Navigating the Uncertain Future: Exploring Inflation Trends in 2025

Navigating the Uncertain Future: Exploring Inflation Trends in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Uncertain Future: Exploring Inflation Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Uncertain Future: Exploring Inflation Trends in 2025

The global economy is a complex system, constantly evolving under the influence of numerous factors. One of the most significant and impactful forces shaping economic landscapes is inflation. Predicting its trajectory with certainty is an impossible task, yet understanding the trends and potential drivers of inflation is crucial for businesses, investors, and individuals alike. This article delves into the potential landscape of trends in inflation 2025, exploring the key factors that might influence its course and offering insights into how this economic force could impact our lives.

Understanding Inflation: A Primer

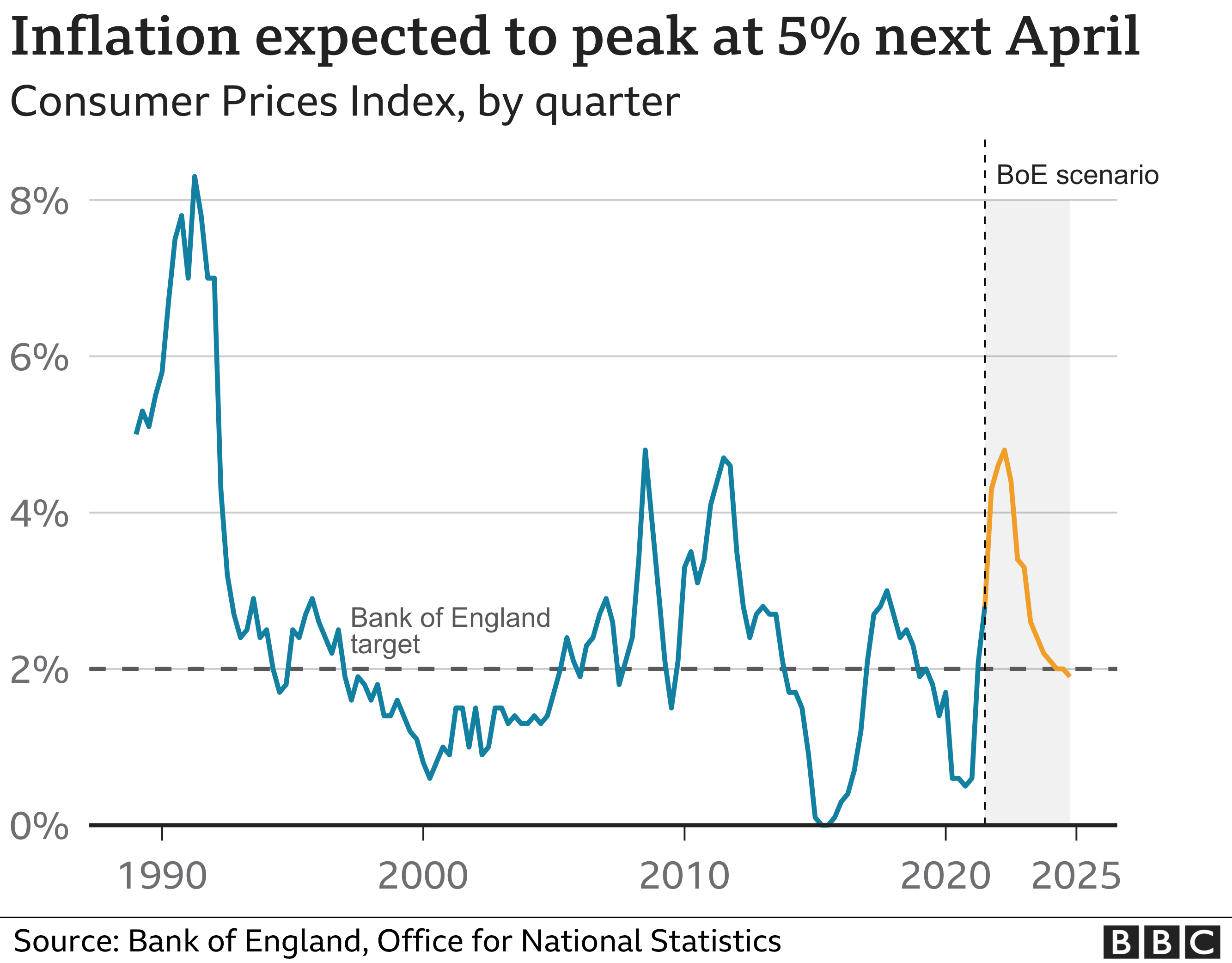

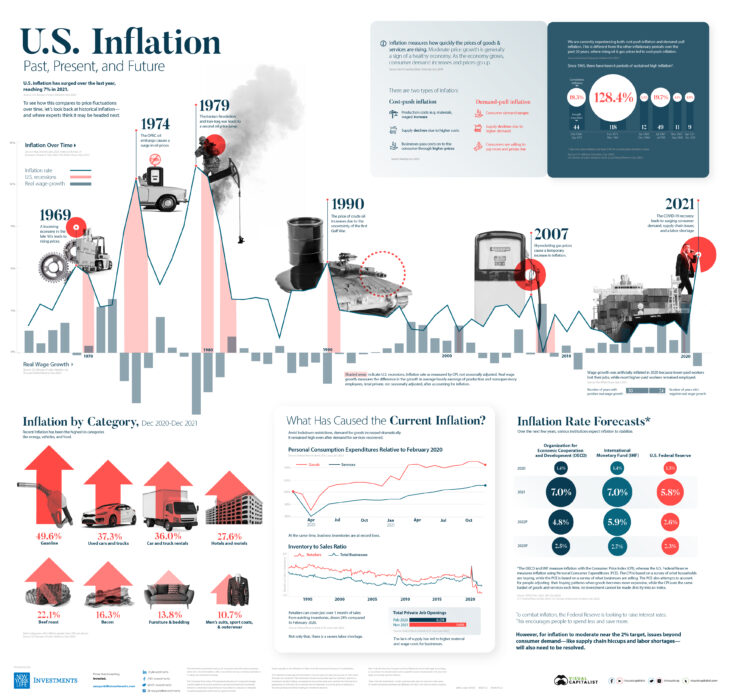

Inflation refers to the sustained increase in the general price level of goods and services within an economy over a specific period. This means that the purchasing power of a currency diminishes over time, requiring more money to buy the same amount of goods and services. Inflation is typically measured using price indices, such as the Consumer Price Index (CPI), which tracks the average change in prices paid by urban consumers for a basket of goods and services.

Key Drivers of Inflation in 2025

Predicting inflation in 2025 requires analyzing a multitude of factors, both global and domestic. Some key drivers that could influence inflation trends include:

- Global Supply Chain Dynamics: The ongoing disruptions in global supply chains, exacerbated by geopolitical tensions and natural disasters, could continue to exert upward pressure on prices. The ability of businesses to source raw materials and transport finished goods efficiently will be crucial in mitigating inflationary pressures.

- Energy Prices: The volatility in energy prices, particularly those of oil and gas, is a significant driver of inflation. Geopolitical events, such as the ongoing conflict in Ukraine, and the transition to renewable energy sources could continue to influence energy prices, impacting overall inflation.

- Monetary Policy: Central banks worldwide are actively managing interest rates to combat inflation. The effectiveness of these policies in curbing inflation while avoiding economic recession will be a critical factor in determining the trajectory of inflation in 2025.

- Labor Market Dynamics: The tightness of labor markets, characterized by low unemployment rates and high demand for workers, can lead to wage inflation. The ability of businesses to attract and retain talent while managing wage increases will be a key factor in controlling inflation.

- Government Spending and Fiscal Policy: Government spending policies, including infrastructure projects and social programs, can influence inflation. Expansionary fiscal policies can stimulate economic growth but also contribute to inflation, while contractionary policies can slow down economic activity but also curb inflation.

- Technological Advancements: Innovation and technological advancements can impact inflation in various ways. Increased automation and productivity can lead to lower prices for goods and services, while the development of new technologies can create new demand and drive price increases.

Exploring Potential Scenarios for Inflation in 2025

Given the complex interplay of these factors, several potential scenarios for inflation in 2025 are possible:

- Scenario 1: Persistent Inflation: This scenario suggests that inflation remains elevated throughout 2025, driven by ongoing supply chain disruptions, high energy prices, and persistent demand pressures. This could lead to higher interest rates, slower economic growth, and a decline in consumer purchasing power.

- Scenario 2: Moderating Inflation: This scenario envisions a gradual decline in inflation as supply chain bottlenecks ease, energy prices stabilize, and monetary policy effectively manages demand. Economic growth could remain moderate, but consumer confidence and spending could improve.

- Scenario 3: Deflationary Pressures: In this scenario, inflation could fall below target levels, driven by a combination of factors such as weak demand, excess supply, and technological deflationary pressures. This could lead to a deflationary spiral, characterized by falling prices, declining economic activity, and potential deflation.

The Importance of Understanding Inflation Trends

Understanding the potential trends in inflation in 2025 is crucial for various stakeholders:

- Businesses: Businesses need to anticipate inflation to adjust pricing strategies, manage costs, and plan for future investments. Accurate inflation forecasts can help businesses make informed decisions about pricing, inventory management, and resource allocation.

- Investors: Inflation can significantly impact investment returns. Investors need to understand the potential impact of inflation on asset classes such as stocks, bonds, and real estate to make informed investment decisions.

- Individuals: Inflation directly affects the purchasing power of individuals’ incomes. Understanding inflation trends can help individuals make informed decisions about spending, saving, and investment strategies to protect their financial well-being.

- Policymakers: Governments and central banks use inflation data to guide monetary and fiscal policies. Accurate inflation forecasts are essential for policymakers to develop effective strategies to maintain price stability and promote economic growth.

Related Searches: Inflation Trends 2025

The importance of trends in inflation 2025 extends beyond general economic forecasting. Understanding the broader context of inflation requires exploring related searches, such as:

- Inflation Rate Forecast 2025: This search focuses on specific numerical projections of inflation rates for 2025, often provided by financial institutions, research organizations, and economists.

- Inflation Impact on Economy 2025: This search explores the potential consequences of different inflation scenarios on economic growth, employment, and consumer spending in 2025.

- Inflation Impact on Investment 2025: This search examines how inflation could affect the performance of different asset classes, such as stocks, bonds, and real estate, providing insights for investors.

- Inflation Impact on Wages 2025: This search analyzes the potential impact of inflation on wage growth, examining the relationship between inflation and real wages and its implications for workers.

- Inflation Impact on Interest Rates 2025: This search focuses on the potential impact of inflation on interest rates, examining how central banks might adjust interest rates to manage inflation and its effects on borrowing costs.

- Inflation Impact on Consumer Spending 2025: This search explores the potential impact of inflation on consumer spending patterns, examining how rising prices might affect consumer confidence and purchasing power.

- Inflation Hedging Strategies 2025: This search investigates strategies that individuals and businesses can employ to protect their assets and investments from the negative effects of inflation.

- Inflation Mitigation Strategies 2025: This search explores policies and measures that governments and businesses can implement to mitigate the negative consequences of inflation and stabilize the economy.

FAQs: Trends in Inflation 2025

Q: What are the main factors driving inflation in 2025?

A: Inflation in 2025 will likely be driven by a combination of factors, including supply chain disruptions, energy price volatility, tight labor markets, government spending policies, and technological advancements.

Q: How will inflation impact economic growth in 2025?

A: High inflation can hinder economic growth by reducing consumer spending, discouraging investment, and increasing borrowing costs. However, moderate inflation can stimulate economic activity by encouraging investment and consumption.

Q: What are the potential risks of high inflation in 2025?

A: High inflation can lead to a decline in consumer purchasing power, erode savings, and create economic uncertainty. It can also lead to social unrest and political instability.

Q: What are the potential benefits of moderate inflation in 2025?

A: Moderate inflation can encourage investment, stimulate economic growth, and provide incentives for businesses to innovate and improve productivity.

Q: How can individuals and businesses prepare for inflation in 2025?

A: Individuals can protect themselves from inflation by diversifying investments, saving money, and seeking out opportunities to increase income. Businesses can prepare by monitoring inflation trends, adjusting pricing strategies, and managing costs effectively.

Tips: Navigating Inflation in 2025

- Stay Informed: Keep abreast of inflation trends, economic forecasts, and policy announcements to make informed decisions.

- Diversify Investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate the risks associated with inflation.

- Manage Expenses: Track your spending, identify areas where you can cut back, and consider alternative options for essential goods and services.

- Negotiate Wages: If you are employed, consider negotiating for higher wages to keep pace with inflation.

- Seek Out Opportunities: Look for opportunities to increase your income, such as starting a side hustle or acquiring new skills.

Conclusion: The Future of Inflation

Predicting the future of inflation with certainty is impossible. However, understanding the key drivers of inflation and the potential scenarios for 2025 can help businesses, investors, and individuals make informed decisions to navigate the economic landscape. By staying informed, adapting to changing conditions, and taking proactive steps, we can mitigate the negative impacts of inflation and harness its potential benefits. The future of trends in inflation 2025 remains uncertain, but by understanding the forces at play, we can better prepare for the economic challenges and opportunities that lie ahead.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncertain Future: Exploring Inflation Trends in 2025. We appreciate your attention to our article. See you in our next article!