Navigating the Uncharted Waters: Stock Market Trends by Month in 2025

Navigating the Uncharted Waters: Stock Market Trends by Month in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Uncharted Waters: Stock Market Trends by Month in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Uncharted Waters: Stock Market Trends by Month in 2025

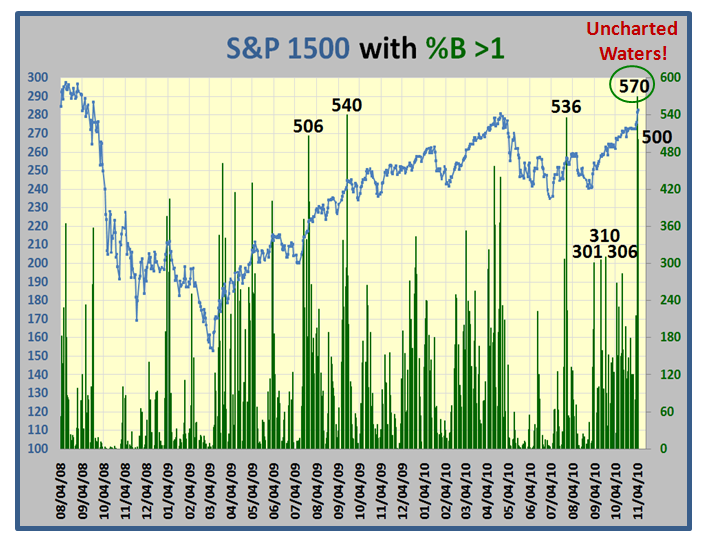

Predicting the future of the stock market is a daunting task, akin to navigating uncharted waters. While no one can definitively say what each month of 2025 will hold, analyzing historical trends, current economic indicators, and emerging technologies can provide valuable insights for investors. This article delves into the potential stock market trends by month in 2025, offering a comprehensive guide for navigating the market’s complexities.

Understanding the Dynamics of Stock Market Trends

The stock market is a complex system influenced by a myriad of factors, including:

- Economic Indicators: Growth rates, inflation, unemployment, and interest rates all impact investor sentiment and corporate profitability.

- Geopolitical Events: Global conflicts, political instability, and trade tensions can cause market volatility.

- Technological Advancements: Innovations in artificial intelligence, renewable energy, and biotechnology drive new investment opportunities.

- Consumer Confidence: Consumer spending plays a crucial role in economic growth, influencing corporate earnings and stock prices.

- Seasonal Factors: Certain industries, like retail and tourism, exhibit seasonal patterns that can affect stock performance.

Forecasting Stock Market Trends by Month in 2025

While predicting specific monthly movements is impossible, we can identify potential themes and trends based on current conditions and expert projections.

January:

- Post-Holiday Market: January typically sees a rebound after the holiday season, as investors reassess their portfolios and seek new opportunities.

- Earnings Season: Many companies release their fourth-quarter earnings reports in January, providing valuable insights into their performance and future outlook.

- Potential for Volatility: Geopolitical events and economic data releases can create volatility in the early months of the year.

February:

- Valentine’s Day Spending: Consumer spending may increase in February, benefiting sectors like retail and hospitality.

- Focus on Emerging Markets: Investors may shift their attention to emerging markets, seeking higher growth potential.

- Inflation Concerns: Rising inflation could continue to impact consumer sentiment and corporate profitability.

March:

- Spring Break Season: Tourism and leisure industries may experience a surge in activity, boosting related stock prices.

- Federal Reserve Interest Rate Decisions: The Federal Reserve’s monetary policy decisions in March can influence interest rates and market sentiment.

- Tax Season: Tax season can lead to increased volatility as investors adjust their portfolios based on their tax liabilities.

April:

- Earnings Season: First-quarter earnings reports are released, providing insights into corporate performance.

- Spring Growth: Economic growth typically accelerates in the spring months, potentially boosting stock prices.

- Potential for Geopolitical Risks: Global events can impact market sentiment, especially during times of geopolitical tension.

May:

- Memorial Day Weekend: Retail and travel industries may experience a surge in activity.

- Focus on Technology: Investors may continue to favor technology stocks, driven by innovation and growth potential.

- Inflation and Interest Rate Concerns: Ongoing inflation and potential interest rate hikes could impact market sentiment.

June:

- Summer Travel Season: Travel and leisure stocks may benefit from increased demand.

- Focus on Energy: Rising energy prices could boost energy sector stocks.

- Earnings Season: Second-quarter earnings reports are released, offering insights into corporate performance.

July:

- Summer Sales: Retail sales may increase during the summer months, benefiting consumer discretionary stocks.

- Focus on Healthcare: Healthcare stocks may perform well, driven by aging demographics and increasing healthcare spending.

- Potential for Volatility: Geopolitical events and economic data releases can create market volatility.

August:

- Back-to-School Season: Retail and education-related stocks may benefit from increased spending.

- Focus on Value Stocks: Investors may shift their focus to value stocks, seeking companies with strong fundamentals and undervalued assets.

- Potential for Market Correction: August has historically been a volatile month, with a higher probability of market corrections.

September:

- Labor Day Weekend: Retail and travel industries may see increased activity.

- Focus on Financial Stocks: Financial stocks may benefit from rising interest rates and increased economic activity.

- Earnings Season: Third-quarter earnings reports are released, providing insights into corporate performance.

October:

- Halloween Spending: Consumer spending may increase in October, benefiting retail and entertainment sectors.

- Focus on Industrials: Industrial stocks may benefit from increased economic activity and infrastructure spending.

- Potential for Market Volatility: October has historically been a volatile month, with heightened risk aversion.

November:

- Black Friday and Cyber Monday: Retail sales are expected to surge during the holiday shopping season.

- Focus on Consumer Discretionary Stocks: Consumer discretionary stocks may benefit from increased holiday spending.

- Earnings Season: Fourth-quarter earnings reports are released, providing insights into corporate performance.

December:

- Holiday Season: Consumer spending is expected to remain high, benefiting retail and consumer discretionary stocks.

- Focus on Real Estate: Real estate stocks may perform well, driven by low interest rates and strong demand.

- Year-End Rebalancing: Investors may rebalance their portfolios before the end of the year, potentially leading to market volatility.

Related Searches

1. Stock Market Predictions 2025: This search explores various forecasts and predictions for the stock market in 2025, encompassing economic indicators, industry trends, and expert opinions.

2. Stock Market Outlook 2025: This search delves into the overall outlook for the stock market in 2025, considering factors like interest rates, inflation, and geopolitical events.

3. Best Stocks to Buy in 2025: This search aims to identify promising investment opportunities in various sectors, considering growth potential, valuation, and market trends.

4. Stock Market Trends by Sector 2025: This search focuses on specific industry trends within the stock market, analyzing growth prospects, challenges, and investment opportunities in each sector.

5. Stock Market Volatility 2025: This search explores potential sources of market volatility in 2025, including economic uncertainty, geopolitical risks, and interest rate changes.

6. Stock Market Crash 2025: This search examines the possibility of a stock market crash in 2025, analyzing historical patterns, current economic conditions, and potential triggers.

7. Stock Market Investing Strategies 2025: This search explores various investment strategies for navigating the stock market in 2025, considering risk tolerance, investment goals, and market trends.

8. Stock Market Tips 2025: This search provides practical advice for investors, offering tips on portfolio diversification, risk management, and navigating market volatility.

FAQs

Q: What are the key factors influencing stock market trends in 2025?

A: The stock market in 2025 will be influenced by a combination of factors, including economic growth, inflation, interest rates, geopolitical events, technological advancements, consumer confidence, and seasonal patterns.

Q: Are there any specific industries expected to perform well in 2025?

A: Several industries are expected to see growth in 2025, including technology, healthcare, energy, and consumer discretionary. However, specific performance will depend on individual company fundamentals and market conditions.

Q: What are the potential risks facing the stock market in 2025?

A: The stock market faces several risks in 2025, including rising inflation, interest rate hikes, geopolitical instability, and potential economic downturns.

Q: How can investors prepare for potential stock market volatility in 2025?

A: Investors can prepare for market volatility by diversifying their portfolios, investing in a mix of assets, and maintaining a long-term investment horizon.

Q: What are some tips for investing in the stock market in 2025?

A: Investors should conduct thorough research, understand their risk tolerance, and consider consulting a financial advisor. It’s also crucial to stay informed about market trends and economic indicators.

Tips for Navigating Stock Market Trends in 2025

- Diversify your portfolio: Spread your investments across different asset classes, sectors, and geographies to mitigate risk.

- Maintain a long-term investment horizon: Avoid short-term trading and focus on long-term growth potential.

- Stay informed about market trends: Follow economic indicators, industry news, and expert opinions to stay informed.

- Manage your risk tolerance: Understand your investment goals and risk appetite before making investment decisions.

- Consider consulting a financial advisor: Seek professional guidance from a qualified financial advisor to develop a personalized investment strategy.

Conclusion

The stock market in 2025 will likely be characterized by continued volatility and uncertainty. While predicting specific monthly movements is impossible, understanding the underlying economic and geopolitical factors, as well as emerging trends, can help investors navigate the market’s complexities. By diversifying portfolios, maintaining a long-term perspective, and staying informed, investors can position themselves for success in the dynamic world of stock market investing.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncharted Waters: Stock Market Trends by Month in 2025. We hope you find this article informative and beneficial. See you in our next article!