Navigating the Golden Path: A Look at Gold Trends in 2025

Navigating the Golden Path: A Look at Gold Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Golden Path: A Look at Gold Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Golden Path: A Look at Gold Trends in 2025

The allure of gold has captivated humanity for millennia. Its inherent value, enduring beauty, and perceived safe haven status have made it a cornerstone of global finance and a popular investment choice. While the future is inherently uncertain, analyzing current trends and market dynamics allows us to gain insights into the potential trajectory of gold in the coming years. This exploration examines the key factors shaping gold trends in 2025, providing a comprehensive understanding of this precious metal’s future prospects.

1. Macroeconomic Factors Shaping Gold’s Future

The global economic landscape plays a pivotal role in shaping gold trends in 2025. Several key macroeconomic factors will influence its performance:

- Inflation and Interest Rates: Gold is often perceived as a hedge against inflation, as its value tends to rise when purchasing power declines. In an environment of rising inflation, as witnessed in recent years, gold can offer a safe haven for investors. However, increasing interest rates can negatively impact gold, as higher rates make holding non-yielding assets like gold less attractive.

- Geopolitical Tensions: Geopolitical uncertainty, including conflicts, trade wars, and global instability, can drive investors towards safe-haven assets like gold. The ongoing Russia-Ukraine war and heightened tensions between major powers have already contributed to gold’s recent price surge.

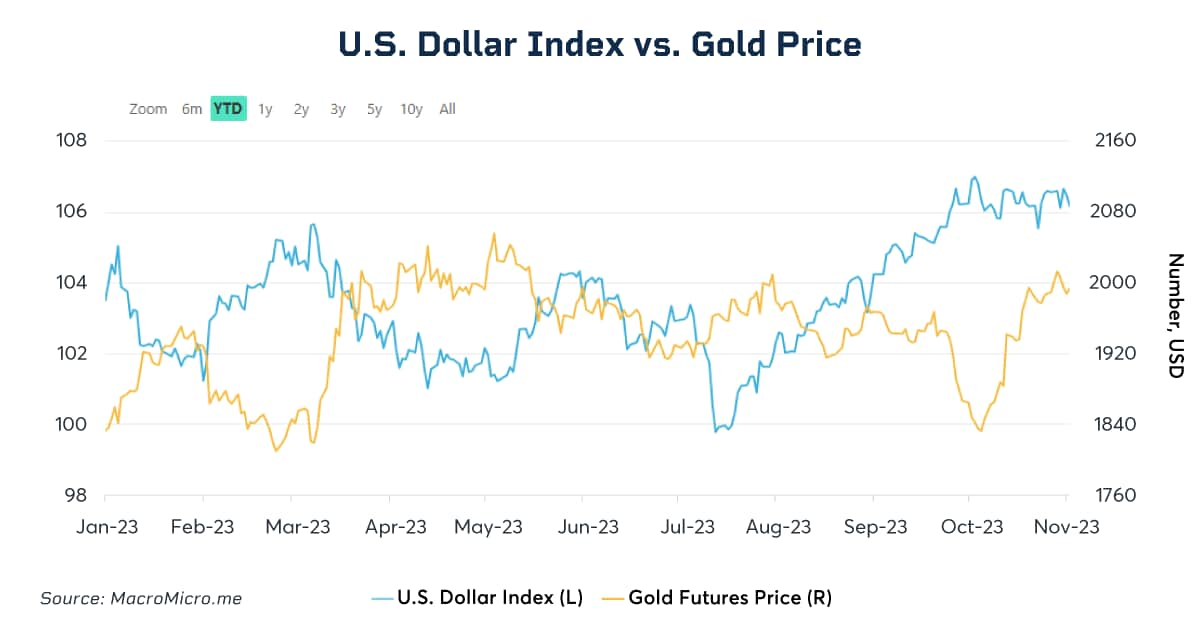

- Currency Fluctuations: Gold’s value is often inversely correlated with the US dollar. A weakening dollar can boost gold prices, as investors seek alternative stores of value. Conversely, a strengthening dollar can put downward pressure on gold prices.

2. Technological Advancements and Gold Mining

Technological advancements in mining and exploration are impacting gold production and supply.

- Improved Mining Techniques: Advancements in mining technology, such as automation and robotics, are increasing efficiency and reducing costs. This can potentially lead to higher gold production, potentially impacting prices.

- Gold Recycling: The growing awareness of sustainability and the need to reduce environmental impact is driving increased efforts in gold recycling. Recycling gold from electronic waste and jewelry can help offset demand from traditional mining sources.

- Exploration and Discovery: New gold discoveries and advancements in exploration techniques are constantly shaping the gold supply landscape. New deposits, particularly in emerging markets, could impact future production levels.

3. The Rise of Central Bank Gold Reserves

Central banks around the world are increasingly accumulating gold reserves, viewing it as a strategic asset.

- Diversification and Safe Haven: Central banks are diversifying their reserves to reduce dependence on US dollar-denominated assets and seeking safe haven assets in times of global uncertainty. Gold’s role as a safe haven asset makes it a valuable addition to central bank portfolios.

- De-Dollarization: Some nations are exploring de-dollarization strategies, potentially leading to an increased demand for gold as a reserve currency alternative.

- Strategic Reserves: Gold can serve as a strategic reserve, providing financial stability during times of crisis.

4. Investment Demand and Gold ETFs

Gold continues to be a popular investment choice for individual investors and institutional funds.

- Portfolio Diversification: Gold is often included in investment portfolios to diversify risk and reduce volatility. Its low correlation with other asset classes makes it a valuable addition to a well-balanced portfolio.

- Inflation Hedge: As mentioned earlier, gold’s perceived ability to hedge against inflation makes it attractive to investors concerned about rising prices.

- Gold Exchange-Traded Funds (ETFs): Gold ETFs have gained popularity as a convenient and cost-effective way to invest in gold. These ETFs track the price of gold, allowing investors to gain exposure to the precious metal without physically holding it.

5. Gold in the Jewelry and Technology Sectors

Gold’s use in jewelry and technology remains significant, driving demand for the precious metal.

- Jewelry Demand: The jewelry industry is a major consumer of gold, particularly in emerging markets with growing disposable incomes. Cultural preferences and trends in jewelry design influence gold demand.

- Technological Applications: Gold is used in various electronics, including smartphones, computers, and medical devices. Its conductivity and resistance to corrosion make it essential in these applications.

- Demand for Gold in the Technology Sector: The increasing demand for electronic devices, driven by technological advancements and growing populations, is contributing to gold demand in the technology sector.

6. Environmental and Social Responsibility in Gold Mining

The gold mining industry is facing increasing scrutiny regarding its environmental and social impact.

- Sustainable Mining Practices: The gold mining industry is under pressure to adopt sustainable mining practices, minimizing environmental damage and ensuring responsible sourcing.

- Ethical Gold Sourcing: Consumers are increasingly demanding ethical gold sourcing, leading to the emergence of certifications and initiatives promoting responsible gold mining.

- Carbon Footprint Reduction: Gold mining has a significant carbon footprint. The industry is exploring ways to reduce its environmental impact, including the adoption of renewable energy sources and cleaner technologies.

7. Gold and the Digital Age

The rise of digital currencies and blockchain technology is posing new challenges and opportunities for gold.

- Digital Gold: The development of digital gold platforms, using blockchain technology to represent ownership of gold, is gaining traction. These platforms offer potential benefits such as increased accessibility, transparency, and lower transaction costs.

- Gold as a Digital Asset: Gold can be tokenized and traded on blockchain platforms, creating new avenues for investment and trading.

- Competition from Digital Assets: The increasing popularity of digital assets, such as Bitcoin, is potentially creating competition for gold as a store of value and safe haven asset.

8. The Future of Gold: A Balancing Act

The future of gold is likely to be shaped by a complex interplay of factors, including economic conditions, technological advancements, and societal trends.

- Long-Term Value: Gold’s long-term value is likely to remain intact due to its inherent scarcity, historical significance, and perceived safe haven status.

- Volatility and Price Fluctuations: Gold prices will likely continue to experience volatility, influenced by factors such as global economic conditions, interest rate changes, and geopolitical events.

- Evolving Role: Gold’s role in the global financial system is evolving. It is likely to remain a significant asset class but may face competition from digital assets and alternative investment options.

Related Searches

1. Gold Price Forecast 2025: Analyzing historical data, current market trends, and expert predictions, analysts provide forecasts for gold prices in 2025. These forecasts consider factors such as inflation, interest rates, and global economic growth.

2. Gold Investment Strategies 2025: Investors seek strategies for maximizing returns and mitigating risks when investing in gold. Options include physical gold, gold ETFs, gold mining stocks, and gold-backed digital assets.

3. Gold Mining Companies 2025: Investors explore companies involved in gold mining, considering factors such as production levels, reserves, operational efficiency, and sustainability practices.

4. Gold Jewelry Trends 2025: The jewelry industry follows trends in design, materials, and consumer preferences. Understanding current trends and predicting future preferences can help jewelry retailers and designers cater to evolving tastes.

5. Gold in Electronics 2025: The use of gold in electronics is expected to continue, driven by the growing demand for smartphones, computers, and other electronic devices.

6. Sustainable Gold Mining 2025: The gold mining industry is focusing on sustainability, reducing environmental impact, and promoting responsible sourcing practices.

7. Digital Gold Platforms 2025: The development and adoption of digital gold platforms using blockchain technology are expected to continue, offering new ways to invest in and trade gold.

8. Gold as a Hedge Against Inflation 2025: Investors are increasingly looking to gold as a hedge against inflation, seeking to protect their wealth from rising prices.

FAQs

1. Will gold prices rise in 2025?

Predicting future gold prices is inherently challenging due to the complex interplay of factors influencing its value. However, experts often consider macroeconomic factors such as inflation, interest rates, geopolitical uncertainty, and the strength of the US dollar when making forecasts.

2. Is gold a good investment in 2025?

Whether gold is a good investment in 2025 depends on individual investment goals, risk tolerance, and market outlook. Gold can offer portfolio diversification, inflation hedging, and a safe haven during times of economic uncertainty. However, it is important to remember that gold is a non-yielding asset, and its value can fluctuate significantly.

3. What are the risks of investing in gold?

Investing in gold carries inherent risks, including:

- Price Volatility: Gold prices can experience significant fluctuations, potentially leading to losses.

- Lack of Income: Gold is a non-yielding asset, meaning it does not generate interest or dividends.

- Storage Costs: Physical gold requires secure storage, which can incur costs.

- Counterparty Risk: Investing in gold through ETFs or other financial instruments involves counterparty risk, the possibility that the issuer may default on its obligations.

4. How can I invest in gold in 2025?

Several ways to invest in gold in 2025 include:

- Physical Gold: Purchasing gold bullion or coins.

- Gold ETFs: Investing in exchange-traded funds that track the price of gold.

- Gold Mining Stocks: Investing in companies involved in gold mining.

- Gold-Backed Digital Assets: Investing in digital assets backed by physical gold.

5. What are the benefits of holding gold in 2025?

Holding gold can offer several potential benefits:

- Portfolio Diversification: Gold can reduce portfolio volatility by diversifying risk.

- Inflation Hedge: Gold can act as a hedge against inflation, preserving purchasing power.

- Safe Haven Asset: Gold is often seen as a safe haven asset during times of economic uncertainty.

- Long-Term Value: Gold has a long history of holding its value over time.

Tips

- Diversify your portfolio: Include gold as part of a well-balanced investment portfolio to mitigate risk.

- Understand your investment goals: Determine your investment objectives and risk tolerance before investing in gold.

- Research investment options: Explore different ways to invest in gold, such as physical gold, ETFs, or gold mining stocks.

- Consider storage costs: If investing in physical gold, factor in the cost of secure storage.

- Stay informed about market trends: Monitor global economic conditions, interest rates, and geopolitical events that can impact gold prices.

Conclusion

Gold trends in 2025 are likely to be shaped by a complex interplay of macroeconomic factors, technological advancements, and societal trends. While the future is uncertain, gold’s inherent value, perceived safe haven status, and growing demand from central banks and investors suggest it will remain a significant asset class. However, investors should carefully consider the risks and potential benefits of investing in gold before making any decisions. By staying informed about market trends, exploring different investment options, and diversifying their portfolios, investors can navigate the golden path and potentially benefit from this precious metal’s enduring allure.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Golden Path: A Look at Gold Trends in 2025. We thank you for taking the time to read this article. See you in our next article!