing trends 2025 are focused on sustainability, technology, and innovation. Investors are prioritizing investments aligned with ESG principles, exploring the potential of AI and DeFi, and leveraging data analytics to make informed decisions.

3. Investment Strategies for 2025

Investment strategies for 2025 should incorporate a focus on sustainability, technology, and diversification. Consider allocating a portion of your portfolio to sustainable investments, exploring AI-powered investment platforms, and diversifying across alternative asset classes.

4. Best Investments for 2025

The best investments for 2025 will depend on individual goals, risk tolerance, and investment horizon. However, consider exploring sectors like renewable energy, healthcare technology, and artificial intelligence.

5. Investing in the Future

Investing in the future means aligning your portfolio with long-term trends. Consider sectors that are expected to experience significant growth, such as clean technology, healthcare, and education.

6. Top Investment Trends

Top investment trends include sustainable investing, AI and ML, DeFi, data analytics, alternative investments, and impact investing. These trends are shaping the investment landscape and offering opportunities for investors.

7. Investment Outlook 2025

The investment outlook for 2025 is generally positive, with strong growth expected in sectors like technology, healthcare, and renewable energy. However, investors should be aware of potential risks and volatility in the market.

8. How to Invest in 2025

To invest in 2025, consider diversifying your portfolio, exploring sustainable and impact investments, and leveraging technology to enhance your investment process. Seek professional advice if needed.

FAQs

1. What are the most important investing trends for 2025?

The most important investing trends for 2025 include sustainable investing, AI and ML, DeFi, data analytics, and alternative investments. These trends are shaping the investment landscape and offering opportunities for investors.

2. How can I invest in sustainable companies?

You can invest in sustainable companies through various methods, including:

- ESG-focused funds: These funds invest in companies with strong ESG practices.

- Impact investing: This involves investing in companies that address social and environmental challenges.

- Direct investment: You can invest directly in sustainable companies through their stocks or bonds.

3. What are the risks associated with AI and ML in investing?

While AI and ML offer potential benefits, they also come with risks:

- Bias: AI algorithms can be biased if they are trained on data that reflects existing inequalities.

- Black box effect: AI algorithms can be complex and difficult to understand, making it challenging to assess their reliability.

- Overreliance: Overreliance on AI can lead to poor decision-making if the algorithms are not properly vetted.

4. What is the potential of DeFi in the future?

DeFi has the potential to revolutionize the financial industry by offering greater transparency, security, and accessibility. However, it is still a relatively new technology, and there are risks associated with its use.

5. How can I improve my financial literacy?

You can improve your financial literacy by:

- Reading books and articles: There are many resources available on personal finance and investing.

- Taking online courses: Numerous online courses can teach you about financial concepts and investment strategies.

- Attending workshops and seminars: Workshops and seminars can provide valuable insights and practical advice.

Tips

1. Diversify Your Portfolio: Diversifying your portfolio across different asset classes and sectors can reduce risk and improve returns.

2. Invest for the Long Term: Avoid short-term market fluctuations and focus on long-term goals.

3. Stay Informed: Keep up-to-date with current investment trends and market developments.

4. Seek Professional Advice: Consult with a financial advisor to develop a personalized investment strategy.

5. Be Patient: Investing is a long-term game, and it takes time to build wealth.

Conclusion

The investment landscape is constantly evolving, and 2025 promises to be a year of significant change. Understanding the key trends, such as sustainable investing, AI and ML, and DeFi, is crucial for navigating the future. By embracing innovation, seeking professional advice, and making informed decisions, investors can position themselves for success in the years to come. Remember, investing is a journey, not a destination. Embrace the opportunities, manage the risks, and stay focused on your long-term goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Investing Trends for 2025 and Beyond. We hope you find this article informative and beneficial. See you in our next article!