Navigating the Future: Investing Trends Shaping 2025

Navigating the Future: Investing Trends Shaping 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Investing Trends Shaping 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Investing Trends Shaping 2025

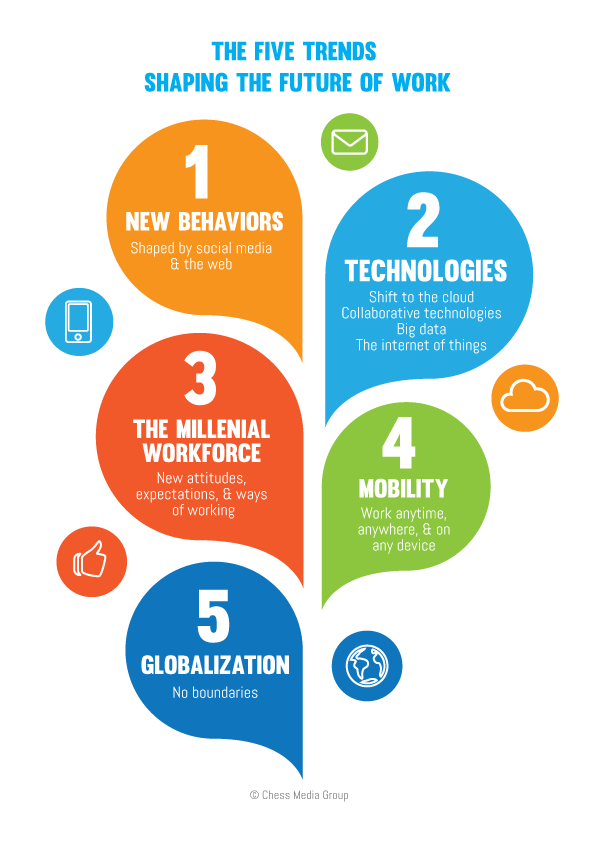

The investment landscape is constantly evolving, driven by technological advancements, shifting demographics, and global economic forces. As we approach 2025, investors must understand the trends shaping the market to make informed decisions and secure their financial future. This comprehensive analysis delves into eight key trends in investing 2025, providing insights into their potential impact and actionable strategies for navigating this dynamic environment.

1. The Rise of Sustainable Investing

Sustainability is no longer a niche concern; it’s a defining factor in responsible investing. Trends in investing 2025 will see a surge in demand for investments aligned with environmental, social, and governance (ESG) principles. Investors are increasingly recognizing the importance of aligning their portfolios with their values, seeking companies that prioritize ethical practices, environmental responsibility, and social impact. This shift is driven by:

- Growing awareness of climate change: The urgency of addressing climate change is prompting investors to seek out companies actively contributing to a sustainable future.

- Enhanced transparency and data: Improved data availability and reporting standards make it easier for investors to assess the ESG performance of companies.

- Regulatory pressure: Governments and regulatory bodies are increasingly emphasizing ESG factors in investment decisions, further driving the trend.

2. The Democratization of Investing

Technology is making investing more accessible than ever before. Trends in investing 2025 will witness a continued democratization of the investment process, with a growing number of individuals taking control of their financial futures. This is fueled by:

- Robo-advisors: Automated platforms offer personalized investment advice and portfolio management services at a fraction of the cost of traditional advisors.

- Micro-investing apps: These apps allow investors to contribute small amounts regularly, making investing accessible even with limited financial resources.

- Fractional shares: Investors can now purchase fractions of shares, enabling them to diversify their portfolios with a wider range of assets.

3. The Growth of Alternative Investments

Traditional asset classes like stocks and bonds are no longer the only game in town. Trends in investing 2025 will see a surge in demand for alternative investments, offering diversification and potentially higher returns. These include:

- Private equity: Investing in privately held companies offers potential for higher returns but comes with higher risk and illiquidity.

- Real estate: Investing in real estate can provide stable income and appreciation potential, but requires significant capital and involves management responsibilities.

- Cryptocurrencies: Digital currencies like Bitcoin and Ethereum offer potential for significant gains but are subject to high volatility and regulatory uncertainty.

4. The Impact of Artificial Intelligence (AI)

AI is revolutionizing the financial industry, impacting every stage of the investment process. Trends in investing 2025 will see AI playing an increasingly prominent role in:

- Portfolio optimization: AI algorithms can analyze vast amounts of data to identify investment opportunities and optimize portfolio allocation.

- Risk management: AI can help identify and mitigate risks, improving investment decision-making and portfolio resilience.

- Fraud detection: AI can detect and prevent fraudulent activities, enhancing investor security and trust in the market.

5. The Rise of Impact Investing

Impact investing goes beyond simply achieving financial returns; it aims to generate positive social and environmental impact alongside financial gains. Trends in investing 2025 will see a growing demand for investments that address societal challenges and promote sustainable development. This trend is driven by:

- Growing social consciousness: Investors are increasingly seeking to align their investments with their values and contribute to a better world.

- Increased demand for impact-focused companies: Investors are seeking companies that are actively working to address social and environmental issues.

- Growing availability of impact-focused funds: More investment vehicles are emerging that specifically focus on impact investing.

6. The Importance of Personalized Investing

One-size-fits-all investment approaches are becoming increasingly outdated. Trends in investing 2025 will emphasize personalized investment strategies tailored to individual goals, risk tolerance, and financial circumstances. This includes:

- Financial planning: Developing comprehensive financial plans that align with individual goals, timelines, and risk appetites.

- Goal-based investing: Focusing investment strategies on specific goals, such as retirement, education, or a down payment on a home.

- Behavioral finance: Understanding the psychological factors that influence investment decisions and developing strategies to mitigate biases.

7. The Evolution of Investment Platforms

Investment platforms are constantly evolving to meet the changing needs of investors. Trends in investing 2025 will see platforms offering:

- Enhanced user experience: Intuitive interfaces, personalized recommendations, and seamless integration with other financial tools.

- Increased transparency and data access: Real-time portfolio tracking, detailed performance reports, and access to market data.

- Integration with other financial services: Connecting investment platforms with banking, insurance, and other financial services for a holistic financial management experience.

8. The Importance of Financial Literacy

As investing becomes more accessible, financial literacy is crucial for individuals to make informed decisions and protect their investments. Trends in investing 2025 will emphasize the importance of:

- Financial education: Providing access to educational resources, workshops, and online courses to enhance financial literacy.

- Financial planning: Encouraging individuals to develop comprehensive financial plans that address their needs and goals.

- Financial counseling: Providing access to financial advisors and counselors to guide individuals in making sound investment decisions.

Related Searches:

1. Future of Investing: This search explores broader predictions about the future of the investment landscape, including technological advancements, regulatory changes, and emerging investment opportunities.

2. Investing Trends 2023: This search focuses on current investment trends and their potential impact in the near future, providing a starting point for understanding the trajectory of the market.

3. Best Investments for 2025: This search seeks specific investment recommendations for 2025, considering factors like risk tolerance, time horizon, and potential returns.

4. Investing in AI: This search explores the opportunities and risks associated with investing in companies developing and utilizing AI technologies.

5. Sustainable Investing Strategies: This search provides insights into specific strategies for incorporating ESG principles into investment portfolios.

6. Impact Investing Funds: This search explores the various funds and investment vehicles available for investors seeking to make a positive impact while generating financial returns.

7. Robo-advisor vs. Human Advisor: This search compares the benefits and drawbacks of using robo-advisors versus traditional financial advisors.

8. Micro-investing Apps: This search provides information about different micro-investing apps and their features, helping investors choose the best platform for their needs.

FAQs:

Q: What are the biggest risks facing investors in 2025?

A: Investors face a variety of risks in 2025, including:

- Market volatility: Economic uncertainty, geopolitical events, and inflation can lead to significant market fluctuations.

- Interest rate hikes: Rising interest rates can impact the value of bonds and other fixed-income investments.

- Cybersecurity threats: Cyberattacks pose a significant threat to investors’ data and financial security.

- Regulatory changes: Changes in regulations can impact investment opportunities and the performance of certain asset classes.

Q: How can investors prepare for these risks?

A: Investors can mitigate risks by:

- Diversifying their portfolios: Investing in a range of asset classes can help reduce the impact of losses in any single investment.

- Developing a long-term investment strategy: Focusing on long-term goals rather than short-term market fluctuations can help weather market volatility.

- Monitoring investments closely: Regularly reviewing investment performance and making adjustments as needed can help mitigate risks.

- Staying informed about market trends: Staying up-to-date on economic developments and industry trends can help investors make informed decisions.

Q: What are the most important factors to consider when choosing investments?

A: When choosing investments, investors should consider:

- Risk tolerance: How much risk are you willing to take to achieve your investment goals?

- Time horizon: How long do you plan to hold your investments?

- Investment goals: What are you trying to achieve with your investments?

- Financial situation: What are your current financial resources and obligations?

Q: What are some tips for successful investing in 2025?

A: Here are some tips for successful investing in 2025:

- Start early: The earlier you start investing, the more time your money has to grow.

- Save regularly: Even small, consistent contributions can make a big difference over time.

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk.

- Seek professional advice: Consider working with a financial advisor to develop a personalized investment strategy.

- Stay informed: Keep up-to-date on market trends and economic developments.

Conclusion:

The investment landscape in 2025 will be shaped by a complex interplay of technological advancements, societal shifts, and economic forces. By understanding the key trends in investing 2025, investors can position themselves to capitalize on emerging opportunities, navigate market volatility, and achieve their financial goals. It’s crucial to embrace the democratization of investing, prioritize sustainability, and adapt to the increasing role of AI in the financial world. By staying informed, proactive, and adaptable, investors can navigate the evolving investment landscape and secure their financial future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Investing Trends Shaping 2025. We hope you find this article informative and beneficial. See you in our next article!