Trends in Gold 2025: A Comprehensive Outlook

Trends in Gold 2025: A Comprehensive Outlook

Introduction

With great pleasure, we will explore the intriguing topic related to Trends in Gold 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Trends in Gold 2025: A Comprehensive Outlook

Gold, a precious metal revered for centuries, has always held a unique position in the global financial landscape. Its inherent value, perceived as a safe haven asset, and its role in various industries make it a compelling investment option. While the future is inherently uncertain, analyzing current trends and economic forecasts provides valuable insights into the potential trajectory of gold in the coming years.

Understanding the Forces Shaping Gold’s Future

Several key factors will influence the trends in gold 2025, shaping its performance and appeal to investors. These include:

- Global Economic Uncertainty: The world economy faces numerous challenges, including rising inflation, geopolitical tensions, and the lingering effects of the COVID-19 pandemic. These factors can drive investors towards safe haven assets like gold, seeking to preserve wealth during turbulent times.

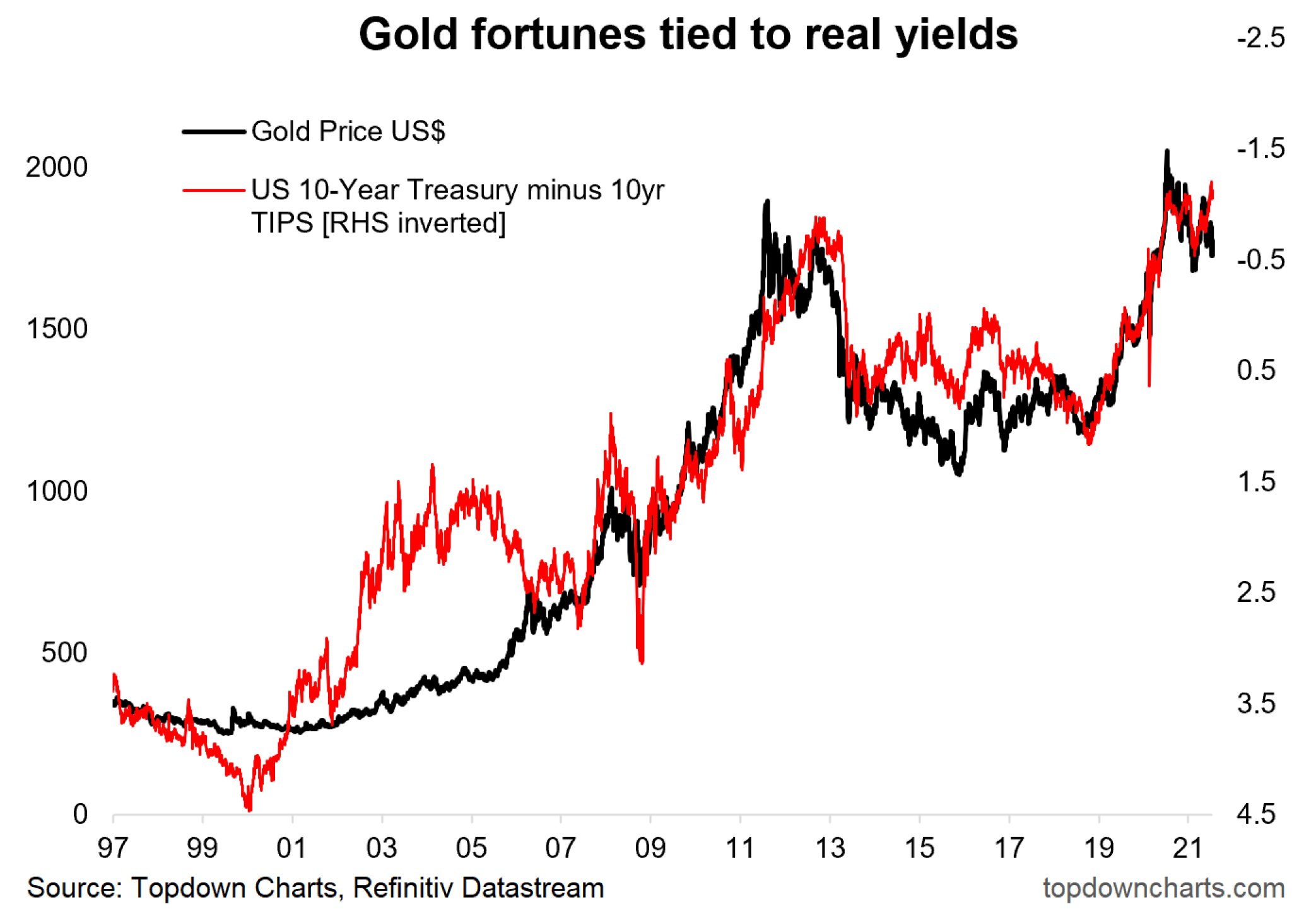

- Interest Rate Policies: Central banks globally are grappling with inflation, leading to interest rate hikes. While higher rates might initially dampen gold’s appeal, as it does not generate interest income, its intrinsic value and potential for capital appreciation can still make it attractive in a high-inflationary environment.

- Technological Advancements: Technological advancements, particularly in the field of blockchain and digital currencies, could potentially impact gold’s role in the financial system. However, gold’s established position as a store of value and its tangible nature are likely to remain relevant in the digital age.

- Geopolitical Landscape: Geopolitical tensions, including conflicts, trade disputes, and political instability, can significantly impact gold prices. These uncertainties often lead to increased demand for safe haven assets, boosting gold’s value.

- Supply and Demand Dynamics: The supply of gold is relatively inelastic, meaning it does not respond quickly to price changes. However, demand for gold can fluctuate significantly based on factors like investment appetite, jewelry consumption, and industrial usage. The interplay between supply and demand will play a crucial role in determining gold’s price trajectory.

Exploring Key Trends in Gold 2025

Based on these influencing factors, several key trends are likely to shape the gold market in the coming years:

1. Continued Demand for Gold as a Safe Haven Asset:

- The ongoing global economic uncertainty and potential for geopolitical instability are likely to fuel demand for gold as a safe haven asset. Investors seeking to preserve capital during times of market volatility will continue to view gold as a reliable hedge against inflation and economic downturns.

- Central bank gold reserves are expected to continue growing as countries seek to diversify their assets and enhance financial security in a volatile world. This institutional demand will further support gold prices.

2. Gold’s Role in Portfolio Diversification:

- Gold’s low correlation with traditional asset classes like stocks and bonds makes it a valuable tool for portfolio diversification. By adding gold to a portfolio, investors can potentially reduce overall risk and enhance returns.

- As investors become increasingly sophisticated in their investment strategies, the demand for gold as a diversifier is likely to increase, contributing to its long-term price stability.

3. Increased Interest in Gold-Backed Digital Assets:

- The rise of blockchain technology has opened up new avenues for gold investment. Gold-backed digital assets, such as tokenized gold, offer investors greater accessibility, transparency, and potential for faster transactions.

- These innovative solutions could attract a new generation of investors, particularly those familiar with digital assets, further enhancing the demand for gold.

4. Growing Demand for Gold in Emerging Markets:

- As emerging economies experience rapid economic growth and rising disposable incomes, demand for gold in jewelry and other consumer applications is expected to increase.

- This trend is particularly pronounced in Asia, where gold holds cultural and investment significance. The rising demand from emerging markets will contribute to overall gold consumption and potentially support prices.

5. Technological Advancements in Gold Mining and Refining:

- Advancements in mining technology and refining processes are expected to improve efficiency and reduce costs, potentially increasing gold supply in the long term.

- However, the environmental impact of gold mining remains a concern, and sustainable practices are becoming increasingly important. The industry will need to adapt to evolving regulations and consumer preferences regarding environmental responsibility.

Related Searches:

Here are some related searches and their respective explanations that provide further insights into the trends in gold 2025:

1. Gold Price Forecast 2025:

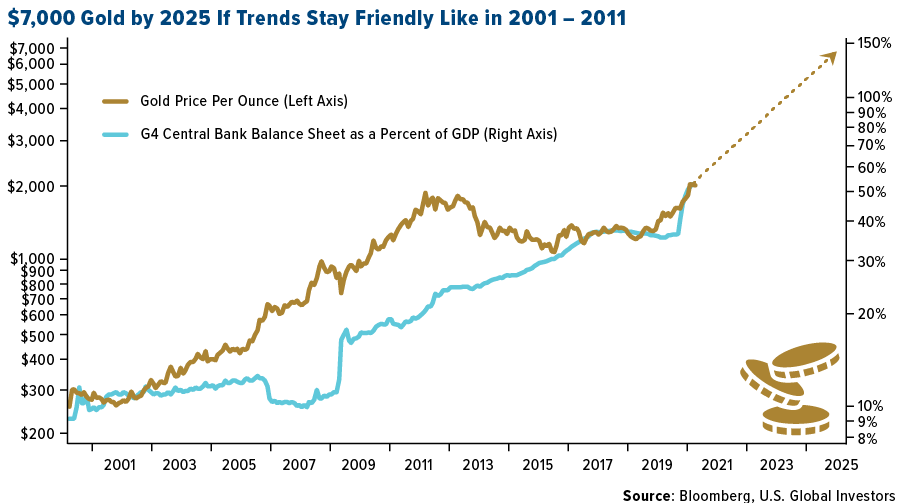

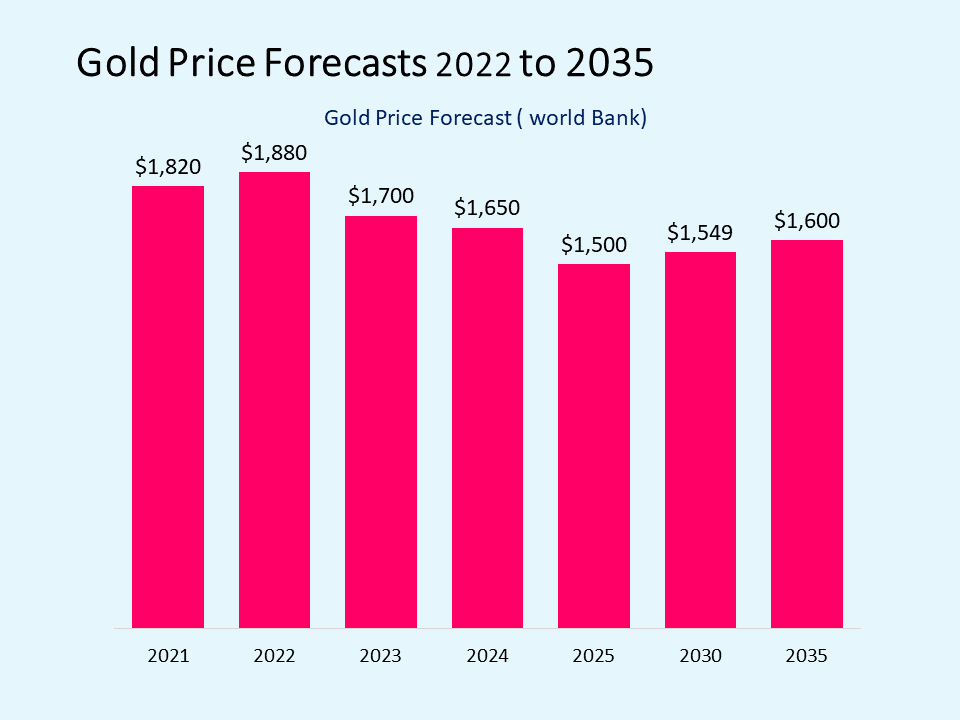

- Forecasting gold prices is a complex endeavor, influenced by numerous factors. While specific price predictions can vary widely, analysts generally expect gold prices to remain elevated in the coming years, driven by factors like inflation, geopolitical uncertainty, and strong demand from emerging markets.

- However, it’s crucial to remember that price forecasts are not guarantees and are subject to change based on unforeseen economic events.

2. Gold Investment Strategies 2025:

- There are various ways to invest in gold, each with its own advantages and risks. Some common strategies include:

- Physical Gold: Purchasing physical gold bars or coins offers direct ownership and tangible possession.

- Gold ETFs: Exchange-traded funds (ETFs) provide a convenient and cost-effective way to invest in gold without physically holding the metal.

- Gold Mining Stocks: Investing in gold mining companies offers exposure to the gold market through their exploration, extraction, and processing activities.

- Gold Futures: Futures contracts allow investors to speculate on future gold prices and potentially profit from price fluctuations.

- The optimal investment strategy depends on individual risk tolerance, investment goals, and market conditions.

3. Gold ETFs 2025:

- Gold ETFs have become increasingly popular in recent years, offering investors a convenient and liquid way to gain exposure to gold.

- These ETFs typically track the price of gold and provide investors with a diversified and cost-effective way to invest in the metal.

- The growing popularity of gold ETFs is expected to continue in the coming years, driven by their accessibility and ease of trading.

4. Gold Mining Companies 2025:

- Investing in gold mining companies offers investors exposure to the gold market through the exploration, extraction, and processing of gold.

- These companies can offer potential for growth, but their performance is also influenced by factors like commodity prices, operational costs, and regulatory environments.

- Investors considering gold mining stocks should conduct thorough research and understand the risks involved.

5. Gold Demand by Country 2025:

- Gold demand varies significantly across countries, influenced by factors like economic growth, cultural preferences, and investment trends.

- Emerging economies, particularly in Asia, are expected to drive significant gold demand in the coming years due to rising disposable incomes and increasing jewelry consumption.

- Developed economies also play a role in gold demand, with investors seeking to diversify portfolios and hedge against inflation.

6. Gold Jewelry Trends 2025:

- Gold jewelry remains a popular choice for consumers globally, driven by its beauty, durability, and perceived value.

- Trends in gold jewelry design and styles are constantly evolving, influenced by fashion, cultural preferences, and economic conditions.

- Sustainable and ethical sourcing of gold is becoming increasingly important to consumers, and brands are responding by promoting responsible jewelry practices.

7. Gold in Technology 2025:

- Gold’s unique properties, including its conductivity and resistance to corrosion, make it valuable in various technological applications.

- It is used in electronics, aerospace, and medical devices.

- Technological advancements are likely to lead to new and innovative applications for gold in the future, potentially driving demand for the metal.

8. Gold and Inflation 2025:

- Gold is often considered a hedge against inflation, as its value tends to rise during periods of economic uncertainty and rising prices.

- In a high-inflationary environment, investors may turn to gold as a way to preserve their purchasing power.

- However, the relationship between gold and inflation is complex and can be influenced by other factors like interest rates and market sentiment.

FAQs by Trends in Gold 2025

1. Is gold a good investment in 2025?

- Whether gold is a good investment in 2025 depends on individual circumstances, risk tolerance, and investment goals.

- Gold can be a valuable addition to a diversified portfolio, providing potential for capital appreciation and protection against inflation.

- However, it is important to understand that gold does not generate income and its price can fluctuate significantly.

2. Will gold prices go up in 2025?

- Forecasting gold prices is challenging, and specific price predictions are highly speculative.

- Several factors, including economic growth, interest rate policies, and geopolitical events, can influence gold prices.

- While some analysts predict price increases, others anticipate price stability or even declines.

3. Is gold a safe haven asset?

- Gold has historically served as a safe haven asset, offering protection against economic uncertainty and market volatility.

- During times of crisis or market turmoil, investors often turn to gold as a way to preserve wealth.

- However, it is important to note that gold’s performance as a safe haven can vary depending on the specific circumstances.

4. What are the risks of investing in gold?

- Investing in gold comes with certain risks, including:

- Price Volatility: Gold prices can fluctuate significantly, potentially leading to losses.

- Lack of Income: Gold does not generate interest income, so investors rely on capital appreciation for returns.

- Storage Costs: Physical gold requires secure storage, which can incur costs.

- Counterfeit Risk: Investing in physical gold carries the risk of purchasing counterfeit items.

5. How can I invest in gold?

- There are various ways to invest in gold, including:

- Physical Gold: Purchasing gold bars or coins offers direct ownership and tangible possession.

- Gold ETFs: Exchange-traded funds (ETFs) provide a convenient and cost-effective way to invest in gold without physically holding the metal.

- Gold Mining Stocks: Investing in gold mining companies offers exposure to the gold market through their exploration, extraction, and processing activities.

- Gold Futures: Futures contracts allow investors to speculate on future gold prices and potentially profit from price fluctuations.

Tips by Trends in Gold 2025

- Diversify your portfolio: Gold can be a valuable addition to a diversified portfolio, reducing overall risk and enhancing returns.

- Consider your investment goals and risk tolerance: Decide whether gold aligns with your investment objectives and your ability to handle potential price fluctuations.

- Research different investment options: Explore various ways to invest in gold, such as physical gold, ETFs, or mining stocks, and choose the option that best suits your needs.

- Stay informed about market trends: Keep abreast of economic developments, geopolitical events, and industry trends that can impact gold prices.

- Consult with a financial advisor: Seek professional guidance from a qualified financial advisor to create a personalized investment strategy that incorporates gold.

Conclusion by Trends in Gold 2025

The trends in gold 2025 suggest that the precious metal will continue to play a significant role in the global financial landscape. Its inherent value as a safe haven asset, its role in portfolio diversification, and its growing demand in emerging markets are likely to support its price in the coming years. However, investors should remain aware of the risks associated with gold investment and carefully consider their investment goals and risk tolerance before making any decisions. As technological advancements continue to shape the financial landscape, gold’s position in the digital age remains to be seen, but its intrinsic value and tangible nature are likely to ensure its enduring relevance.

Closure

Thus, we hope this article has provided valuable insights into Trends in Gold 2025: A Comprehensive Outlook. We appreciate your attention to our article. See you in our next article!