Navigating the Future: Quality Investment Trends in 2025

Navigating the Future: Quality Investment Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Quality Investment Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Quality Investment Trends in 2025

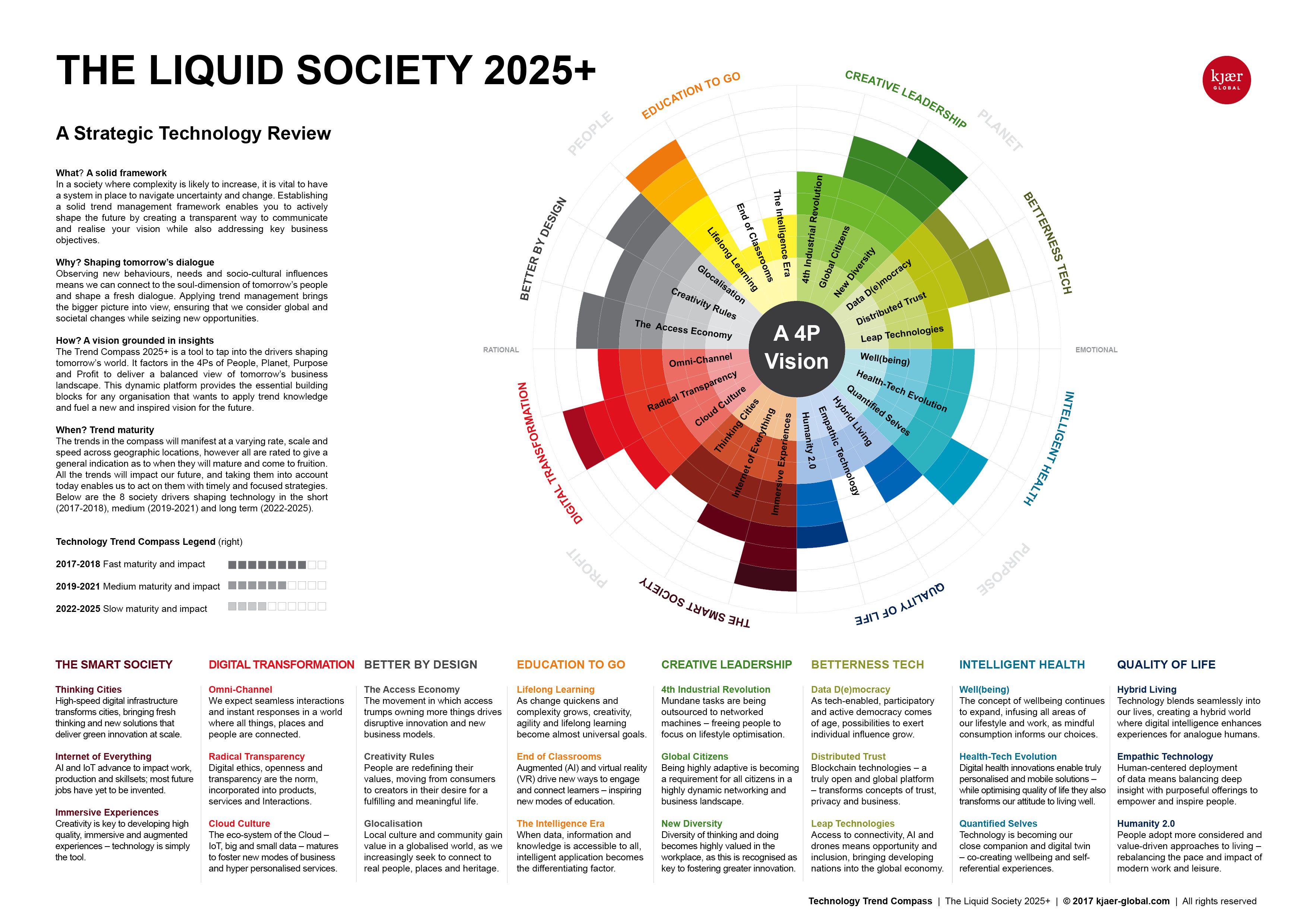

The investment landscape is constantly evolving, driven by technological advancements, shifting demographics, and global economic trends. As we approach 2025, investors are seeking opportunities that offer both strong returns and a positive impact on the world. This pursuit of quality investments is shaping the future of finance, emphasizing sustainability, innovation, and responsible growth.

Understanding Quality Investment Trends in 2025

ItalicQuality Investment Trends in 2025italic refer to investment strategies that prioritize long-term value creation, sustainable practices, and responsible growth. This approach goes beyond maximizing short-term profits, focusing on investments that contribute to a more resilient and equitable future.

Key Drivers of Quality Investment Trends in 2025:

- Growing Investor Demand for Sustainability: Environmental, social, and governance (ESG) factors are becoming increasingly important for investors. They are seeking investments that align with their values and contribute to a sustainable future.

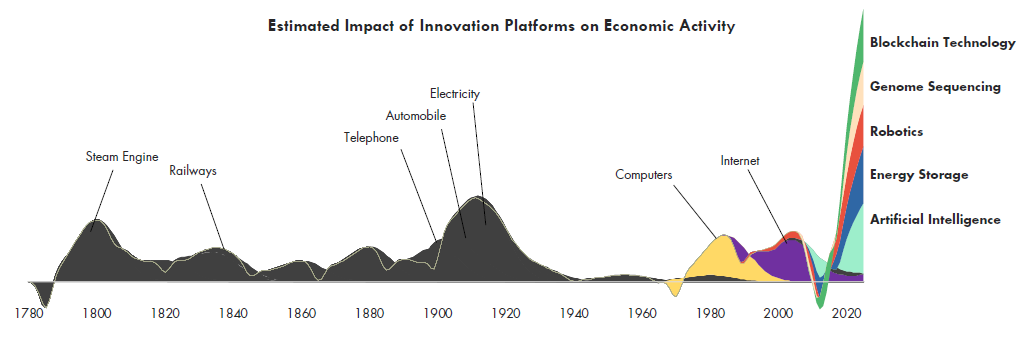

- Technological Advancements: Emerging technologies, such as artificial intelligence, blockchain, and renewable energy, are driving innovation and creating new investment opportunities.

- Demographic Shifts: An aging global population and rising middle classes in developing economies are influencing investment trends, creating demand for healthcare, education, and infrastructure investments.

- Geopolitical Uncertainty: Global events, such as trade wars and climate change, are creating volatility and uncertainty, leading investors to seek more resilient and diversified portfolios.

Exploring the Landscape of Quality Investment Trends in 2025:

1. Sustainable Investing:

- Green Bonds: These bonds are issued to finance projects that have a positive environmental impact, such as renewable energy, energy efficiency, and sustainable transportation.

- Impact Investing: This focuses on investments that aim to generate both financial returns and positive social and environmental impact.

- ESG Integration: ESG factors are increasingly being incorporated into investment analysis and portfolio construction, leading to a shift towards companies with strong sustainability practices.

2. Tech-Driven Investments:

- Artificial Intelligence (AI): AI is revolutionizing industries and creating opportunities for investors in areas like healthcare, finance, and manufacturing.

- Blockchain Technology: Blockchain is transforming industries by creating decentralized and secure systems for transactions, supply chain management, and identity verification.

- Cybersecurity: With the increasing reliance on technology, cybersecurity is becoming a critical investment area, as companies seek to protect their data and systems from cyberattacks.

3. Healthcare Innovation:

- Precision Medicine: Personalized medicine and advanced diagnostics are driving innovation in the healthcare sector, offering new treatments and therapies.

- Digital Health: Telemedicine, wearable technology, and remote patient monitoring are transforming how healthcare is delivered and accessed.

- Aging Population: The growing number of older adults is creating demand for healthcare services, assisted living facilities, and pharmaceuticals.

4. Infrastructure Development:

- Renewable Energy: Investing in renewable energy infrastructure, such as solar and wind power, is crucial for addressing climate change and reducing carbon emissions.

- Transportation Infrastructure: Investments in public transportation, electric vehicle charging stations, and smart traffic management systems are essential for sustainable urban development.

- Digital Infrastructure: Investing in high-speed internet connectivity, data centers, and cloud computing infrastructure is vital for economic growth and innovation.

5. Emerging Market Opportunities:

- Consumer Discretionary: Rising middle classes in emerging markets are driving growth in sectors like consumer goods, retail, and travel.

- Financial Services: Expanding access to financial services in emerging markets is creating opportunities for investments in banking, insurance, and microfinance.

- Infrastructure Development: Rapid urbanization in emerging markets is creating a significant need for investments in infrastructure, such as transportation, energy, and housing.

6. Real Estate Investments:

- Sustainable Real Estate: Investors are increasingly seeking properties with high energy efficiency, green building certifications, and sustainable materials.

- Urban Regeneration: Investments in revitalizing urban areas, creating mixed-use developments, and improving public spaces are becoming more attractive.

- Data-Driven Real Estate: Technology is transforming real estate with platforms for property management, data analytics, and virtual tours.

7. Alternative Investments:

- Private Equity: Investing in private companies offers potential for higher returns but also comes with higher risks.

- Venture Capital: Investing in early-stage startups with high growth potential can provide significant returns but is also highly speculative.

- Hedge Funds: Hedge funds use complex strategies to generate returns, often employing leverage and derivatives.

8. Impact Investing:

- Social Impact Bonds: These bonds are issued to finance social programs, with returns tied to the achievement of specific social outcomes.

- Community Development Finance Institutions (CDFIs): CDFIs provide financial services to underserved communities, promoting economic development and social equity.

- Philanthropic Investments: High-net-worth individuals and foundations are increasingly using their wealth to support charitable causes and social change.

Related Searches:

- ESG Investing Trends: Explore the growing importance of environmental, social, and governance factors in investment decisions.

- Sustainable Finance: Discover how the financial industry is adapting to the need for sustainable investments.

- Impact Investing Funds: Learn about funds that focus on investments with both financial and social impact.

- Future of Investing: Gain insights into the long-term trends shaping the investment landscape.

- Responsible Investing: Understand the ethical considerations and principles behind responsible investment strategies.

- Green Technology Investments: Explore opportunities in renewable energy, energy efficiency, and other green technologies.

- Emerging Market Investments: Learn about the risks and rewards of investing in developing economies.

- Global Macro Trends: Analyze the global economic factors that influence investment decisions.

FAQs on Quality Investment Trends in 2025:

Q: What are the benefits of investing in quality companies?

A: Investing in quality companies offers several benefits:

- Long-Term Growth Potential: Companies with strong fundamentals, sustainable practices, and innovative products and services have a higher likelihood of achieving long-term growth.

- Reduced Risk: Quality companies tend to be more resilient to economic downturns and market volatility.

- Ethical Alignment: Investing in companies that align with your values and contribute to a positive social and environmental impact can provide a sense of purpose and satisfaction.

Q: How can I identify quality investment opportunities?

A: Several factors can help you identify quality investments:

- Financial Performance: Analyze the company’s revenue growth, profitability, and cash flow.

- Management Quality: Assess the competence and integrity of the company’s leadership team.

- Competitive Advantage: Determine whether the company has a sustainable competitive edge in its industry.

- ESG Performance: Evaluate the company’s environmental, social, and governance practices.

Q: What are the risks associated with quality investments?

A: While quality investments offer potential benefits, they also carry risks:

- Valuation Risk: Quality companies may be overvalued, leading to potential losses if the market corrects.

- Sector Risk: The performance of a specific sector can be affected by industry-specific challenges or regulatory changes.

- Geopolitical Risk: Global events can impact the performance of companies operating in specific regions or industries.

Tips for Investing in Quality Companies:

- Do your research: Thoroughly analyze the company’s financial performance, management team, and industry dynamics.

- Consider your investment horizon: Quality investments typically require a long-term perspective for maximum returns.

- Diversify your portfolio: Spread your investments across different sectors and asset classes to mitigate risk.

- Seek professional advice: Consult with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance.

Conclusion:

ItalicQuality Investment Trends in 2025italic are shaping the future of finance, prioritizing sustainability, innovation, and responsible growth. Investors seeking to achieve both strong returns and a positive impact on the world should consider incorporating these trends into their investment strategies. By focusing on companies with strong fundamentals, sustainable practices, and innovative products and services, investors can build portfolios that contribute to a more resilient and equitable future. However, it is crucial to remember that all investments carry risks, and thorough research and due diligence are essential for making informed investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Quality Investment Trends in 2025. We thank you for taking the time to read this article. See you in our next article!