Navigating the Future of Homeownership: Mortgage Trends 2025

Navigating the Future of Homeownership: Mortgage Trends 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future of Homeownership: Mortgage Trends 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future of Homeownership: Mortgage Trends 2025

- 2 Introduction

- 3 Navigating the Future of Homeownership: Mortgage Trends 2025

- 3.1 The Rise of Digital Mortgage Experiences

- 3.2 Shifting Housing Preferences

- 3.3 Mortgage Product Innovation

- 3.4 The Impact of Interest Rates

- 3.5 The Role of Technology in Mortgage Lending

- 3.6 The Importance of Financial Literacy

- 3.7 Related Searches

- 3.8 FAQs

- 3.9 Tips

- 3.10 Conclusion

- 4 Closure

Navigating the Future of Homeownership: Mortgage Trends 2025

The housing market is a dynamic entity, constantly evolving in response to economic shifts, technological advancements, and societal changes. As we look toward 2025, several key trends are poised to shape the landscape of mortgage trends 2025, influencing how individuals and families finance their homeownership dreams.

The Rise of Digital Mortgage Experiences

The mortgage industry is experiencing a digital transformation, with borrowers increasingly seeking streamlined, tech-enabled solutions. This trend is driven by the desire for greater transparency, efficiency, and convenience.

- Online Mortgage Applications: Expect a surge in online applications, allowing borrowers to initiate the mortgage process from the comfort of their homes, accessing real-time updates and tracking their progress.

- Artificial Intelligence (AI) and Machine Learning: AI-powered tools will play a more significant role in mortgage lending, automating tasks, analyzing data, and personalizing recommendations.

- Digital Closing: Virtual closing procedures, utilizing electronic signatures and secure document management platforms, will become increasingly prevalent, expediting the closing process and reducing paperwork.

Shifting Housing Preferences

The pandemic has accelerated shifts in housing preferences, impacting the types of properties and locations in demand.

- Suburban Sprawl: With remote work becoming more common, many individuals are seeking larger homes with more space in suburban areas, offering a blend of privacy and affordability.

- Focus on Outdoor Living: Outdoor spaces, such as backyards and patios, are becoming increasingly important, as homeowners seek to create more versatile living environments.

- Sustainable Housing: Environmental concerns are driving a growing interest in sustainable homes, with energy-efficient features and eco-friendly building materials gaining popularity.

Mortgage Product Innovation

The mortgage landscape is constantly evolving, with new products and financing options emerging to cater to diverse needs.

- Flexible Loan Terms: Lenders are offering more flexible loan terms, including adjustable-rate mortgages (ARMs) with lower initial interest rates and options for shorter or longer repayment periods.

- Down Payment Assistance Programs: Government-backed programs and private lenders are expanding down payment assistance options, making homeownership more accessible to a wider range of buyers.

- Mortgage Refinancing: With interest rates fluctuating, refinancing options will remain crucial for homeowners seeking to lower their monthly payments or shorten their loan terms.

The Impact of Interest Rates

Interest rates play a pivotal role in shaping the mortgage market. While predicting future interest rate movements is inherently challenging, several factors may influence their trajectory.

- Inflation and Monetary Policy: The Federal Reserve’s monetary policy decisions, aimed at controlling inflation, will directly impact interest rates.

- Economic Growth: Strong economic growth can lead to higher interest rates, as investors seek higher returns.

- Global Economic Conditions: Global economic events, such as international trade tensions or geopolitical instability, can influence interest rate trends.

The Role of Technology in Mortgage Lending

Technology is transforming the mortgage lending industry, enhancing efficiency, transparency, and the overall borrower experience.

- Digital Document Verification: Automated document verification systems utilize AI and machine learning to streamline the process of verifying borrower information and income.

- Real-Time Loan Status Updates: Online platforms provide borrowers with real-time updates on their loan application status, ensuring transparency and reducing uncertainty.

- Personalized Recommendations: AI-powered tools can analyze borrower data and provide personalized recommendations for mortgage products and financing options, tailoring solutions to individual needs.

The Importance of Financial Literacy

As the mortgage landscape becomes more complex, the importance of financial literacy for borrowers cannot be overstated.

- Understanding Mortgage Terms: Borrowers need to understand key mortgage terms, such as interest rates, loan terms, and closing costs, to make informed decisions.

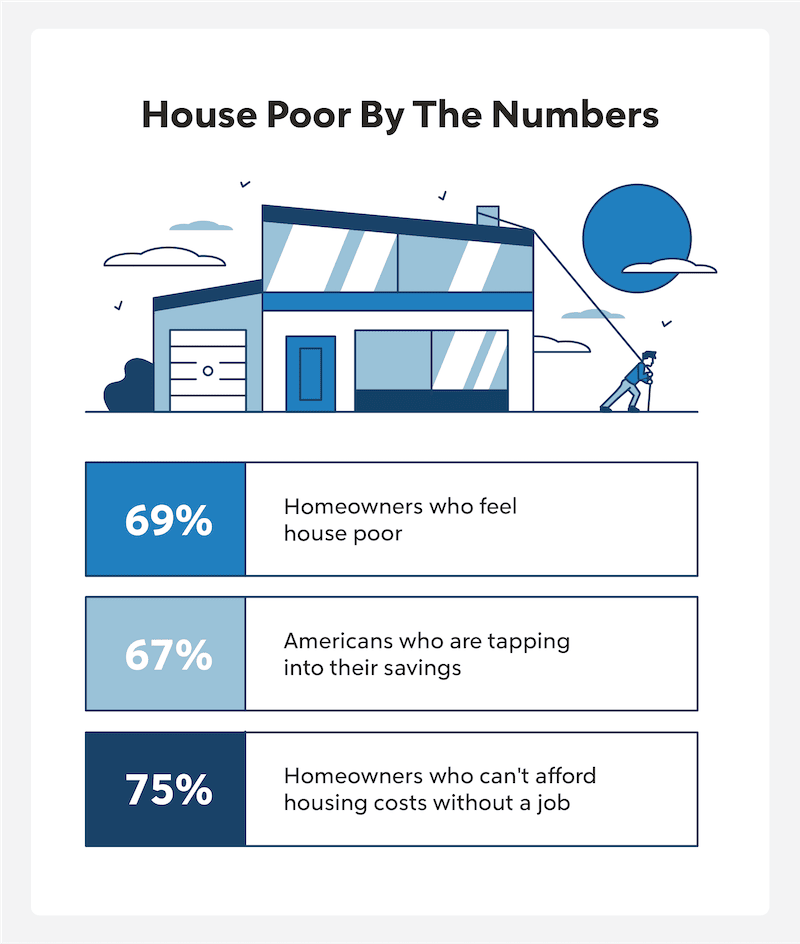

- Budgeting and Financial Planning: Effective budgeting and financial planning are essential for ensuring affordability and managing mortgage payments over the long term.

- Seeking Professional Advice: Consulting with a qualified mortgage professional can provide valuable guidance and support throughout the mortgage process.

Related Searches

The following related searches provide deeper insights into the evolving landscape of mortgage trends 2025:

1. Mortgage Rates Forecast 2025

Predicting mortgage rate movements is inherently complex, requiring an understanding of economic indicators, monetary policy, and global market conditions. While specific predictions are difficult to make, analyzing historical trends and current economic data can provide valuable insights.

- Factors Influencing Mortgage Rates: Key factors include inflation, economic growth, monetary policy decisions, and global economic events.

- Historical Trends: Analyzing historical mortgage rate fluctuations can reveal patterns and cyclical trends.

- Expert Opinions: Consulting with economists and financial analysts can provide valuable perspectives on potential rate movements.

2. Mortgage Technology Trends 2025

Technology is revolutionizing the mortgage industry, offering faster, more efficient, and more transparent processes.

- AI-Powered Mortgage Underwriting: AI algorithms can analyze vast amounts of data, automating the underwriting process and reducing human error.

- Digital Mortgage Platforms: Online platforms streamline the application process, allowing borrowers to manage their applications, track progress, and access real-time updates.

- Blockchain Technology: Blockchain can enhance security, transparency, and efficiency in mortgage transactions, ensuring secure recordkeeping and tamper-proof data.

3. Mortgage Refinance Trends 2025

Refinancing remains a crucial tool for homeowners seeking to lower their monthly payments, shorten their loan terms, or take advantage of favorable interest rate fluctuations.

- Interest Rate Fluctuations: When interest rates decline, refinancing can offer significant savings.

- Loan Term Modifications: Refinancing allows borrowers to adjust their loan terms, such as shortening the repayment period or switching to a fixed-rate mortgage.

- Equity Release: Refinancing can help homeowners tap into their home equity for various purposes, such as home improvements or debt consolidation.

4. Housing Market Predictions 2025

Predicting future housing market trends is challenging, but analyzing current conditions and economic factors can provide valuable insights.

- Economic Growth and Job Market: A strong economy and healthy job market typically support a robust housing market.

- Interest Rates and Affordability: Rising interest rates can make homeownership less affordable, potentially impacting demand.

- Supply and Demand Dynamics: The balance between housing supply and demand plays a crucial role in determining price fluctuations.

5. Sustainable Mortgage Trends 2025

Environmental concerns are driving a growing interest in sustainable homes, with lenders increasingly offering specialized financing options.

- Green Mortgages: Green mortgages offer lower interest rates or other incentives for purchasing or refinancing energy-efficient homes.

- Energy Efficiency Standards: Lenders are incorporating energy efficiency standards into their underwriting criteria, promoting the development of sustainable homes.

- Government Incentives: Government programs and tax credits encourage homeowners to invest in energy-efficient upgrades.

6. Mortgage Fraud Trends 2025

Mortgage fraud remains a significant concern, with criminals constantly devising new schemes.

- Identity Theft: Criminals may use stolen identities to obtain mortgages fraudulently.

- Property Flipping: Fraudulent schemes involving the manipulation of property values and inflated appraisals.

- Loan Modification Scams: Fraudsters may target homeowners facing financial difficulties, promising to lower their mortgage payments through fraudulent schemes.

7. Mortgage Industry Regulations 2025

The mortgage industry is subject to a complex web of regulations designed to protect consumers and ensure fair lending practices.

- Consumer Financial Protection Bureau (CFPB): The CFPB plays a crucial role in overseeing mortgage lending practices, enforcing regulations, and protecting consumers from unfair or abusive practices.

- Truth in Lending Act (TILA): TILA requires lenders to disclose specific loan terms and costs to borrowers, ensuring transparency and informed decision-making.

- Real Estate Settlement Procedures Act (RESPA): RESPA regulates real estate settlement procedures, ensuring fair and competitive practices.

8. Mortgage Innovation and Fintech 2025

Fintech companies are disrupting the mortgage industry, offering innovative solutions and challenging traditional lending practices.

- Digital Mortgage Origination: Fintech companies are developing digital mortgage origination platforms, streamlining the application process and making it more accessible.

- Alternative Data Analysis: Fintech companies utilize alternative data sources, such as social media activity and online financial transactions, to assess creditworthiness.

- Automated Valuation Models (AVMs): AVMs use algorithms to estimate property values, offering faster and more efficient valuations than traditional appraisals.

FAQs

1. What are the key factors influencing mortgage rates in 2025?

Mortgage rates are influenced by a complex interplay of economic factors, including inflation, economic growth, monetary policy decisions, and global economic conditions.

2. How will technology impact the mortgage industry in 2025?

Technology is expected to transform the mortgage industry, streamlining processes, enhancing transparency, and improving the borrower experience. AI, machine learning, and digital platforms will play a significant role in automating tasks, analyzing data, and personalizing recommendations.

3. What are some emerging mortgage products expected to be available in 2025?

New mortgage products are emerging to cater to diverse needs, including flexible loan terms, down payment assistance programs, and innovative financing options.

4. How can I prepare for the mortgage market in 2025?

Building a strong credit score, saving for a down payment, and consulting with a qualified mortgage professional are crucial steps in preparing for the mortgage market.

5. What are the risks associated with the mortgage market in 2025?

Potential risks include interest rate fluctuations, economic instability, and mortgage fraud.

6. What are the benefits of using a mortgage broker?

Mortgage brokers can help borrowers compare different loan options, negotiate favorable terms, and navigate the complex mortgage process.

7. What are the latest mortgage regulations impacting borrowers in 2025?

Stay informed about the latest mortgage regulations and consumer protection laws to ensure fair and transparent lending practices.

8. How can I find the best mortgage deal in 2025?

Shop around, compare loan options, and consult with multiple lenders to secure the best mortgage deal.

Tips

- Build a Strong Credit Score: A good credit score is essential for securing favorable mortgage terms.

- Save for a Down Payment: A substantial down payment can reduce your monthly payments and improve your loan approval chances.

- Shop Around for Rates: Compare loan options from multiple lenders to secure the best interest rate.

- Understand Loan Terms: Thoroughly understand the terms of your mortgage, including interest rate, loan term, and closing costs.

- Seek Professional Advice: Consult with a qualified mortgage professional to navigate the complex mortgage process.

Conclusion

The mortgage market is constantly evolving, with mortgage trends 2025 shaping the landscape of homeownership. Understanding these trends and staying informed about industry developments can empower borrowers to make informed decisions and navigate the complexities of the mortgage process. By embracing technology, prioritizing financial literacy, and seeking professional advice, individuals can confidently pursue their homeownership goals in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Homeownership: Mortgage Trends 2025. We hope you find this article informative and beneficial. See you in our next article!