Shaping the Future of Finance: Key Trends for 2025 and Beyond

Shaping the Future of Finance: Key Trends for 2025 and Beyond

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Shaping the Future of Finance: Key Trends for 2025 and Beyond. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Shaping the Future of Finance: Key Trends for 2025 and Beyond

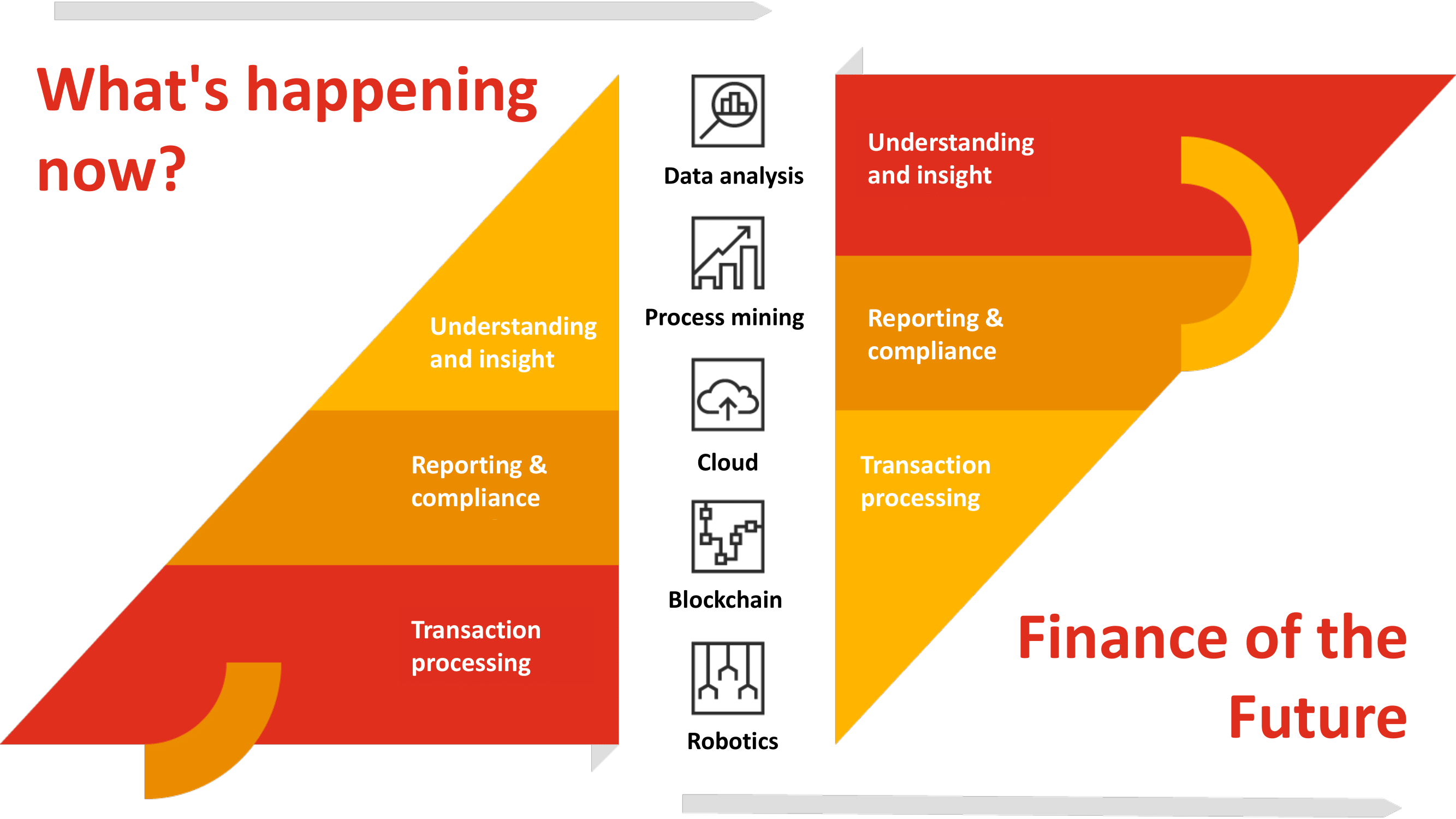

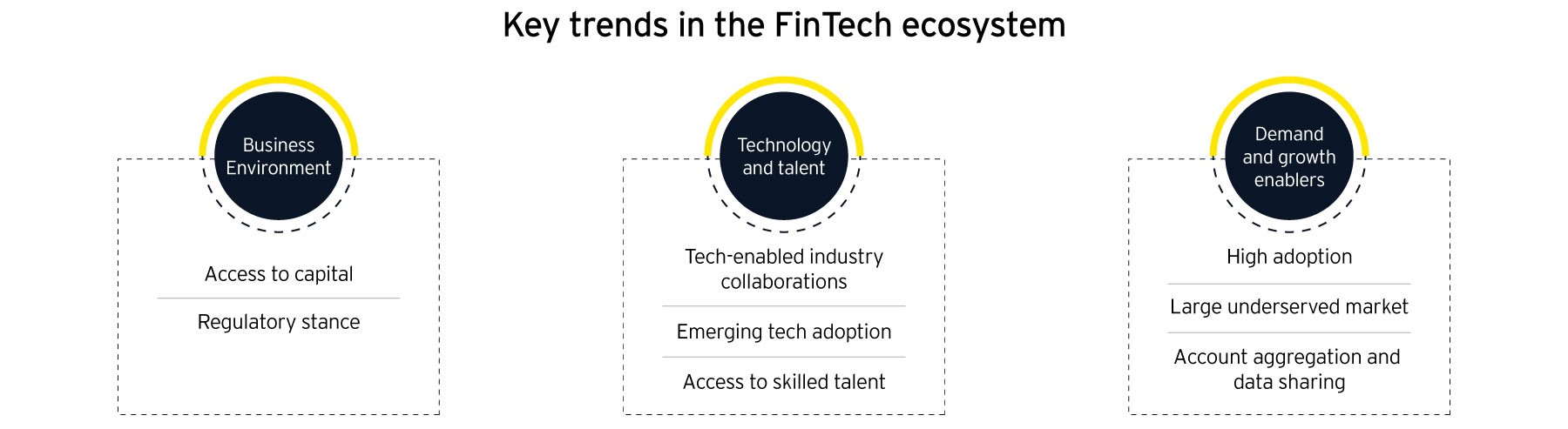

The financial landscape is constantly evolving, driven by technological advancements, shifting consumer preferences, and a growing focus on sustainability. As we look toward 2025, it’s clear that the industry will continue to undergo significant transformations, reshaping how individuals and businesses manage their finances. Understanding these trends in finance 2025 is crucial for navigating the evolving financial world and staying ahead of the curve.

1. The Rise of Embedded Finance

Embedded finance, also known as "fintech-as-a-service," is a trend that will see financial services seamlessly integrated into non-financial platforms. This means that consumers can access banking, insurance, and investment products directly within their favorite apps and services, such as ride-sharing platforms, e-commerce websites, and social media platforms.

Benefits:

- Enhanced Convenience: Consumers can manage their finances without switching between multiple apps.

- Personalized Experiences: Embedded finance allows for tailored financial solutions based on individual needs and preferences.

- Increased Accessibility: Financial services become accessible to a wider audience, including those previously underserved by traditional institutions.

Example: Imagine booking a flight on an airline’s website and simultaneously securing travel insurance through a built-in option, all within the same platform.

2. The Power of Open Banking

Open banking is a system that allows consumers to securely share their financial data with third-party applications with their consent. This data sharing fosters innovation by enabling new financial products and services built on top of existing bank infrastructure.

Benefits:

- Increased Competition: Open banking encourages competition in the financial sector, driving innovation and better customer offerings.

- Personalized Financial Management: Consumers can leverage aggregated data from different accounts to gain a comprehensive view of their financial situation and make informed decisions.

- Enhanced Financial Inclusion: Open banking can help underserved populations access financial services by enabling the development of tailored solutions.

Example: An app could aggregate data from various bank accounts, investment platforms, and credit cards to provide users with a holistic financial overview and personalized budgeting recommendations.

3. The Growing Importance of Data Analytics

Data analytics is becoming increasingly crucial in the financial sector. By analyzing vast amounts of data, financial institutions can gain valuable insights into customer behavior, market trends, and risk profiles. This enables them to offer personalized services, optimize investment strategies, and detect fraudulent activities.

Benefits:

- Improved Risk Management: Data analytics helps financial institutions identify and mitigate potential risks.

- Enhanced Customer Experience: By understanding customer preferences, institutions can tailor financial products and services to individual needs.

- Increased Efficiency: Data analytics can streamline operations and optimize processes for greater efficiency.

Example: Using data analytics, a bank can identify customers who are likely to default on their loans and intervene early to prevent potential losses.

4. The Expansion of Digital Currencies

Digital currencies, such as cryptocurrencies and stablecoins, are gaining traction and are expected to play a more significant role in the financial landscape. These currencies offer advantages like faster transaction speeds, lower fees, and enhanced security.

Benefits:

- Faster and Cheaper Transactions: Digital currencies can facilitate faster and more cost-effective transactions compared to traditional payment methods.

- Increased Financial Inclusion: Digital currencies can provide access to financial services for individuals in remote areas or those lacking access to traditional banking systems.

- Enhanced Security: Cryptocurrencies utilize advanced encryption techniques to secure transactions.

Example: Businesses could use stablecoins to settle international payments more efficiently and at a lower cost.

5. The Rise of Sustainable Finance

Sustainable finance is gaining momentum as investors increasingly prioritize environmental, social, and governance (ESG) factors in their investment decisions. This trend encourages investments in companies and projects that promote sustainable practices and contribute to a positive social impact.

Benefits:

- Positive Environmental Impact: Sustainable finance channels investments towards projects that address climate change and promote environmental sustainability.

- Social Responsibility: Investments in companies with strong ESG practices contribute to a more equitable and inclusive society.

- Long-Term Value Creation: Companies with sustainable practices often demonstrate better long-term financial performance.

Example: Investors may choose to invest in renewable energy companies or social enterprises that address poverty or inequality.

6. The Evolution of Payment Technologies

Payment technologies are constantly evolving, with innovations like contactless payments, mobile wallets, and biometrics becoming increasingly prevalent. These advancements provide consumers with faster, more secure, and convenient payment options.

Benefits:

- Enhanced Convenience: Contactless payments and mobile wallets streamline the payment process, making it faster and more convenient.

- Increased Security: Biometric authentication adds a layer of security to transactions.

- Global Reach: Mobile wallets and other payment technologies facilitate cross-border transactions.

Example: Consumers can use their smartphones to make contactless payments at retail stores, restaurants, and other venues.

7. The Growing Importance of Cybersecurity

As financial institutions rely more heavily on technology, cybersecurity becomes paramount. Protecting sensitive data and preventing cyberattacks is crucial to maintain customer trust and ensure the integrity of financial operations.

Benefits:

- Protecting Customer Data: Robust cybersecurity measures are essential to safeguard sensitive customer information, including financial data and personal details.

- Preventing Financial Losses: Cyberattacks can result in significant financial losses for both individuals and institutions. Strong cybersecurity mitigates these risks.

- Maintaining Reputation: A data breach can damage a financial institution’s reputation and erode customer trust.

Example: Implementing multi-factor authentication, encryption, and regular security audits can help financial institutions protect their systems and data from cyberattacks.

8. The Impact of Artificial Intelligence (AI)

AI is transforming the financial sector, automating tasks, improving decision-making, and enhancing customer experiences. AI-powered tools can analyze vast amounts of data, detect fraud, provide personalized recommendations, and automate routine processes.

Benefits:

- Increased Efficiency: AI can automate repetitive tasks, freeing up human resources for more strategic initiatives.

- Improved Decision-Making: AI can analyze data and provide insights to inform better investment decisions and risk management strategies.

- Personalized Customer Experiences: AI can personalize financial products and services based on individual needs and preferences.

Example: AI-powered chatbots can provide customers with 24/7 support and answer frequently asked questions.

Related Searches:

1. Future of Finance: This search explores broader trends and predictions for the financial industry in the coming years.

2. Fintech Trends: This search focuses on specific technological advancements shaping the financial sector.

3. Digital Banking Trends: This search examines the evolution of online and mobile banking.

4. Financial Technology Innovation: This search explores new technologies and solutions impacting the financial landscape.

5. Impact of AI on Finance: This search focuses on the role of artificial intelligence in financial services.

6. Blockchain in Finance: This search examines the application of blockchain technology in financial transactions.

7. Sustainable Finance Investments: This search explores investment opportunities in companies and projects promoting sustainability.

8. Payment Technology Trends: This search focuses on advancements in payment methods and technologies.

FAQs by Trends in Finance 2025

1. What are the key benefits of embedded finance?

Embedded finance offers enhanced convenience, personalized experiences, and increased accessibility to financial services. It allows consumers to manage their finances seamlessly within the platforms they already use, leading to a more integrated and user-friendly financial ecosystem.

2. How does open banking impact consumers?

Open banking empowers consumers by giving them control over their financial data. It enables them to share their information with third-party apps with their consent, allowing for personalized financial management tools, better comparison shopping, and access to innovative financial products.

3. How can data analytics improve financial decision-making?

Data analytics provides financial institutions with valuable insights into customer behavior, market trends, and risk profiles. This information helps them make informed decisions about lending, investment strategies, and fraud detection, leading to more efficient and effective operations.

4. What are the potential challenges of adopting digital currencies?

While digital currencies offer advantages like faster transactions and lower fees, they also face challenges related to volatility, regulation, and security. These challenges require careful consideration and robust solutions to ensure the widespread adoption of digital currencies.

5. How can investors contribute to sustainable finance?

Investors can contribute to sustainable finance by choosing to invest in companies and projects that prioritize environmental, social, and governance (ESG) factors. This includes investing in renewable energy, green technology, and social enterprises that address social and environmental challenges.

6. What are the security risks associated with payment technology advancements?

Advancements in payment technologies, such as contactless payments and mobile wallets, introduce new security risks. Ensuring robust security measures, including data encryption, multi-factor authentication, and fraud detection systems, is crucial to protect sensitive financial data.

7. How can AI enhance customer experiences in the financial sector?

AI can personalize financial products and services based on individual needs and preferences. AI-powered chatbots can provide 24/7 customer support, and AI algorithms can analyze data to offer tailored financial advice and recommendations.

8. What are the ethical considerations surrounding the use of AI in finance?

The use of AI in finance raises ethical concerns related to bias, privacy, and transparency. It’s essential to develop AI systems that are fair, unbiased, and respect customer privacy while ensuring transparency in their decision-making processes.

Tips by Trends in Finance 2025

1. Embrace Technological Advancements: Stay informed about emerging technologies and their potential impact on the financial sector. Explore how these technologies can enhance your personal or business financial management.

2. Prioritize Data Security: Implement robust cybersecurity measures to protect sensitive financial data from cyberattacks. Regularly update software and security protocols to mitigate potential vulnerabilities.

3. Consider Sustainable Investments: Explore investment opportunities that align with your values and promote sustainability. Consider investing in companies and projects that address climate change and social issues.

4. Stay Informed about Regulatory Changes: Keep abreast of evolving regulations related to open banking, digital currencies, and other financial technologies. Understand how these changes may impact your financial decisions.

5. Seek Personalized Financial Advice: Leverage the power of data analytics and AI to receive personalized financial advice and recommendations. Utilize financial tools and services that offer tailored solutions based on your specific needs.

6. Adapt to Evolving Payment Technologies: Embrace new payment technologies, such as contactless payments and mobile wallets, to enjoy enhanced convenience and security.

7. Be Aware of Emerging Risks: Stay informed about emerging financial risks, such as fraud, cyberattacks, and market volatility. Take steps to mitigate these risks and protect your financial well-being.

8. Embrace Continuous Learning: The financial landscape is constantly evolving. Stay informed about industry trends, new technologies, and regulatory changes to maintain your financial literacy and make informed decisions.

Conclusion by Trends in Finance 2025

The trends in finance 2025 are shaping a future where financial services are more accessible, personalized, and integrated into our daily lives. By embracing technological advancements, prioritizing data security, and staying informed about regulatory changes, individuals and businesses can navigate this evolving financial landscape and capitalize on the opportunities it presents. As the financial industry continues to evolve, understanding these trends is crucial for making informed decisions and achieving financial success in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Shaping the Future of Finance: Key Trends for 2025 and Beyond. We hope you find this article informative and beneficial. See you in our next article!