Shaping the Future: The Insurance Industry in 2025

Shaping the Future: The Insurance Industry in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Shaping the Future: The Insurance Industry in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Shaping the Future: The Insurance Industry in 2025

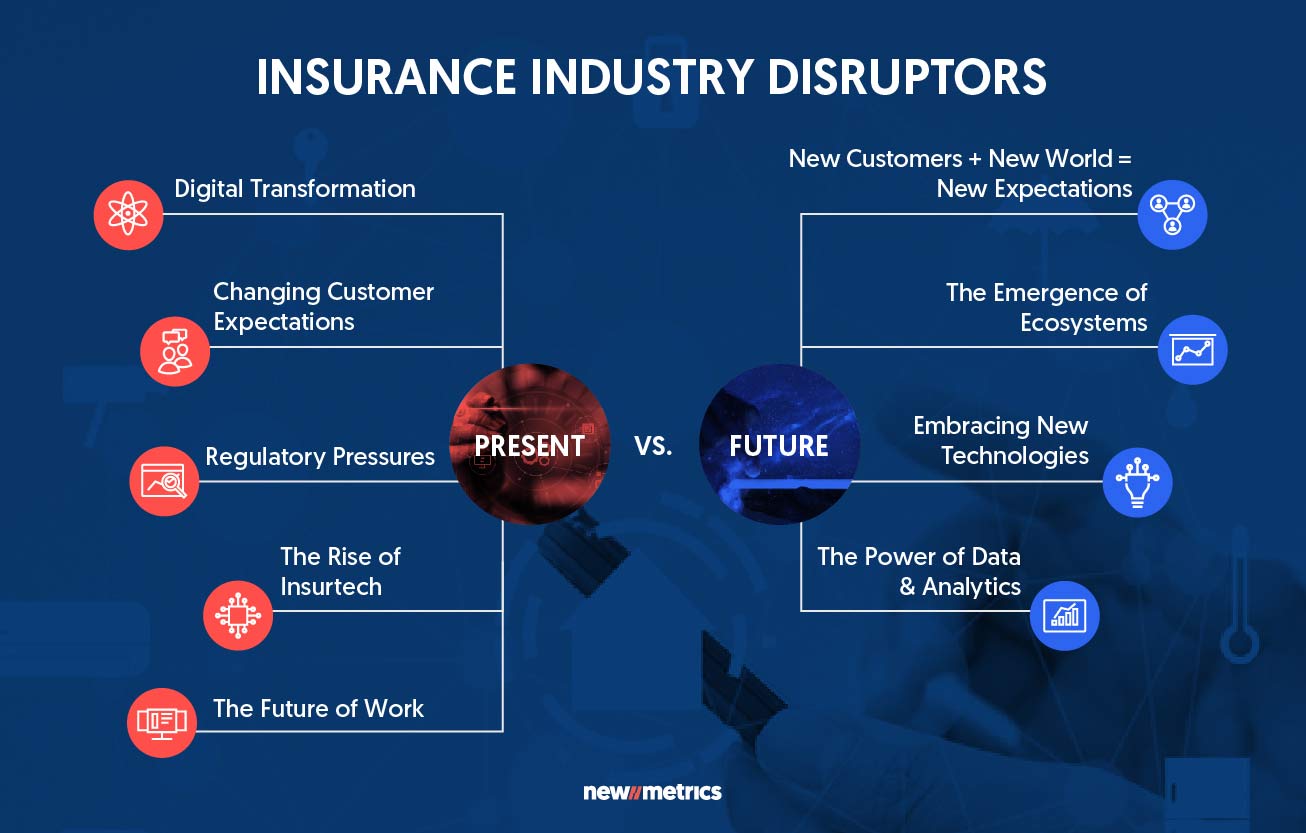

The insurance industry is undergoing a dramatic transformation, driven by technological advancements, evolving customer expectations, and a rapidly changing global landscape. As we approach 2025, several trends are poised to reshape the industry, creating both opportunities and challenges for insurers. This article delves into these trends, exploring their implications and offering insights into how the insurance industry can navigate this evolving landscape.

Key Trends Shaping the Insurance Industry in 2025

-

The Rise of Insurtech: Insurtech, the intersection of insurance and technology, is revolutionizing the industry. This trend encompasses a range of innovations, including:

- Artificial Intelligence (AI): AI is being used to automate processes, personalize customer experiences, and improve risk assessment.

- Blockchain: This technology offers secure and transparent data management, streamlining claims processing and improving efficiency.

- Internet of Things (IoT): IoT devices are generating vast amounts of data, enabling insurers to develop risk-based pricing models and offer personalized insurance products.

- Big Data Analytics: Insurers are leveraging big data analytics to gain deeper insights into customer behavior, market trends, and risk patterns.

-

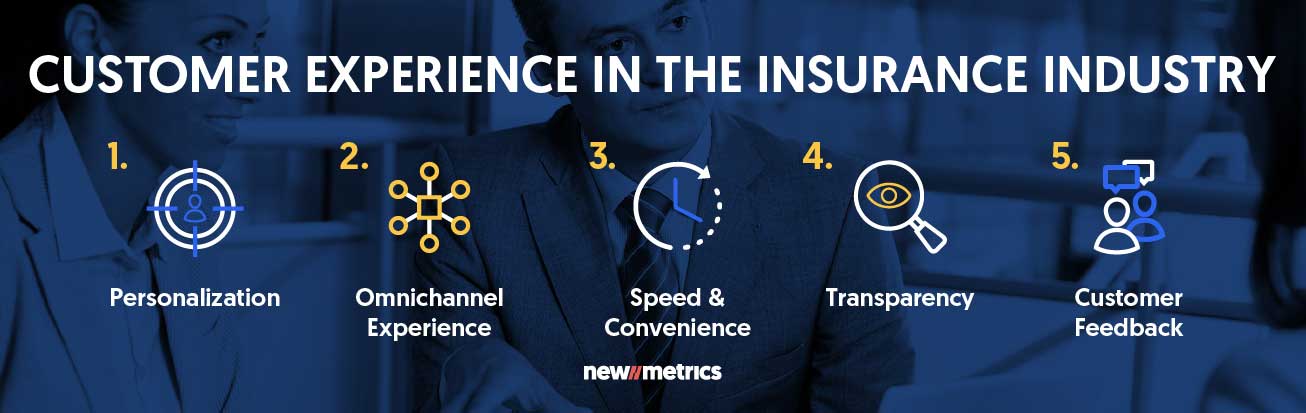

Customer-Centricity and Personalized Experiences: Customers are demanding more personalized and seamless insurance experiences. This trend is driving insurers to:

- Offer digital-first experiences: This includes online platforms, mobile apps, and chatbots for convenient access to insurance services.

- Provide customized products and services: Insurers are tailoring their offerings to meet the specific needs of individual customers.

- Focus on customer engagement: Building relationships and fostering trust through personalized communication and proactive service.

-

Increased Focus on Sustainability and Climate Change: The growing awareness of climate change is impacting the insurance industry.

- Climate-related risks: Insurers are increasingly accounting for climate-related risks in their underwriting and pricing models.

- Sustainable insurance products: New insurance products are emerging to address the risks associated with climate change, such as renewable energy insurance.

- Environmental, Social, and Governance (ESG) investing: Insurers are incorporating ESG principles into their investment strategies, supporting sustainable businesses and projects.

-

Emerging Risks and Coverage Needs: The world is facing new and evolving risks, demanding innovative insurance solutions.

- Cybersecurity threats: Cyberattacks are becoming more frequent and sophisticated, requiring specialized insurance coverage.

- Data privacy breaches: Data breaches can have significant financial and reputational consequences, leading to a rise in data breach insurance.

- Emerging technologies: The rapid development of new technologies, such as autonomous vehicles, presents both opportunities and challenges for insurers.

-

Regulation and Compliance: The insurance industry is subject to a complex and evolving regulatory landscape.

- Data privacy regulations: Insurers must comply with data privacy regulations, such as GDPR and CCPA, to protect customer data.

- Cybersecurity regulations: Regulations are being implemented to enhance cybersecurity standards and mitigate cyber risks.

- Regulatory changes: Changes in regulations can impact insurance products, pricing, and distribution channels.

-

Talent Acquisition and Development: Attracting and retaining skilled talent is crucial for the insurance industry to thrive.

- Skills gap: The industry faces a skills gap in areas such as data analytics, cybersecurity, and digital marketing.

- Investing in talent development: Insurers are investing in training programs to equip their employees with the skills needed to navigate the digital landscape.

- Diversity and inclusion: Creating a diverse and inclusive workforce is essential for innovation and attracting top talent.

-

Partnerships and Collaboration: Collaboration is becoming increasingly important for insurers to address complex challenges and capitalize on emerging opportunities.

- Insurtech partnerships: Insurers are partnering with insurtech startups to access innovative technologies and solutions.

- Industry collaborations: Insurers are collaborating with other industry players to develop new products, share data, and improve efficiency.

- Government partnerships: Insurers are working with governments to develop policies and regulations that support innovation and sustainability.

-

The Future of the Insurance Industry: The insurance industry is poised for significant growth in the coming years, driven by the trends outlined above.

- Increased demand for insurance: As the world becomes more interconnected and complex, the demand for insurance is expected to increase.

- Innovation and disruption: Insurtech and other technological advancements will continue to disrupt the industry, creating new opportunities for innovation.

- Focus on customer experience: Insurers that prioritize customer experience and embrace digital transformation will be best positioned for success.

Related Searches

- Future of insurance industry: This search focuses on the long-term outlook for the insurance industry, exploring the impact of technology, customer expectations, and global trends.

- Insurance industry trends 2023: This search explores current trends shaping the industry, including the rise of insurtech, customer-centricity, and the impact of climate change.

- Digital transformation in insurance: This search focuses on how insurers are leveraging technology to improve their operations, enhance customer experiences, and develop new products.

- AI in insurance: This search delves into the applications of AI in the insurance industry, including risk assessment, fraud detection, and customer service.

- Blockchain in insurance: This search explores the potential of blockchain technology to revolutionize insurance processes, such as claims processing and policy management.

- Climate change and insurance: This search examines the impact of climate change on the insurance industry, including the increasing frequency and severity of weather events and the need for climate-related insurance products.

- Cybersecurity in insurance: This search focuses on the growing threat of cyberattacks and the need for insurers to develop robust cybersecurity strategies.

- Insurance industry jobs: This search explores the job market in the insurance industry, highlighting the skills and qualifications needed for success in this evolving sector.

FAQs

-

What are the biggest challenges facing the insurance industry in 2025?

- The insurance industry faces several challenges, including:

- Keeping pace with rapid technological advancements

- Meeting evolving customer expectations

- Adapting to changing regulatory landscapes

- Addressing climate-related risks

- Managing cybersecurity threats

- The insurance industry faces several challenges, including:

-

How can insurers prepare for the trends shaping the insurance industry in 2025?

- To prepare for the future, insurers should:

- Embrace digital transformation and invest in new technologies

- Prioritize customer experience and personalization

- Develop innovative products and services to meet emerging needs

- Foster a culture of innovation and collaboration

- Invest in talent development and attract skilled professionals

- To prepare for the future, insurers should:

-

What are the potential benefits of these trends for the insurance industry?

- The trends shaping the insurance industry offer significant benefits, including:

- Improved efficiency and cost savings through automation

- Enhanced customer experiences and increased loyalty

- New revenue streams from innovative products and services

- Greater resilience to climate change and other emerging risks

- Increased competitiveness and market share

- The trends shaping the insurance industry offer significant benefits, including:

Tips

- Embrace digital transformation: Invest in technology and data analytics to improve operations and customer experiences.

- Focus on customer experience: Design products and services that meet the specific needs of individual customers.

- Stay ahead of regulatory changes: Monitor regulations and adapt your business practices to ensure compliance.

- Develop a robust cybersecurity strategy: Protect your systems and data from cyberattacks.

- Invest in talent development: Ensure your employees have the skills needed to succeed in the digital age.

Conclusion

The insurance industry is on the cusp of a major transformation, driven by technological advancements, evolving customer expectations, and a changing global landscape. The trends outlined in this article highlight the opportunities and challenges that insurers will face in the coming years. By embracing innovation, prioritizing customer experience, and adapting to the changing world, the insurance industry can thrive in this dynamic environment. Insurers that embrace these trends will be best positioned to navigate the future and create value for their customers, stakeholders, and society as a whole.

![Going Digital: The Future of Insurance [Infographic]](https://infographicjournal.com/wp-content/uploads/2016/04/future-insurance.jpg)

Closure

Thus, we hope this article has provided valuable insights into Shaping the Future: The Insurance Industry in 2025. We hope you find this article informative and beneficial. See you in our next article!