Navigating the Market Landscape: Anticipating Stock Trends Patterns in 2025

Navigating the Market Landscape: Anticipating Stock Trends Patterns in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Market Landscape: Anticipating Stock Trends Patterns in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Market Landscape: Anticipating Stock Trends Patterns in 2025

- 2 Introduction

- 3 Navigating the Market Landscape: Anticipating Stock Trends Patterns in 2025

- 3.1 Understanding the Forces Shaping Stock Trends Patterns

- 3.2 Stock Trends Patterns in 2025: A Glimpse into the Future

- 3.3 Related Searches

- 3.4 FAQs

- 3.5 Tips

- 3.6 Conclusion

- 4 Closure

Navigating the Market Landscape: Anticipating Stock Trends Patterns in 2025

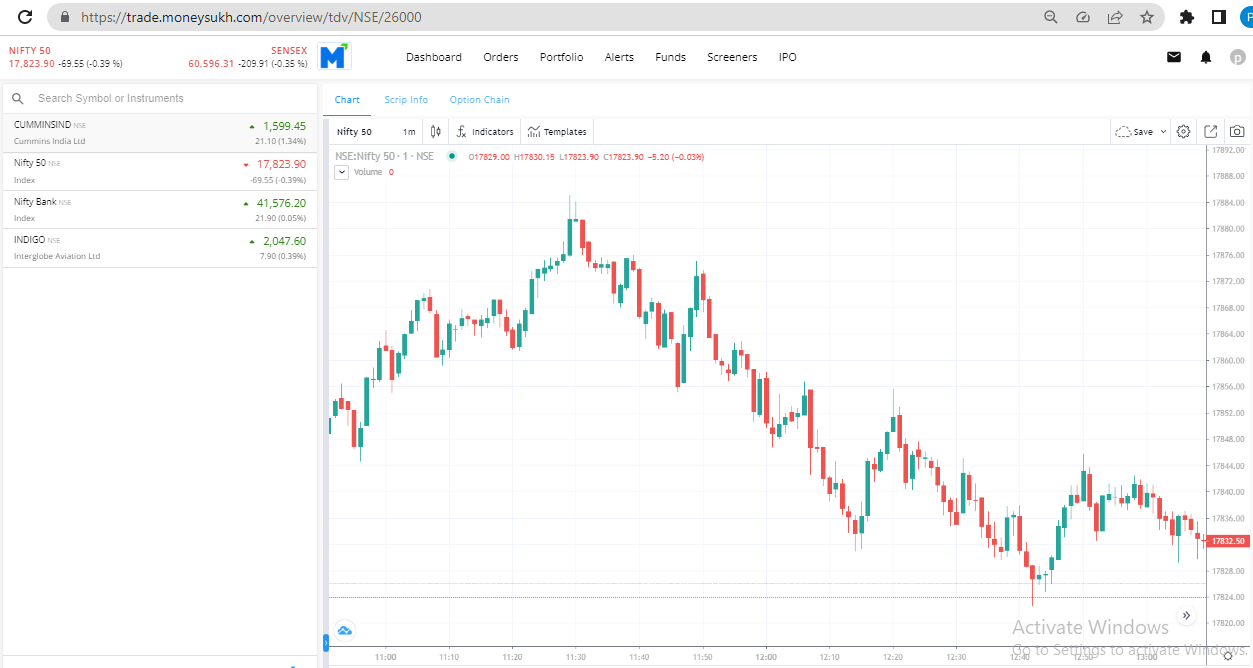

The stock market is a dynamic and unpredictable entity, perpetually in flux. While predicting the future with absolute certainty is impossible, understanding the underlying forces shaping market trends can provide valuable insights for informed investment decisions. This article delves into the potential stock trends patterns that could emerge by 2025, examining the factors that may influence them and exploring their implications for investors.

Understanding the Forces Shaping Stock Trends Patterns

Several key factors will likely shape the trajectory of the stock market in the coming years. These include:

- Technological Advancements: The rapid pace of technological innovation continues to reshape industries and create new opportunities. Artificial intelligence (AI), blockchain technology, and the Internet of Things (IoT) are driving transformative changes, potentially leading to significant growth in sectors like software, cybersecurity, and renewable energy.

- Global Economic Landscape: The global economy is interconnected, and events in one region can ripple through others. Factors such as geopolitical tensions, interest rate policies, and inflation rates can influence investor sentiment and affect stock market performance.

- Demographic Shifts: Aging populations, urbanization, and rising middle classes in emerging markets will continue to impact consumer spending patterns and demand for goods and services. These demographic shifts can influence investment opportunities in sectors like healthcare, consumer goods, and infrastructure.

- Environmental Sustainability: Growing concerns about climate change and environmental sustainability are driving a shift towards investments in renewable energy, sustainable agriculture, and green technologies. Companies embracing sustainable practices are likely to attract investors seeking long-term value.

- Regulatory Landscape: Government regulations and policies can significantly impact businesses and industries. Changes in tax laws, trade agreements, and environmental regulations can create both opportunities and challenges for investors.

Stock Trends Patterns in 2025: A Glimpse into the Future

Based on these driving forces, several potential stock trends patterns may emerge by 2025:

- Growth in Technology Sectors: The continued proliferation of AI, blockchain, and other disruptive technologies is likely to fuel growth in related sectors. Companies developing and implementing these technologies are expected to see significant demand, potentially leading to strong stock performance.

- Focus on Sustainable Investing: Investors are increasingly prioritizing companies with strong environmental, social, and governance (ESG) practices. This trend is expected to continue, driving investment towards companies committed to sustainability.

- Emerging Markets Opportunities: As middle classes grow in emerging markets, demand for consumer goods and services is likely to rise. This presents opportunities for investors in sectors like retail, consumer durables, and healthcare.

- Healthcare Innovation: The aging global population will drive demand for healthcare services and technologies. Companies developing innovative treatments, diagnostics, and healthcare solutions are likely to experience significant growth.

- Infrastructure Development: Investments in infrastructure, particularly in renewable energy, transportation, and digital infrastructure, are crucial for sustainable economic growth. Companies involved in these areas are likely to attract investors seeking long-term returns.

Related Searches

Here are some related searches that delve deeper into specific aspects of stock trends patterns in 2025:

- AI Stock Trends 2025: This explores the potential impact of AI on the stock market, focusing on companies developing and implementing AI technologies.

- Sustainable Investing Trends 2025: This examines the growing trend of ESG investing and its implications for the stock market.

- Emerging Market Stock Trends 2025: This focuses on the potential growth opportunities in emerging markets and the sectors likely to benefit.

- Healthcare Stock Trends 2025: This analyzes the impact of an aging population on the healthcare sector and the potential for stock growth.

- Infrastructure Stock Trends 2025: This explores the investment opportunities in infrastructure development, including renewable energy, transportation, and digital infrastructure.

- Cryptocurrency Stock Trends 2025: This examines the potential impact of cryptocurrencies on the stock market and the companies involved in this space.

- ESG Investing in 2025: This delves into the principles and practices of ESG investing and its growing importance for investors.

- Global Macroeconomic Outlook 2025: This provides an overview of the global economic landscape and its potential impact on the stock market.

FAQs

Q: What are the biggest risks to stock market performance in 2025?

A: Several risks could impact stock market performance, including:

- Economic Recession: A global economic recession could significantly impact corporate earnings and stock market valuations.

- Geopolitical Instability: Conflicts and tensions between nations can disrupt global trade and investment flows, affecting stock market performance.

- Inflation: High inflation can erode purchasing power and increase borrowing costs, potentially impacting stock prices.

- Interest Rate Hikes: Central banks may raise interest rates to control inflation, potentially leading to slower economic growth and a decline in stock market valuations.

- Cybersecurity Threats: Increasingly sophisticated cyberattacks can disrupt businesses and damage investor confidence, impacting stock prices.

Q: How can investors prepare for these potential trends?

A: Investors can prepare for these potential trends by:

- Diversifying Portfolios: Diversifying across different asset classes, sectors, and geographies can mitigate risk and enhance returns.

- Conducting Thorough Research: Understanding the fundamentals of companies and the industries they operate in is crucial for making informed investment decisions.

- Monitoring Economic Indicators: Tracking economic indicators such as inflation, interest rates, and unemployment can provide insights into the health of the economy and its impact on the stock market.

- Seeking Professional Advice: Consulting with a financial advisor can provide personalized guidance and help develop a tailored investment strategy.

Tips

- Focus on Long-Term Growth: Investing for the long term allows you to ride out market fluctuations and benefit from the potential for long-term growth.

- Stay Informed: Stay updated on global events, economic trends, and technological advancements that can influence stock market performance.

- Don’t Chase Returns: Avoid chasing hot stocks or trends, as this can lead to impulsive decisions and potential losses.

- Be Patient and Disciplined: Investing requires patience and discipline. Avoid making emotional decisions based on short-term market movements.

- Consider Your Risk Tolerance: Understand your risk tolerance and invest accordingly. Don’t take on more risk than you are comfortable with.

Conclusion

While the future of the stock market is inherently uncertain, understanding the key drivers of stock trends patterns can provide valuable insights for investors. By staying informed, diversifying portfolios, and making informed decisions, investors can navigate the market landscape and potentially capitalize on the opportunities that lie ahead.

Remember, the stock market is a complex and dynamic system. No single prediction can guarantee success. However, by understanding the underlying forces shaping the market and developing a sound investment strategy, investors can position themselves for long-term success.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market Landscape: Anticipating Stock Trends Patterns in 2025. We hope you find this article informative and beneficial. See you in our next article!